The highest-yielding dividend stocks have been sharp laggards on the year, with their yields failing to compensate for the underperformance

It hasn’t been a good year to be an investor in dividend stocks, especially when you consider that Treasuries currently are yielding above 5% out to one year.

“Investors deciding where to allocate funds are likely asking themselves, ‘What is the attractiveness of a low-growth stock paying 5% when the money can instead be parked in a “risk-free” Treasury yielding a similar amount?’” Bespoke Investment Group analysts wrote in a Thursday note.

Indeed, high-yielding stocks have lagged so significantly this year that their juicy dividends aren’t enough to make up for the underperformance. As of Wednesday morning, the 101 S&P 500 SPX components that don’t pay dividends were up 20.7% on average on a year-to-date basis, while the 100 highest-yielding dividend payers in the index were down 3.2%, the Bespoke team highlighted.

Given a 17%-plus return for the S&P 500 (

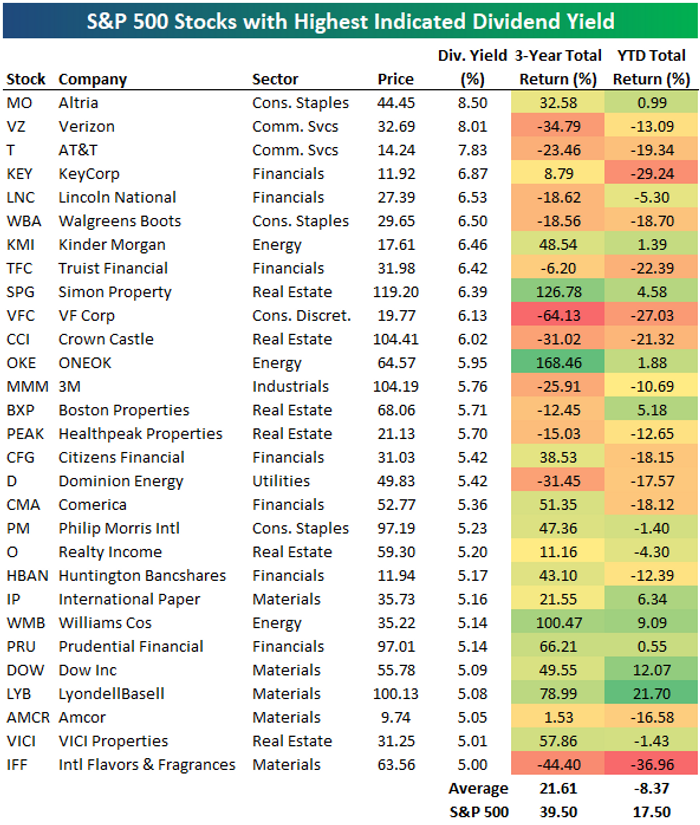

When narrowing on just the 29 stocks with the highest indicated dividend yields, all of which were at least 5%, Bespoke flagged even weaker relative performance. That bucket of names had seen a year-to-date average decline of 8.4% on the basis of total returns. The grouping lagged the S&P 500 over a three-year span as well, returning 21.6% versus a 39.5% return for the index.