Investors are so worried about a potential recession around the corner that even dividends at an all-time high aren’t proving enough to lure them to income strategies.

Typically high-paying sectors such as energy, mining and financial sectors have lagged this year amid the rotation out of cyclicals into defensive and growth sectors. That’s made dividend yield among the worst-performing investing factors in Europe and the US, according to data compiled by Bloomberg.

Risks of a recession are rising in Europe and the US, with the timing of a peak in central banks’ rate-hike campaigns hotly debated. Companies with robust balance sheets, profit growth and potential for expansion have found favor, while there’s uncertainty about whether so-called “dividend aristocrats” can maintain their largesse in leaner times. Recent banking turmoil has also made traders wary of financials.

The concern “is how sustainable is the growth for those businesses that are exhibiting high dividends,” says Luke Barrs, managing director and global head of fundamental equity client portfolio management at Goldman Sachs Asset Management. While dividend is a very valuable asset, “the only way you sustain that over time is if you continue to grow the underlying earnings within the business,” he adds.

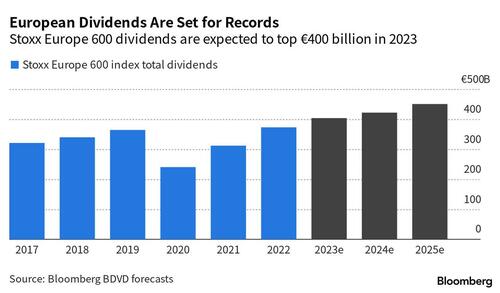

Global dividends jumped to a record $327 billion in the first quarter, according to Janus Henderson Investors. And Bloomberg dividend forecasts show payouts from Stoxx 600 firms in 2023 are expected to top €400 billion for the first time ever.

Still, some warning signs are emerging. An uneven recovery in China and falling metal prices have weighed on the high-paying mining sector — giants BHP (

Stephen Payne, a portfolio manager on Janus Henderson’s Global Equity Income Team, says this year’s underperformance in dividend payers is primarily due to the rotation into growth and tech stocks as traders bet on a rates peak, rather than because of any underlying issues with dividend stocks. He sees the strategy coming back into favor if the US and Europe manage to avoid a recession this year.

Dividend strategies tend to outperform in the long run, proving particularly strong during bull runs. And payouts still look strong in Europe for now. In a gauge of European companies tracked by Janus Henderson, 96% raised payouts or held them steady in the first three months of the year. The firm expects dividends to grow further in the second quarter.

Strong forecasts are also reflected on the derivative side, with dividend futures on the Euro Stoxx 50 maturing in 2023 and 2024 widely outperforming the benchmark in the past year.

Meanwhile, fixed income has become more attractive, narrowing the yield gap with equities to compete with dividend strategies. The Stoxx 600’s dividend yield now equals that of investment grade bonds, with the spread between them hitting the lowest level since 2008 earlier this year.

Photo by Priscilla Du Preez on Unsplash