A small exchange-traded fund focused on high-quality, dividend-paying stocks is beating the pummeled stock market this year even after its recent bounce which is seen as a rally marked by “euphoria” that will likely ease, according to its portfolio manager, Austin Graff.

TrueShares Low Volatility Equity Income ETF DIVZ, which has $62.5 million in assets, has a total return of 3.1% this year through Thursday, according to FactSet data. That beats the SPDR S&P 500 ETF Trust SPY, which has lost almost 11% over the same period on a total return basis, FactSet data show.

“Right now, we’re more weighted towards value,” said Graff, portfolio manager for TrueMark Investments’s TrueShares Low Volatility Equity Income ETF, in a phone interview. Graff, who is a former PIMCO portfolio manager, said the actively managed ETF is concentrated and holds both value and growth stocks.

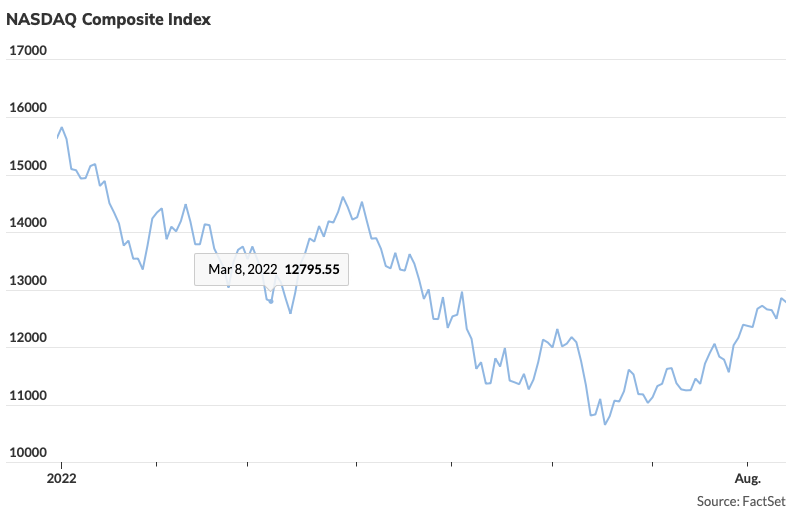

The U.S. stock market has surged in recent weeks, with the Nasdaq Composite COMP exiting bear market territory on Wednesday, according to Dow Jones Market Data. Growth stocks have been pummeled this year but are outperforming value so far in the third quarter, as investors see signs of easing inflation potentially leading to a less aggressive Federal Reserve.

Graff isn’t planning any big portfolio shifts at the moment.

“There’s been a lot of rhetoric around peak inflation,” with the assumption that “it’s going to decline as rapidly as it went up,” he said. The “knee-jerk reaction” has been for equities to climb higher as interest rates went down, said Graff, pointing to the yield on the 10-year Treasury note.

The 10-year yield has dropped from its peak this year of 3.482% on June 14, according to Dow Jones Market Data. On Thursday, the 10-year yield BX:TMUBMUSD10Y rose 10.6 basis points to 2.886%.

Growth stocks — which are sensitive to higher interest rates and were hurt as the 10-year yield rose earlier this year — could keep outperforming if the long-term Treasury rate keeps falling, according to Graff.

But in his view, the recent stock-market rally reflects “short-term euphoria that will likely ease” as the Fed continues battling stubbornly high inflation. He expects that means stocks in the Nasdaq-100 index NDX and some of the “high-flying” companies in the S&P 500 are poised for a decline.

Invesco QQQ Trust QQQ, which tracks the Nasdaq-100 index and provides exposure to tech, growth and large-cap stocks, has tumbled more than 18% this year after surging more than 15% so far this quarter, FactSet data show.

The Federal Reserve has been aggressively hiking its benchmark interest rate to combat high inflation. “I think the Fed has a lot longer to go,” said Graff. To his thinking, interest rates aren’t going to “just revert back to being accommodative” in the next two to six months.

In the meantime, Graff said that it’s his job to find companies in which he can invest by “paying very little for as much growth as possible.”

UnitedHealth Group Inc. UNH, one of his bets in the traditionally defensive healthcare sector, is growth-oriented, according to Graff. “It’s a company that’s growing faster than the market but trading at a valuation that’s cheaper than the market,” he said, adding that UnitedHealth is the second largest holding in the TrueShares Low Volatility Equity Income ETF.

Within tech, Graff said his portfolio includes cybersecurity company NortonLifeLock NLOK. The stock was not in the firm’s top 10 holdings as of Aug. 11, according to data on the ETF’s website.

Graff sees “a bifurcation” in the way investors now think about growth, explaining that some “value names” are expected to grow faster than some growth stocks while trading at low valuations. For example, “we have a significant position in some of these oil and gas E&Ps that are growing faster than the market in general,” he said.

The ETF’s top holding is Exxon Mobil Corp. XOM, with the fund’s other energy positions including Devon Energy Corp. DVN and Coterra Energy Inc. CTRA, the website shows.

As an indirect “clean energy play,” the TrueShares Low Volatility Equity Income ETF also has exposure to electric utilities that are increasing their transmission grids, as opposed to the ETF investing directly in, say, a solar company, according to Graff.

“It’s a more value conscious way to play green energy,” he said, citing the fund’s position in American Electric Power Co. AEP and FirstEnergy Corp. FE as examples.

As usual, here’s your weekly look at the bottom and top ETF performers over the past week through Wednesday, according to FactSet data.

The good…

| Best performers | %Performance |

| VanEck Rare Earth/Strategic Metals ETF REMX | 11.1 |

| First Trust Nasdaq Oil & Gas ETF FTXN | 6.5 |

| iShares U.S. Oil & Gas Exploration & Production ETF IEO | 6.4 |

| AdvisorShares Pure US Cannabis ETF MSOS | 5.6 |

| iShares U.S. Energy ETF IYE | 5.3 |

| Source: FactSet data through Wednesday, Aug. 10, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater. |

…and the bad

| Worst performers | %Performance |

| VanEck Semiconductor ETF SMH | -2.7 |

| FlexShares iBoxx 5 Year Target Duration TIPS Index Fund TDTF | -0.9 |

| VanEck Preferred Securities ex Financials ETF PFXF | -0.8 |

| VanEck High Yield Muni ETF HYD | -0.7 |

| JPMorgan U.S. Aggregate Bond ETF JAGG | -0.7 |

| Source: FactSet |

New ETFs

J.P. Morgan Asset Management announced Aug. 9 the launch of the JPMorgan Active Growth ETF JGRO, an actively- managed pure growth ETF that seeks to outperform the Russell 1000 Growth Index.

Strive Asset Management said August 10 that it launched its flagship index fund, the Strive U.S. Energy ETF DRLL “to unlock the potential of the U.S. energy sector.”