The broader markets have seen cautious trading lately amid ongoing discussions about the U.S. debt ceiling, uncertainty that could send investors scrambling for safety plays, leading to a raised profile for dividend stocks. Chevron (NYSE:CVX

Shares of the multinational oil and gas firm have had a sluggish start to the year. After shares struck a gusher in 2022, rising by 53% during the year, the stock has now fallen 9.9% through the first 5 months of 2023.

CVX’s cooling stock price comes as oil (CL1:COM) has seen a choppy year, slumping recently to near $74/bbl. The commodity entered 2023 near $80/bbl.

To see whether CVX still makes sense as a dividend pick, here are some details about its safety and consistency as a dividend play, as judged by Seeking Alpha’s Quant Rating system, which grades stocks based on relative performance in quantifiable categories..

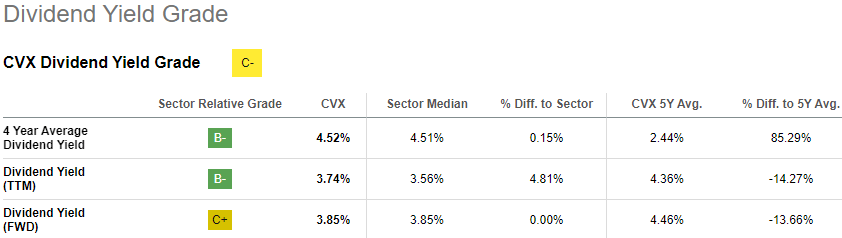

Chevron Dividend Yield:

Seeking Alpha’s quant grades gave CVX a C- in regards to the energy firm’s dividend yield. At the moment, shares of Chevron come with a dividend yield of 3.85%, which is on par with the sector median.

See below a breakdown of the stock’s dividend yield grade:

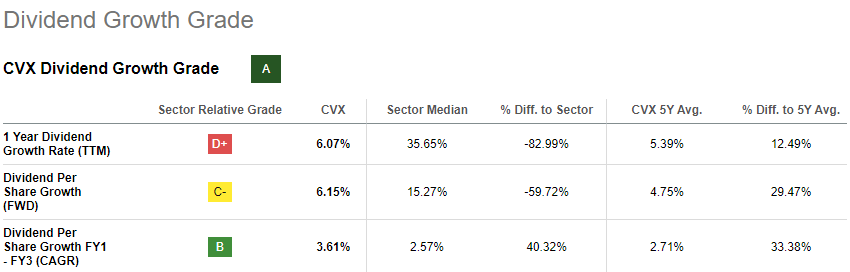

Chevron Dividend Growth:

Chevron (CVX

Here’s a breakdown of Chevron’s dividend growth grade:

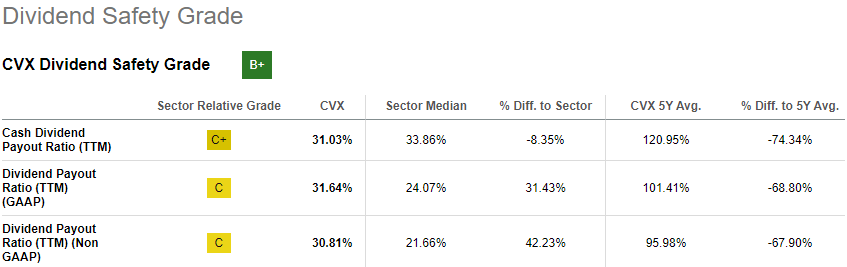

Chevron Dividend Safety:

CVX can be looked at as stable in terms of dividend safety. Per Seeking Alpha’s metrics, the stock was given a B+ for this key area of concern.

See a breakdown of CVX’s dividend safety grade:

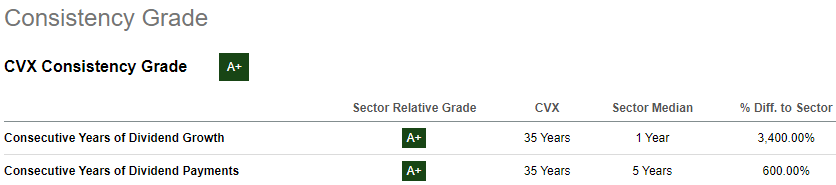

Chevron Dividend History:

Shares of Chevron have long been considered a stronghold of dividend consistency. Seeking Alpha classified CVX with an A+ as it pertains to its dividend history.

See a breakdown of Chevron’s dividend consistency grade:

What Others Say about Chevron:

Aside from the dividend offering, does CVX provide a sound investment opportunity, given the current market landscape?

Seeking Alpha contributor Fluidsdoc believes the company is a Buy, stating: “Chevron Corporation is trading near all-time highs and is scaring some investors and authors on Seeking Alpha. We think these concerns are overblown and investors who are long the stock should look through the current weakness driven by short-term oscillations in oil prices and stay the course.”

On the other side, The Value Portfolio, another SA analyst, views Chevron as a Sell, arguing “there’s a reason Warren Buffett sold.” The author added: “Berkshire Hathaway Inc. took advantage of low crude oil prices to make a massive acquisition in Chevron Corporation worth $10s of billions. The company recently sold $6 billion worth of Chevron stock as that company’s equity has hit all-time highs.”

Other Investing Options:

For investors who are not completely sold on Chevron, they can always access exposure to the company in a diversified approach through the use of exchange traded funds. CVX is owned by 310 ETFs. Listed below are the five funds that have the heaviest concentrations towards the firm (listed along with their weightings within the fund):

- Energy Select Sector SPDR Fund (XLE

at 19.56%. - Vanguard Energy ETF (VDE

at 16.27%. - Fidelity MSCI Energy Index ETF (FENY

at 16.07%. - iShares U.S. Energy ETF (IYE

at 16.06%. - ProShares Ultra Energy (DIG

at 15.60%.

Furthermore, market participants can also look at some of CVX’s competitors as an option. Some names include ExxonMobil (XOM

Moreover, for investors who are looking for broad exposure to dividends, there are many general dividend ETFs to consider as well. Some names include:

- Vanguard Dividend Appreciation ETF (VIG

- Vanguard High Dividend Yield Index ETF (VYM

- Schwab US Dividend Equity ETF (SCHD

- iShares Core Dividend Growth ETF (DGRO

- SPDR S&P Dividend ETF (SDY

- iShares Select Dividend ETF (DVY