- Dividend stocks have taken a beating lately after Chairman Powell expressed little urgency to cut interest rates.

- We turn to Warren Buffett for some sage wisdom on why this is a huge gift to dividend investors.

- We share what we are buying right now.

Warren Buffett of Berkshire Hathaway (BRK.A

[Falling stock prices are] good for us actually – we’re a net buyer of stocks over time. Just like being a net buyer of food – I expect to buy food for the rest of my life, and I hope that food goes down in price tomorrow. Who wouldn’t rather buy at a lower price than a higher price? People are really strange on that. They should want the stock market to go down – they should want to buy at a lower price.

For dividend investors, the benefits of Buffett’s words of wisdom extend beyond even the idea that potential total returns increase the further a stock price drops, because it also means that we can buy dividend stocks with even higher dividend yields, thereby growing our income stream at an even faster pace.

Given that the high yield space has dropped so sharply in the wake of recent comments from Chairman Powell, now is a great time for dividend investors to take advantage of the opportunity to load up on quality dividend stocks that are yielding much higher than they would otherwise. As Warren Buffett said once:

Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.

Jerome Powell’s Gift To Dividend Investors

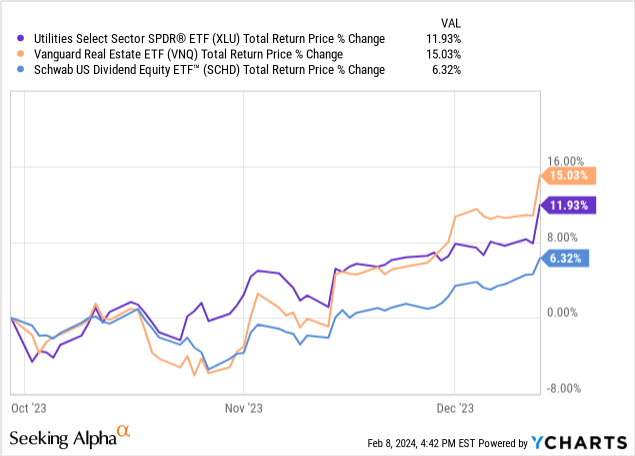

Powell originally sparked a Santa Claus rally with his dovish comments back in December. The Fed not only left rates unchanged, but they projected three rate cuts in 2024 and Chairman Powell stated that the central bank is “at or near its peak rate.” This sent many dividend stocks like utilities (XLU

Since then, however, strong GDP and labor market data has indicated that a recession is not coming just yet and then this past week Jerome Powell stated:

The labor market is strong — 3.7% unemployment — with the economy strong like that, we feel like we can approach the question of when to begin to reduce interest rates carefully.

Upon hearing the news that the Fed does not feel any sense of urgency to cut rates, high yield stocks headed straight back to where they were before the year-end 2023 rally. As a result, investors now have the opportunity to buy quality high yield dividend stocks at very compelling prices.

While many investors may not like this and be growing weary of seeing their dividend stocks languish day after day while the S&P 500 (SPY

- The companies have the option of buying back their own stock at cheaper prices than they would otherwise, thereby creating more value for shareholders.

- The potential for future valuation multiple expansion increases, thereby increasing capital appreciation potential for purchases of these stocks made today.

- The yield on cost increases, thereby increasing the passive income stream growth potential for net buyers of stocks today.

Again, even if the said stocks are not buying back stock right now and you have no new cash to purchase new shares with, the fact that stock prices are low does not hurt you, provided that you do not need to sell any shares. That is exactly what makes income investing so powerful, by the way. As I detailed in a recent article, retiring with dividends instead of the standard 4% portfolio liquidation rule frees you from being tied to the fate of the market. As long as your passive income stream continues to roll in, it does not matter if the market pulls back by 10-15% or if it rises by 10-15%. All else being equal, your income stream remains constant through it all.

This is why, as income investors, we have everything to celebrate and gain from Powell’s recent comments that have sent high yield stocks lower. It is a huge gift for us, as it allows us to grow our passive income stream faster than we would otherwise.

What We Are Buying Right Now

With that in mind, what is our shopping list looking like right now? I personally am very bullish on four sectors of the high yield space:

- Infrastructure

- Real Estate

- Materials

- Midstream

All four of these sectors have dipped meaningfully in recent weeks and days, yet, all four have bright long-term outlooks.

As we discussed in a recent article, infrastructure in particular has an extremely bright outlook and is attracting literally hundreds of billions of dollars in investment from some of the leading billionaire investors and top asset managers in the world. One way to invest in this space is to simply invest in the leading alternative asset managers like Blackstone (BX

Real estate – while certainly facing its share of headwinds in the office space and a few others – remains attractive over the long-term as REITs in particular now trade at deep discounts to NAV in most cases. Even blue chips like Realty Income (O

The materials segment also looks highly attractive given that many prominent analysts think that we are in the early innings of a commodity supercycle, with copper, gold (GLD

Last, but not least, the midstream sector (AMLP

Investor Takeaway

Jerome Powell giveth and Jerome Powell taketh away as the market hangs on his every word for clues about where interest rates may be headed in the near term. Many dividend investors are disappointed – if not growing increasingly impatient – with the recent sharp pullback in the sector even as the broader indexes are soaring to all-time highs.

However, as long term-oriented, income-focused investors, we should view this as a huge gift from Chairman Powell, as he has given us yet another opportunity to load up on quality high-yielding stocks at compelling valuations and yields. Given that our entire philosophy hinges on not needing to sell shares of stock, but rather to live off of the passive income that they throw off, a pullback like this does not hurt us. Rather, it accelerates our income compounding process by giving us higher yields on new share purchases.

As a result, I am excited to be able to buy infrastructure, real estate, materials, and midstream stocks hand-over-fist right now.