Just 34 stocks in the S&P 500 have a dividend yield above that on the six-month Treasury bill

AT&T (T

Stocks used to be the only game in town for investors chasing robust returns. That is hardly the case any more.

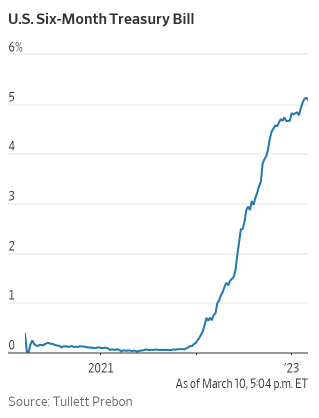

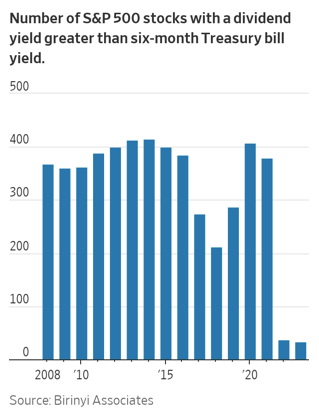

Soaring inflation has pushed government-bond yields to their highest levels in more than a decade. That, coupled with a soggy stock market, has led to a steady decline in the number of stocks that offer comparatively high yields: There were just 34 stocks in the S&P 500 with a dividend yield above that on the six-month Treasury bill as of Friday, according to Birinyi Associates. The six-month yield settled at 5.116%, according to Dow Jones Market Data

That is a dramatic shift from much of the past decade when interest rates were near zero and hundreds of stocks within the index offered higher yields. At the end of 2021, before interest rates began to rise, there were 379 index constituents that offered a better yield than the Treasury bill, according to Birinyi.

Because U.S. government bonds are considered to be safer than even blue-chip stocks, some investors say it is difficult to justify putting money in the relatively risky stock market. The extra yield from a dividend-paying stock isn’t worth the added chance that a company will endure a business slump, they say, especially because of the uncertain economic outlook.

“There’s no reason whatsoever to buy a risky company just because it’s in the same yield ZIP Code as cash,” said Macro4Micro editor Glenn Reynolds, who said he has more than 80% of his portfolio in cash.

Stocks and bond yields tumbled last week over worries about the health of the banking sector and a hotter-than-expected labor market. A sharp decline in bank stocks, however, raised the possibility that the Federal Reserve might be forced to end its tightening campaign sooner than previously expected. The S&P 500 is up 0.6% this year and down 19% from its January 2022 peak.

The state of the economy will be in focus again this week as investors seek clues on the path of interest rates. Consumer-price index data for February is expected Tuesday, while retail sales data is due Wednesday. Earnings from FedEx Corp. (

The yield curve remains sharply inverted, meaning short-term interest rates are higher than longer-term rates. That reflects uncertainty surrounding the economy’s long-run direction.

“From a top down perspective, the yield curve is sending a cautionary message to equity investors,” said Ryan Hedrick, portfolio manager of the T.Rowe Price value fund. In such environments, dividend payments often account for a greater share of investor returns than from capital appreciation, he said.

Dividend-paying stocks were a bright spot in last year’s battered market. The S&P 500 High Dividend Index fell 1.1% last year including payouts, compared with an 18% decline for the broad index. The index has fallen 4.9% in 2023.

Despite the turmoil in markets, companies in the S&P 500 have continued to boost dividend payouts to investors. They paid out a record $564.6 billion in 2022 and are on course to set another high this year based on current dividend rates and assuming no membership changes to the index, according to the S&P Dow Jones Indices.

The list of highest-yielding stocks includes many old-economy businesses. Companies typically return cash through dividends or repurchase their stock when the business generates more cash flow than needed to fund operations. These businesses generally have mature operations that generate significant cash flow but increase sales and profits more slowly than in more nascent industries like technology.

Several energy companies such as Pioneer Natural Resources Co. (PXD

Investors say dividend-paying stocks still play an important role, even with interest income from bonds readily available. Mr. Hedrick said he favors stocks in more defensive sectors, such as healthcare, consumer staples, and property and casualty insurance.

“I do think inflation shortens people’s investment time horizons,“ said Lawrence Hamtil, an investment adviser at Fortune Financial Advisors who has identified tobacco investments as a hedge against inflation. In environments where prices are rising, preservation of capital becomes relatively more important to investors than long-term appreciation, a dynamic that makes dividend payers more attractive, he said.

Dividend stocks can still present risks if it becomes too expensive for companies to afford the payouts. Intel Corp. (INTC

“In this environment, we came to the conclusion that the highest dividend payer shouldn’t also be the highest capital investor,” Intel CEO Pat Gelsinger said on a conference call.

AT&T (T

Photo by Jp Valery on Unsplash