Summary

- Dividend stocks, once a stalwart of steady performance and reliable returns, are largely getting left out of the supposed “melt-up” and “new bull market.”

- From a trading perspective, money tends to favor dividend stocks and low beta companies when in high volatility risk-off regimes.

- The pendulum will swing back to dividend ETFs, as it always does.

Do you know the only thing that gives me pleasure? It’s to see my dividends coming in. – John D. Rockefeller.

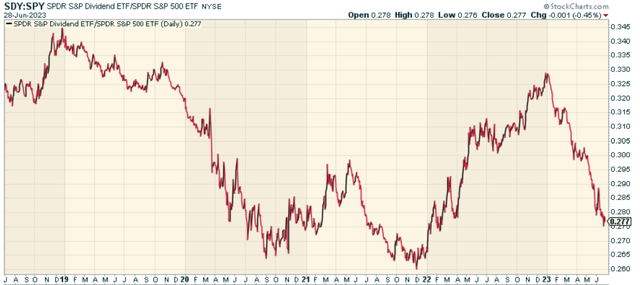

Dividend stocks, once a stalwart of steady performance and reliable returns, are largely getting left out of the supposed “melt-up” and “newbull” market. If we look at the price ratio of the SPDR® S&P Dividend ETF (NYSEARCA:SDY

The Current State of Dividend Stocks

Dividend investing was a standout performer in 2022, providing protection during the bear market in global equities. However, the tables have turned in 2023, with dividend-focused strategies struggling to maintain momentum. And we know precisely why – the AI chase which dividend proxies simply don’t have much exposure to.

This too shall end. From a trading perspective, money tends to favor dividend stocks and low beta companies when in high volatility risk-off regimes. We are likely due for another volatility pulse given sentiment, seasonality, and fundamentals. But regardless, of whether you’re a trader or not, dividend-oriented companies deserve a place in your portfolio.

Dividend ETFs Worth Focusing On

Vanguard Dividend Appreciation Index Fund ETF Shares (VIG

The Vanguard Dividend Appreciation ETF closely tracks the performance of the S&P U.S. Dividend Growers Index, which consists of common stocks of companies that have a record of increasing dividends over time. The fund has a major allocation to the information technology, financials, and health-care sectors.

Schwab U.S. Dividend Equity ETF™ (SCHD

The Schwab U.S. Dividend Equity ETF closely tracks the performance of the Dow Jones U.S. Dividend 100 Index, which measures the performance of high dividend-yielding stocks issued by U.S. companies that have a record of consistently paying dividends.

iShares Select Dividend ETF (DVY

The iShares Select Dividend ETF seeks to track the investment results of the Dow Jones U.S. Select Dividend Index, which measures the performance of a selected group of equity securities issued by companies that have provided relatively high dividend yields on a consistent basis over time.

SPDR S&P Dividend ETF (SDY

The SPDR S&P Dividend ETF seeks to closely track the performance of the S&P High Yield Dividend Aristocrats Index. The S&P High Yield Dividend Aristocrats Index measures the performance of the highest dividend-yielding S&P Composite 1500 Index constituents that have followed a managed-dividends policy of consistently increasing dividends every year for at least 20 consecutive years.

ProShares S&P 500 Dividend Aristocrats ETF (NOBL

The ProShares S&P 500 Dividend Aristocrats ETF seeks investment results that track the performance of the S&P 500 Dividend Aristocrats Index. The Index targets companies that are currently members of the S&P 500, have increased dividend payments each year for at least 25 years, and meet certain market capitalization & liquidity requirements.

Conclusion

While dividend stocks continue to grapple with challenges, they remain a viable investment option for those seeking stable returns and a degree of protection against market volatility. If I’m right that we are in a high risk period for equities, and volatility does suddenly pick up, it’s best to considering being defense in advance of increased price gyration for the broader market.

Despite current underperformance, it’s crucial to remember that markets are cyclical, and what is out of favor today may well be tomorrow’s top performer, and vice versa. The pendulum will swing back to dividends, as it always does.

Photo by Alexander Mils on Unsplash