Summary

- If a stock pays a dividend or not doesn’t tell you anything about the underlying company’s quality.

- Dividends are only the distribution of value, and not the generation of value.

- Moreover, due to tax considerations and retained earnings opportunity cost, dividends are also quite ineffective in distributing value.

- In this article, I would like to provide investors with a concise argument on why I believe dividends are dumb.

Investors seem to love dividends, especially readers on Seeking Alpha. But here is the thing: If a stock pays a dividend or not, it doesn’t tell you anything about the underlying company’s quality; and the magnitude of the dividend doesn’t tell you anything either. Because dividends are only the distribution of value, and not the generation of value. Moreover, due to tax considerations and retained earnings opportunity cost, dividends may not even be the best strategy to distribute value to shareholders.

In this article, I would like to provide investors with a concise argument on why I believe dividends are so damn dumb, based on three reasons: (1) opportunity costs of retained earnings, (2) tax implications, and (3) false signaling of value/ strength.

(1) Opportunity Costs Of Retained Earnings

Let’s keep the argument very simple: A company has earned one dollar, which can either be distributed to investors, or retained in the business for future growth (self-funding investments). If a company decides to distribute the dollar earned, the shareholder will pocket 75-80 cents of value (depending on investor’s residence and other tax implications). If a company chooses to keep the earned dollar in the business, the additional capital will serve as an investment in productive assets and growth, leveraging the dollar for additional value creation.

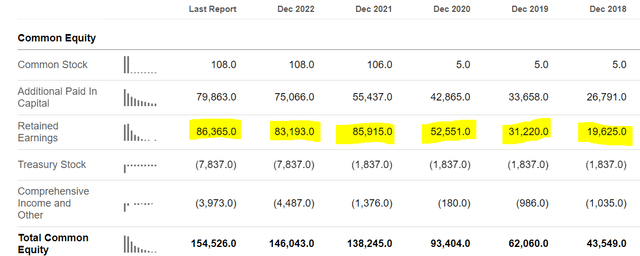

Or in other words: when a company pays out dividends, it reduces the retained earnings that could have been reinvested back into the business for growth and expansion. Growth-oriented companies often reinvest their profits into research and development, expanding their operations, or acquiring new assets. These companies may not pay dividends or offer lower dividend yields, as they prioritize reinvesting in their business for future growth.

As a general rule, if a company’s return on equity is greater than the cost of equity [ROE > COE], then a company should not pay a dividend, as it would be value destroying. Likewise, if a company’s ROE < COE, then then earnings should be distributed. The fun aspect of this argument is, however, that if a company is allowed to pay dividends based on the ROE < COE argument, then the company is likely a big loser and you shouldn’t invest in it anyways — because don’t give capital to companies that cannot earn the ‘cost of capital’.

With that frame of reference, investors should consider Amazon (AMZN

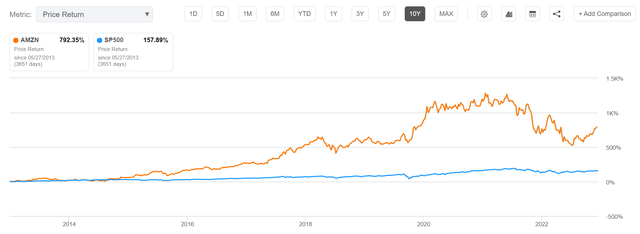

Despite the lack of dividends, AMZN investors have been rewarded handsomely: Over the past 10 years, AMZN stock has appreciated by close to 800%, outperforming the S&P 500 (SP500

(2) Tax Implications

Tax implications is another reason why dividends are, in my point of view, stupid: Capital income is subject to taxation, and depending on an individual’s tax bracket, the tax rate on dividends can be higher than the rate on long-term capital gains. This can reduce the net return on investment for dividend-focused portfolios, making them less attractive from a tax efficiency standpoint.

By avoiding dividends, investors can delay the recognition of taxable income from their equity holdings until they actually sell the stock and realize a gain. Accordingly, opting for non-dividend stocks is a strategy that allows investors to exert greater control over the timing of their taxable income.

Admittedly, investing in dividend stocks within tax-efficient accounts, such as 401k or Roth accounts, can be highly advantageous and would render the ‘tax argument’ ineffective. However, investors should consider that these type accounts [401k or Roth] provide a favorable tax environment for investors irrespective of the specific stock types held within them. So, the value of investing with such an account is based on the account itself, not based on any specific value-added from dividends.

A similar argument applies to Dividend reinvestment/DRIP: In the base case scenario, assuming taxes are not considered at the moment, is basically equivalent to the company not having paid the dividend to begin with — mathematically speaking, reinvesting dividends is identical to the company retaining the dividends.

(3) False Signaling Of Value/ Strength

Expanding on my ‘ROE > COE’ argument in the previous section of the article, it makes sense that only healthy/ strong companies should be allowed to pay dividends. And the stronger the company, the higher the dividend, in theory. However, the reality is just very different. Or in the words of Warren Buffett:

The equation is pretty simply, but the practice doesn’t necessarily follow logic.

How high is the dividend paid by Amazon (AMZN), Google (GOOG

On the other hand, some companies may aim to fake their economic health through the distribution of dividends. For example, what is the dividend yield of ‘losers’ such as AT&T (T

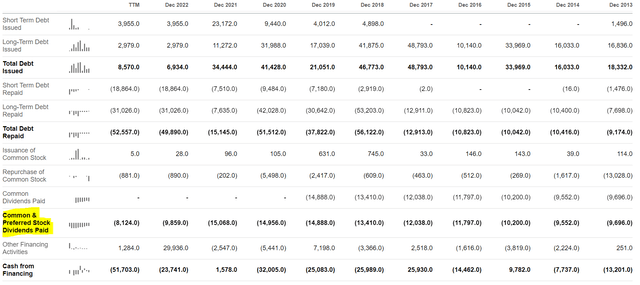

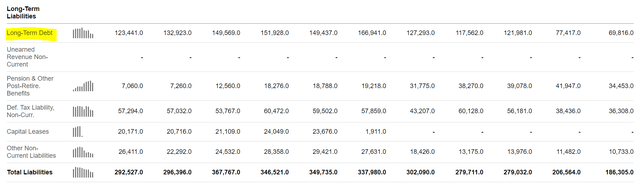

Over the same period, AT&T has accumulated about $55 billion of net financial debt.

Thus, a shrewd observer might argue that AT&T took on debt to keep the dividends going — a strategy that will break down quickly and aggressively once interest rates rise, and credit starts to become more restrictive.

AT&T’s share price tells the story: Over the past decade, shares are down about 41%, as compared to a gain of almost 160% for the S&P 500. Needless to say, this is quite a spectacular example of value destruction while keeping the dividends flowing.

Investors should also consider that a high dividend yield on a stock may also be a function of a sharp drop in share price, possibly due to underlying issues with the company leading to eventually unstable or unsustainable dividends.

Concluding on the ‘false signaling of value/ strength’ argument, I will highlight my argument in quotes, as I cannot stress the importance of the takeaway enough:

The presence or absence of dividends in a stock does not provide any direct indication of the underlying quality of the company. Similarly, the size or magnitude of the dividend does not necessarily reflect the company’s overall performance or value. This is because dividends merely represent the distribution of value to shareholders and are not directly linked to the generation of value within the company itself.

Conclusion

The primary reason for investing in the stock market is anchored on the expectation that an investment will increase in value through business expansion. However, if the company distributes money back to shareholders in the form of dividends, it not only creates a taxable event, but it also undermines the original purpose of investing. Of course, I understand that many investors are approaching retirement and like to secure some recurring income. However, I would like to point out that even without the dividends, investors can generate income and return simply through selling shares — according to individual timing preferences and financial objectives.

Overall, I am not saying investors should avoid dividends. I am just saying investors should not care about them. Screening the stock market for companies that pay high dividends is a mistake; while owning a quality company with strong earnings power that incidentally also happens to pay a dividend is quite acceptable.

I am sorry to tell you, but looking at dividend yields is not a short cut to finding quality companies, and neither is it a shortcut to get rich on a ‘fat and juicy yield’, a pitch that is so often promised by companies and some equity analysts alike. There is simply no way around the requirement to conduct thorough research and independent analysis on a company’s economic, financial and commercial fundamentals, both current and projected.

Photo by Uday Mittal on Unsplash