Summary

- The value rotation story has been hard to miss – it’s a trend that’s been underway since late 2020 and has since continued to gather steam.

- A theme often heard in the narrative is that value had been floundering relative to growth for a long stretch leading up to the rotation.

- However, a closer look at performance and relative valuations over the longer term reveals the value factor has been alive and well for decades.

The value rotation story has been hard to miss – it’s a trend that’s been underway since late 2020 and has since continued to gather steam. A theme often heard in the narrative is that value had been floundering relative to growth for a long stretch leading up to the rotation.

However, a closer look at performance and relative valuations over the longer term reveals the value factor has been alive and well for decades.

The perfect storm for a value rotation

As Central Banks respond to today’s inflationary environment with rate hikes, they’ve also introduced quantitative tightening. The resulting rising rates, reduced liquidity, and economic uncertainty have been key drivers behind the value rotation.

Rising real rates – the discounting factor for equity valuations – have had an outsize impact on growth company valuations, bulk of whose earnings and cash flows are, by definition, far into the future. And reduced liquidity has further compressed previously stretched growth company valuations. Economic uncertainty has also been a headwind for growth stocks, as investors shy away from the risks associated with companies that are forecast to grow in an uncertain future.

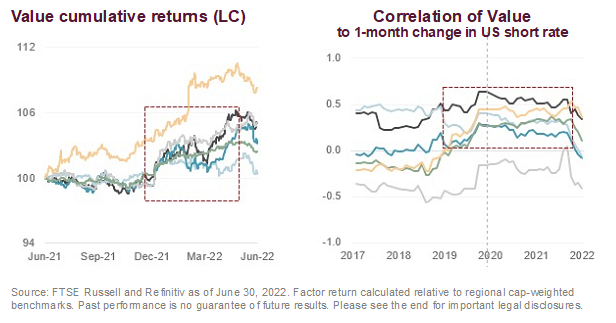

The impact of these trends is evident in recent returns. As shown in the graph, cumulative value factor returns have soared in recent months, as correlations with changes in US short-term rates have increased to an economically and significantly positive level – signaling a clear rotation into value.

Value’s relative track record isn’t just about performance

While value stocks have indeed rotated back into favor, relative performance alone doesn’t tell the entire story. It’s important to also examine how value and growth valuations compare over time.

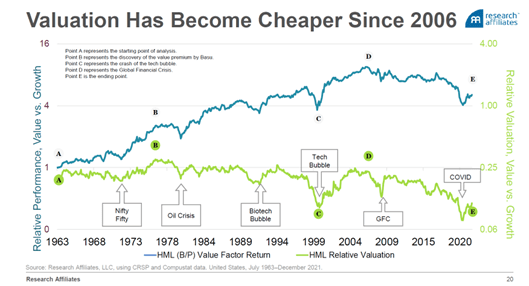

In the chart below, the blue line denotes the value factor return from 1963 to the present. The line’s end point (E) indicates that if investors had allocated equal amounts to value and growth in 1963, today the value investor would be 5x as wealthy as the growth investor.

We can also observe that from 2007-2020, the blue line declined considerably as value fell out of favor. In fact, if the chart ended at the value factor’s peak in 2007, the value investor would have been 10x as wealthy as the growth investor.

While the blue line does support the narrative that value lagged growth for five years prior to the value rotation, it’s important to also consider the green line’s trajectory during this time. The green line represents value’s cheapness relative to growth, as measured by price-to-book (P/B).

While on average relative valuation has hovered around 0.25 – meaning that growth is 4x as expensive as value – the graph indicates that during value’s underperformance from 2007-2020, growth became 12x as expensive as value.

The value factor: Alive and well from peak to trough

While each line is independently informative, Rob Arnott, Founder and Chairman of the Board of Research Affiliates, would draw our attention to the space between the blue and green lines.

“The key point in this graph lies in the gap between the two lines. That’s the structural alpha of value. You’ll notice that value has been consistently winning compared to its relative valuation over the past 60 years.”

If we examine the most recent stretch of value underperformance, we can observe that from its peak in 2007 to its trough in 2020, value underperformed growth by 58% but cheapened by 73%.

This disparity points to improving fundamentals – book value in this case – indicating that contrary to popular belief, the value factor was alive and well in the years leading up to the value rotation.

Cleanly capturing the value factor

While style indexes can be effective tools for navigating the value rotation, the FTSE RAFI Indexes can offer investors an alternative approach. Instead of weighting index constituents by market values, the indexes weight them using a composite of fundamental factors, including total cash dividends, free cash flow, total sales, and book equity value. This approach trims growth stocks and boosts value stocks to their fundamental weight – cleanly capturing the value effect.

As shown in the graph, cumulative value factor returns have soared in recent months, as correlations with changes in US short-term rates have increased to an economically and significantly positive level – signaling a clear rotation into value.

Photo by Josh Appel on Unsplash