As long as I’ve been writing about dividend investing, people have asked me, “Doesn’t a high yield indicate higher risk?”. I am faced with incredulity and shock when I reply that it doesn’t.

Now, I won’t sit here and tell you I have some secret method to avoid dividend cuts forever. I don’t. If you are investing in dividend stocks, it is only a matter of time before you find yourself holding one that is cutting its dividend. That is a reality of investing. Not every call will work out, and not everything that will work out in the long run will look good today.

As Warren Buffett wrote in his 2023 Letter To Shareholders:

Over the years, I have made many mistakes. Consequently, our extensive collection of businesses currently consists of a few enterprises that have truly extraordinary economics, many that enjoy very good economic characteristics, and a large group that are marginal. Along the way, other businesses in which I have invested have died, their products unwanted by the public.

The harsh reality is that the majority of stocks you buy will be mediocre. Everyone always looks for a stock that will take off like a rocket. Where they will see the price go up 1000%+. Or, in the case of dividend investors, everyone talks about wanting to find that dividend growth stock that will hike its dividend 10%+/year every year for decades.

Over decades of investing, you will find those gems. You’ll have that occasional company that proves to be truly exceptional. You will also invest in a wide variety of mediocre or, sometimes, downright terrible holdings.

The reality is that the only dividend that is guaranteed is the one that is in your pocket. Until you get cold hard cash, any expected dividend is a prediction.

Lower Yield, Lower Risk?

The problem with saying that high yield equals higher risk is that it implies that lower-yielding stocks are not at risk of cutting their dividends. This simply isn’t true.

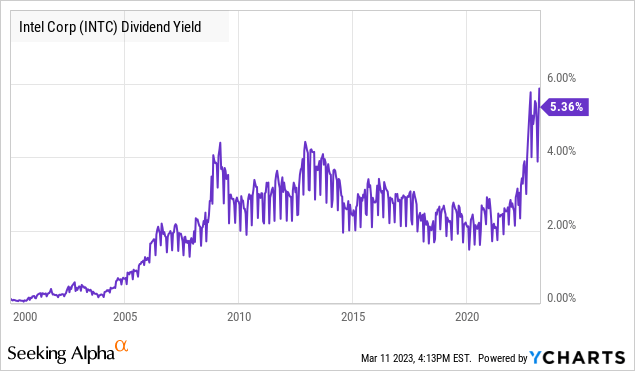

Intel Corporation (INTC

The yield on INTC’s dividend typically traded in the 2-3% range.

INTC has a stellar dividend history of 2-3% yields, annual dividend growth in 28 out of 30 years, and no cuts for 30 years through the dot-com bust, the GFC, and COVID. Looking in the rearview mirror, INTC had an apparently very safe dividend.

In truth, it wasn’t.

INTC isn’t the only example. Hanesbrands (HBI

From 1989 to early 2020, BA paid a dividend that had never been cut and was raised inconsistently but by very reasonable amounts. For 30 years, BA yield spent most of its time below 2.5%. Spikes over 3% were buying opportunities. Then one day, it was just gone. Three years later, BA still hasn’t paid another penny in dividends.

I could go on. The bottom line is that investors should never look at yield and history to judge the safety of any dividend. It doesn’t matter how stellar the record is. Future dividends are paid from future cash flows. Whether a stock has a 2% yield or a 12% yield, we need to base our analysis on what we believe will happen in the future.

Betting On Dividend Growth Is High Risk

Among income investors, there are two broad categories that investments fall into. “Dividend growth” investment styles seek to identify opportunities likely to grow their dividend consistently over time. “High yield” strategies seek to invest in companies that are paying large dividends right now. It isn’t exactly a clear line, and you will find stocks that fit in both categories, and you will find investors who pursue both strategies.

At HDO, our Income Method targets high-yield investments with an average current yield of 8-10%. Yet, in our portfolio, we mix in a few dividend-growth-style investments. Realty Income (O

I love a dividend raise as much as the next income investor. Yet betting on future dividend growth is an uncertain proposition at best. INTC and BA both carry A-rated balance sheets. These are modern behemoths, not speculative companies with an unproven business model.

In our arrogance, it is sometimes easy to forget that we don’t know the future. Consider two stocks: One yields 3% and has 10% dividend growth, and the other yields 10% and doesn’t change its dividend. The companies would take approximately 14 years to have roughly the same income.

What can happen in 14 years? A lot. Can you state with certainty that any company paying a dividend today will still pay a dividend in 14 years? I’m sure most investors in BA from 2006-2019 were all very confident that BA would be paying a dividend in the future.

You can’t know for certain that any company will pay a dividend in 14 years. You also can’t know whether a company will be able to sustain a dividend growth rate of 10% for 14 years.

It is difficult enough to predict what will happen with any particular company over the next year. The further out into the future you go, the more uncertainty you must have. If your investment assumptions require a company to do something 15-20 years in the future, you are walking on very thin ice.

Immediate Income Reduces Risk: A Case Study

Income in your pocket is a realized return. It is a mathematical fact that with each dividend you receive, the largest possible loss on your investment declines until it becomes $0. At that point, your smallest possible gain rises with each dividend received.

Total return equals dividends received plus any capital gains (losses). Let’s look at a high-yielding company with numerous dividend cuts over its history and compare it to INTC, which has had one dividend cut.

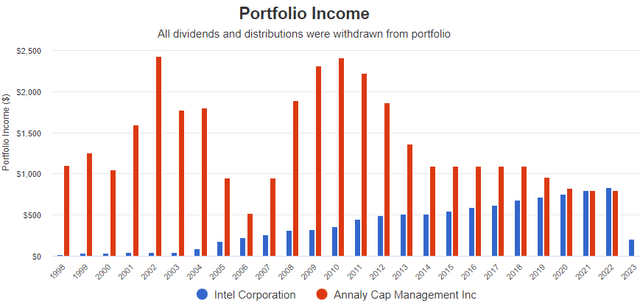

If you invested $10,000 in each in 1998, here is what your income would have looked like (assuming no reinvestment). Source

Note that Annaly Capital’s (NLY

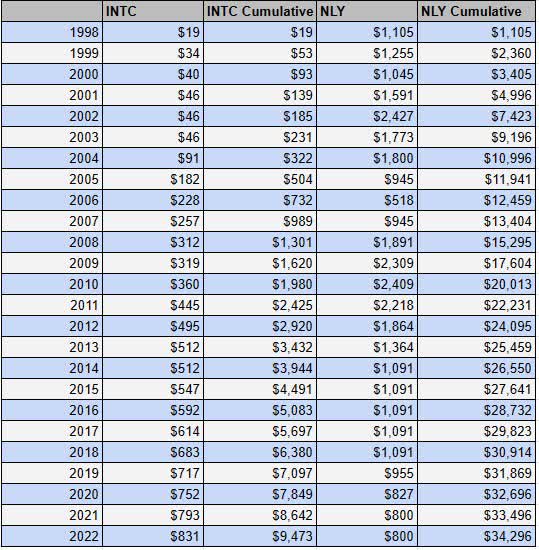

Here are the dividends received over the past 24 years on a $10,000 investment without any reinvestment:

Note that by 2004, NLY investors had already received their entire $10,000 original investment in dividends alone. Meanwhile, INTC had only paid $322 in dividends. In just seven years, the NLY investor was guaranteed a net gain on investment even if NLY’s share price went to $0.

It took INTC 24 years to catch up to NLY’s annual dividend, which was with some help from NLY reducing its dividend. Dividend Growth Investors held for 24 years just to “catch up” on an annual basis, yet in total dividends paid, how many more years would it take for them to catch up on the $24,823 more in dividends that the NLY position collected?

Even with a very bullish outlook, it would have taken many years. Yet INTC investors won’t get that chance with the dividend being cut 65%, INTC’s dividend will be closer to $291 in 2023. Meanwhile, we do expect a dividend cut this week from NLY as well, which according to management comments on the earnings call, will be a 25-30% cut as conditions for the MBS market become very similar to what we saw in 2006. Yet the dividend will still be much higher than INTC’s.

But What About The Share Price?

Share price matters only at two points in the course of your investment: The day you buy and the day you sell. Any point between those points is, at best, a piece of useless trivia. You could have sold INTC for over $60 two years ago. You can’t sell it for $60 today!

People are obsessed with measuring their prices mid-investment. They love to talk about how much they are “up”.

Did you sell?

“Of course not, it is a great company! Look how much money it made me!”

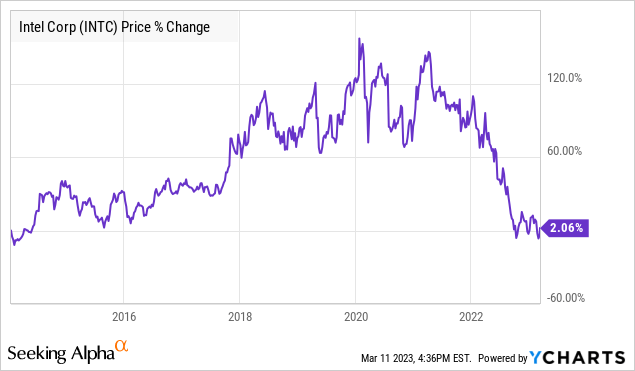

Unrealized gains don’t pay bills. People never believe how quickly they can disappear. INTC had fantastic gains, until the past 12 months.

In 12 short months, INTC lost eight years of capital gains. Until you are actually clicking that sell button, unrealized gains are counting the chips on the table. You are counting the money you still have at risk.

Looking at the total return for INTC and NLY, Portfolio Visualizer reports a value on the INTC investment as of January 31st, 2023, of $16,091. In contrast, NLY had a residual value of $5,334.

INTC’s total return: $9,473 in dividends + $16,091 in share value = $25,564

NLY’s total return: $34,296 in dividends + $5,334 in share value = $39,630

NLY’s theoretical total return if an investor sold today is much higher. But let’s not talk about theory. NLY’s realized total return is much higher. If NLY went to $0 tomorrow and never paid another dividend, the $10,000 investment would have a total return of $34,296.

Meanwhile, for the INTC investment, only $9,473 is realized return. There is still $16,091 at risk.

You Can “Take Your Chips Off the Table”

In the game of poker, there is a term called “Going South”. It is when a player is winning, and they take some chips off the table. By taking them off the table, they have less money at risk in the next big hand. That way, even if they lose everything on the table in an unlucky hand, they still have the money in their pocket, guaranteeing a smaller loss if not a profit. Going South is considered cheating, and it is certainly bad etiquette at the poker table.

Fortunately, investing isn’t gambling. “Going south” with your investments is perfectly fair game. When you collect a dividend, you have absolutely no obligation to put it back into the investment. You can put it in your pocket, spend it, or invest it in something completely different. Every dividend you receive, you have the power to decide what to do with it.

Investing Has Risks, But You Can Manage Them

There are risks to all investing. Companies will hit hard times, earnings will fail to meet expectations, dividends will be cut or suspended, and some companies will outright fail. This will happen among high-yielders, low-yielders, and companies that don’t pay a dividend at all.

Sometimes a negative event will be something that is predictable, but we are all human and miss things. Other times, a negative event is a complete “Black Swan”, something that couldn’t have been predicted.

Whether you choose a dividend growth, high-yield, or growth style of investing, it makes sense to manage your risks. How?

- Diversify. For the Income Method, I promote the “Rule of 42“, owning at least 42 investments. Watch for investments that become “overweight” in your portfolio. With a high-yield investing style, those are the ones you want to Go South with and take some chips off the table. Reinvest dividends from your largest positions into some of your smallest positions or into new positions.

- Focus on the future. It is easy to get bogged down in the past, but future dividends are paid from future cash flow. Ask yourself what the future looks like for a company and whether it is a company you want to own. Just because the dividend might have been “safe” in the past does not mean it will be safe in the future. Similarly, the dividend being cut today does not mean that the future will be dark. Saratoga Investment Corp. (SAR

is a BDC that suspended its dividend for a brief period during COVID and then restarted the dividend 30% lower. We held onto it, and today SAR is paying a dividend that is 23% higher than it was paying pre-COVID! Whenever a company cuts its dividend, take some time to understand the dynamics causing it, and whether those will be permanent, or temporary. Often, shortly after a dividend cut is the best time to buy. - Have a cushion built into your plan. If you need $60,000 in dividend income, then you need a portfolio that is producing more than $60,000 in dividends. The Income Method calls for reinvesting at least 25% of your dividends. So if you “need” $60,000 in dividend income to retire, you want to plan to have a portfolio that is producing $80,000 in dividends. This will allow you to reinvest $20,000 in the first year, growing your income and providing a cushion to protect your income from any cuts.

Conclusion

When raising chickens, there is a famous saying about not counting your chicks until they hatch. Just because you have eggs today doesn’t mean you’ll have new chicks tomorrow. Unsurprisingly, you can even have up to 50% loss of chicks that do hatch! When you invest for the future promise of dividend growth, you are buying a stock now with the expectation of chicks tomorrow – often that’s not the result.

INTC is an example of why I dislike the “dividend growth” style of investing. It is hard enough to predict which companies will pay what dividends next year. Trying to predict which companies will increase their dividend every year for 20+ years? That is a feat.

The “Dividend Aristocrat” list is short and trades at a premium due to the assumed dividend growth. This is the list of stocks that have hiked their dividend every year for at least 25 consecutive years. More importantly, companies are taken off of the list fairly frequently. Hiking for 25 consecutive years is not at all proof that the company will hike for another 25!

If you could go back to 1990 and buy only the stocks that are on the Dividend Aristocrat list today, you would have a very impressive portfolio. But you can’t invest with a time machine. For every dividend aristocrat, there were a dozen companies that an investor could have reasonably believed might achieve that lofty goal.

If you diversify into 42+ dividend growth investments, I’m sure you will find a few that become great. You’ll also have several INTCs that don’t grow their dividend as expected or slash it.

If you have a diversified portfolio of 42+ high-yielders, you will see some that are simply phenomenal. You’ll also have some that cut, at which point you need to make a decision on whether the company still has potential, or if it is better to move on.

The further into the future you look, the harder it is to predict what will happen. With the Income Method, you don’t need to predict what will happen in 10 to 20 years. You are getting your income today.

Photo by Natalia Y. on Unsplash