Summary

- Orange Telecom has had a rough 2022 for a variety of reasons.

- The current yield is approximately 7.6% and the trailing-twelve-month payout ratio is 48.7%.

- Heading into 2023, this yield should reward income-focused investors.

- In addition to the distribution, the shares may also ride higher due to a variety of macro and company-specific factors.

- Though this is my top dividend pick for 2023, there are caveats to mention for income-seeking investors.

Introduction

Orange’s (NYSE:ORAN

For those new to the name, Orange is a French telecommunications provider. Its French business is complemented by operations in Spain, Poland, and other European countries. Not only are they in Europe, but Orange has significant operations throughout the Middle East and Africa, which have great growth potential. It also provides clients with cybersecurity, cloud storage, and even banking services. The shares are listed in New York under the symbol ORAN and in Paris under the symbol ORA.

For full disclosure, we own a stake in the telecom here at Contra the Heard Investment Newsletter. The shares were first purchased over a decade ago, and in the time since then we have used it to harvest dividends while waiting for capital appreciation. The capital appreciation has not yet materialized, but the yield has been excellent and we expect that to continue into 2023 and beyond.

The Dividend

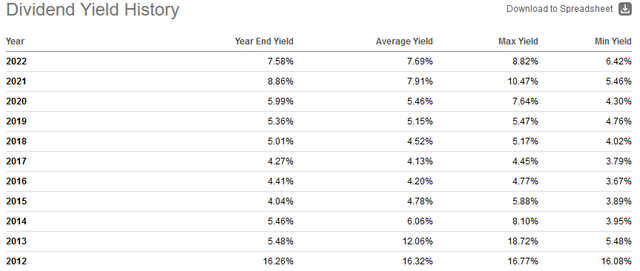

Orange has a yield today of approximately 7.6% with a trailing-twelve-month payout ratio of 48.7%, according to data provided by Seeking Alpha. The yield is good and the payout is low, which makes this an attractive income-oriented opportunity. The distribution has been consistently good over time, but thanks to the stock’s selloff this year, it is higher today than it has been for much of the past decade. Here is the annual dividend history table, courtesy of Seeking Alpha, which dates to 2012:

Another possibility is a dividend increase, which would add to the overall distribution. A dividend rise is not our base case, but regardless of if it happens, a 7.6% distribution from one of Europe’s largest telecommunication providers is excellent.

Other Factors And Considerations

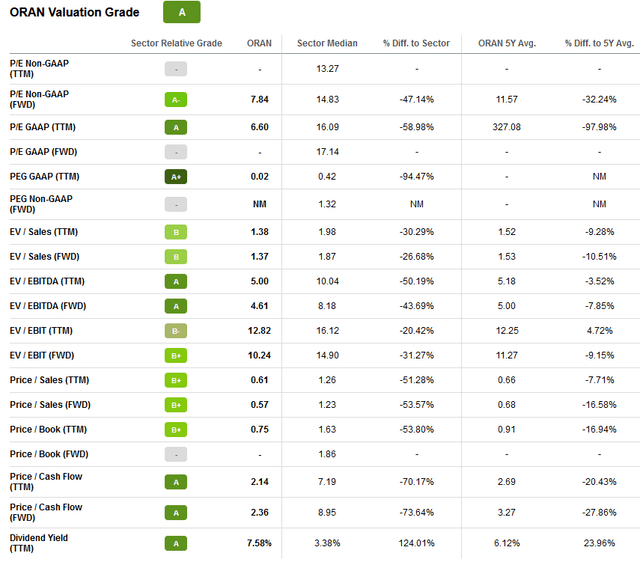

In addition to the distribution, it is possible owners will see capital appreciation in 2023, as the corporation’s valuations are currently low and could move higher. Here is the stock’s valuation table from Seeking Alpha, which compares the telecom to its peers:

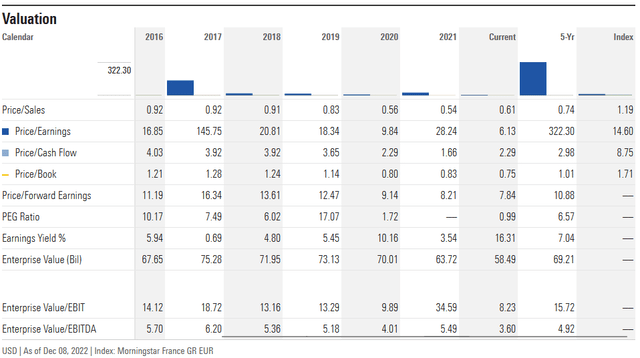

In addition to having low valuations versus peers, the organization is cheap compared to where it has traded in the past, as well as against the market in general. This table by Morningstar highlights the corporation’s valuations today against its five-year average, and the index too:

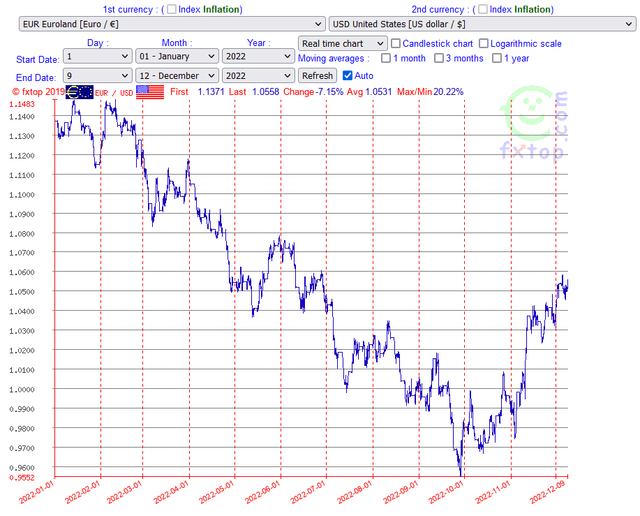

To make a long story short, Orange looks cheap, and cheap stocks have higher odds of capital appreciation compared to more expensive peers. In addition to considering the valuation picture, Orange’s US-listed ADR has been beaten up this year as the US Dollar strengthened against the Euro. While this trend was reversed somewhat recently, the Dollar is still lofty versus historic standards. Here is the year-to-date exchange rate chart via FXTop:

Global equity benchmarks are coming out of a bad year. It is possible global stock markets may have another bad year in 2023, but stocks tend to go up over time, and the odds favour a rebound of some sort. Even if a rebound does not transpire and the economic situation gets worse, telecoms like Orange should do relatively well.

The shares could get a final boost if the company is able to turn around its underperforming Spanish division. This market is very competitive, which has hurt Orange’s business there. To remedy the situation, Orange and MásMóvil have signed an agreement to combine their operations in this country. The transaction is based on an enterprise value of €18.6 billion – €7.8 billion for Orange and €10.9 billion for MásMóvil. Though the merger is subject to approval from antitrust authorities and is not expected until the second half of 2023, passage of the deal would cut the number of big competitors in Spain from four to three, and help Orange in the process.

Orange’s outlook is strong, but there are caveats for income-oriented investors. First, the distribution is not paid out monthly or even quarterly, which could be an issue for those needing regular payments. Second, there are ADR fees associated with the dividend. These cautions aside, the organization represents an excellent income-oriented opportunity for 2023.

Conclusion

Orange Telecom’s share price has had a rough 2022, but the distribution has helped offset this issue. The current yield is approximately 7.6%, and the trailing-twelve-month payout ratio is 48.7%. The combination of a high yield and relatively low payout means investors can be confident that they will receive respectable distributions going forward. Though admittedly a long shot, owners could potentially see a dividend increase next year, in addition to the already good dividend income. The name currently has low valuations, so owners could see the shares rise higher, and the Euro could continue to rebound against the US Dollar too. It is for these reasons that Orange represents our top dividend stock pick for 2023.