Summary

- Some claim that stocks whose dividend yields are higher than inflation are a hedge against inflation. That’s like comparing the top speed of one car with the acceleration of another.

- I will demonstrate the fallacy of inflation protection through dividend yields using the example of Altria and Houlihan Lokey.

- In addition, I will analyze both companies from the perspective of dividend safety, operating performance and balance sheet strength, with a focus on the current inflationary environment.

- I will also present a model portfolio of stocks, most of which I own, that currently beats inflation and has a starting yield of 3.6%.

Introduction And Scope Of The Article

A key priority for many investors (myself included) is protecting purchasing power from inflation. When investing in bonds, inflation protection can be achieved by investing in Treasury Inflation-Protected Securities (TIP). When investing in stocks, investors should put an emphasis on companies that have monopolistic tendencies and consequently have a wide economic moat with high barriers to entry.

Investors who focus on cash flows primarily in dividend-paying stocks and therefore look beyond capital gains (i.e., retired individuals or those soon to be so). Several articles – and I have stumbled across this line of thought in several discussions as well – claim that dividend stocks with yields above the current rate of inflation (as measured by the Consumer Price Index, CPI) are a good hedge against inflation.

In this article, I will demonstrate that investors who engage in this practice can fall victim to a potentially costly mistake. I will use the well-known tobacco giant

Before going into detail about the fallacy of inflation protection through high dividend yields, I will discuss the business models of the two companies as well as their profitability and balance sheet quality, with a focus on dividend safety. After all, the highest dividend yield is of no use if the dividend is not sustainable.

Readers who already know the two companies well enough and are only interested in the fallacy of inflation protection through high dividend yields can, of course, jump directly to the relevant section in the article.

Overview Of The Two Companies

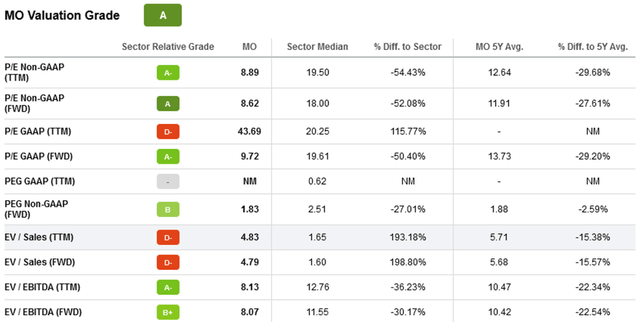

The cigarette manufacturer Altria exclusively distributes premium brands such as Marlboro in the United States. MO is the U.S. business of Philip Morris that remained after the spin-off of the international business (PM) in 2008. Unlike PM, MO’s revenues are still generated primarily in the combustion products segment, although the company has made efforts to diversify its operations. The acquisition of stakes in JUUL and Cronos Group reeks of desperation considering the price, and Altria is still not making a profit on e-cigarettes. Most of the investment in JUUL has now been written off, but the negative news related to the segment is not abating. In June, the FDA withdrew authorization for JUUL products, a decision that Altria appealed. The company scored a temporary victory when the FDA announced that it would allow JUUL products to continue to be sold. In the heated tobacco products segment, Altria also leaves much to be desired, as it has still been unable to capitalize on IQOS’ international success, in part due to ongoing patent issues with British American Tobacco (BTI, OTCPK:BTAFF). Speculation that PM may market IQOS and IQOS ILUMA itself in the U.S. following the announced acquisition of Swedish Match (OTCPK:SWMAY) (see my May article) is another reason why investor sentiment toward Altria is currently subdued and shares are trading relatively cheap:

Houlihan Lokey is a leading global investment bank with particular expertise in financial restructuring and mergers and acquisitions. Compared to Altria ($75.1 billion), Houlihan is a much smaller company with a current market cap of only $5.3 billion. I published a bullish analysis of the company in May. Houlihan generated more than one-third of its fiscal 2021 revenue in the Financial Restructuring segment. Arguably, in fiscal 2022, this percentage was significantly lower due to the consolidation of GCA corporation – most of GCA’s revenues are included in the Corporate Finance segment. Nevertheless, financial restructuring is a major driver of company earnings, as is underlines by the fiscal 2021 segment operating margin of over 40%. With the U.S. expected to experience a recession in the near future, bankruptcies will increase, and with them the need for restructuring expertise.

As a result, I view HLI as a relatively low-risk exposure to the highly profitable investment banking sector, but would not be surprised if the stock is beaten down significantly in a recession, as investors misunderstand Houlihan as a traditional investment bank. Still, with a current price-to-earnings ratio of 11 and a free cash flow yield of over 10%, I think the stock is already a good value.

Houlihan also operates in Europe, so it should be seen as a beneficiary of what is likely to be a severe recession in that region. Of course, at the same time, the weaker euro is a headwind for HLI’s earnings. Altria’s main business is confined to the U.S., but through its stake in Anheuser-Busch InBev SA/NV (BUD), the company has indirect exposure to Europe. The fact that the U.S.-Belgian beverage and brewing company declares its dividend in euros results in an exchange rate risk for Altria.

A Brief Note On Exchange Rate And Interest Rate Risks

In the context of investing in companies that have foreign exposure, such as HLI, a brief discussion of foreign exchange risk is warranted. U.S.-based companies with exposure to foreign economies naturally experience a decline in profits when foreign currencies depreciate against the U.S. dollar. However, it is important to understand that this decline in profits is not necessarily reflected in dividends, which are typically declared and paid in U.S. dollars. Therefore, U.S.-based investors are typically not directly exposed to exchange rate risk. Of course, if the international exposure is significant and the company is poorly managed, it could be forced to slow dividend growth or even cut the dividend.

Conversely, profits are rising for foreign companies that have significant operations in the U.S. (all other things being equal). British American Tobacco is a welcome example in this context. BTI is a U.K.-based company that distributes its products globally. In 2017, the company acquired Reynolds American, giving it significant exposure to the U.S. tobacco market (it manufactures and distributes Newport, the top-selling menthol cigarette brand). Many U.S.-based investors hold British American Tobacco through ADRs (ticker BTI) – the share price and dividend are typically quoted in U.S. dollars. Because of the weakening of sterling, some investors may mistakenly believe that BTI has cut its dividend. The share price has also performed miserably in recent months. However, these are merely the consequences of the strengthening U.S. dollar. For a U.S.-based investor, the dollar amount distributed by the company has declined in recent years, which is disappointing, but the company’s dividend record remains intact. U.S.-based investors in international companies need to be aware that their dividend income carries direct exchange rate risk.

Of course, dividend stocks are also sensitive to interest rates, and therefore investors should always take foreign interest rates into account, as they can have a significant impact on both the share price (in an ideal world, the current share price is the result of all future cash flows discounted to today) and the dividend (as interest rates rise, investors’ interest in bonds increases). However, because of the typically shorter duration (a term typically used in the context of debt investments) of value stocks – i.e., those with strong current cash flows – their stock prices are much less affected than those of growth stocks. I explained this aspect in more detail and with two examples in my recent article on Adobe (ADBE).

Altria And Houlihan Lokey Are Both Very Profitable, Asset Light Businesses

Altria mainly manufactures and distributes cigarettes, while Houlihan is active in consulting. Both companies are so-called “asset-light” businesses. Unlike industrial companies, where most of the capital is tied up in fixed assets, such companies generally generate very high returns on invested capital and have high profit margins.

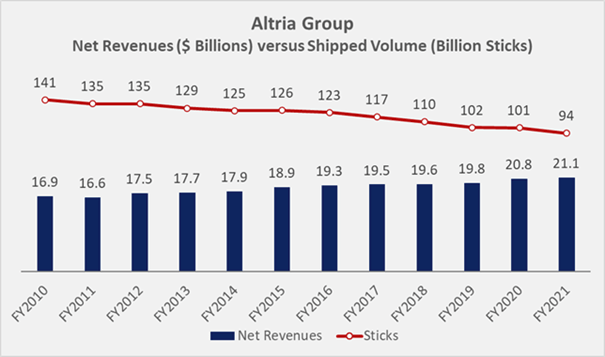

Altria’s operating margin increased from 37% in 2010 to over 55% in 2022, based on net sales excluding excise taxes. The company’s cash return on invested capital (based on free cash flow, CROIC) has increased to 24% in recent years. This is primarily due to steadily declining cigarette sales (Figure 2), which the company has had to address with cost savings and other efficiency measures. Largely because of Altria’s remarkable product inelasticity and strong brand portfolio, but also because of the still relatively low cost of a pack of cigarettes, I expect the company to continue to do well in this inflationary environment. Another takeaway from my more detailed article in April was that Altria’s expected operating outperformance in an inflationary environment could be due to “WYSIATI” – What You See Is All There Is. According to psychologists Daniel Kahneman and Amos Tversky, most people fall prey to this cognitive bias that gives preference to recently gathered information when making decisions. I suspect, therefore, that consumers may become accustomed to higher rates of inflation, especially for consumer goods in the single-digit dollar range. Moreover, people generally have difficulty correctly classifying price changes in this price range. Of course, as already mentioned, the expected good operating performance does not necessarily translate into dividend growth.

Houlihan’s consolidated operating margin is arguably weaker than Altria’s, but still very high at 25-28% currently. However, CROIC is on par with Altria’s – even after accounting for stock-based compensation, which is arguably an important item at investment banks. Houlihan’s operating costs are mostly variable and consist mainly of employee compensation and related expenses (e.g., 63% of revenues in fiscal 2022). As a result, Houlihan’s margins are unlikely to continue to increase as the company needs to retain talent and does so in part through appropriate compensation. This makes the company somewhat more vulnerable to inflation-driven increases in employee compensation, but given HLI’s market-leading position, I have no doubt that the company can successfully pass on increased operating costs to its clients. Also, in financial restructuring, advisors generally do not accept assignments unless sufficient funds are available. Furthermore, in many (if not all) jurisdictions, bankruptcy advisors are paid before creditors’ claims are satisfied.

Prime Profitability And Balance Sheet Quality Equals Dividend Safety

Companies with high operating and free cash flow margins are in a comfortable position to distribute good amounts of cash to shareholders in the form of dividends – provided the balance sheet is not over-leveraged, the maturity profile does not have a significant positive skew, and interest expense is low relative to pre-interest free cash flow.

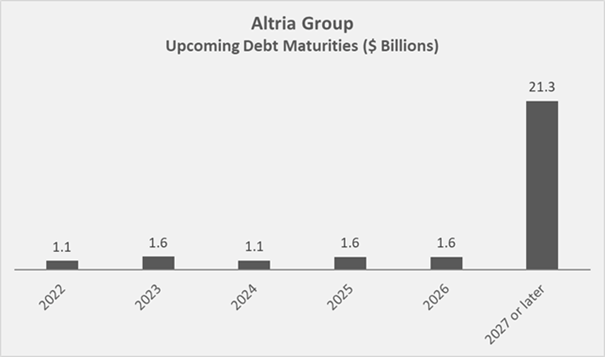

Altria’s balance sheet quality has deteriorated somewhat with the acquisition of the $12.8 billion stake in JUUL, but the interest coverage ratio for 2021 was still solid at 8 times normalized free cash flow before interest. Of course, this should only be considered as an approximation, as it does not take into account the beneficial tax shield effect. Net debt to normalized free cash flow has declined from 3.5x to 2.9x in 2021 since the acquisition of the JUUL stake. Standard & Poor’s has rated Altria’s long-term debt at BBB with a stable outlook (p. 44, 2021 10-K). The company’s maturity profile is also very reassuring and exhibits a significant negative skew (Figure 2). As a result, and given the strong pricing power as well as the pronounced inelasticity of Altria’s products, the dividend appears very safe, even if a 9% yield suggests a value trap. Altria’s payout ratio in terms of free cash flow, normalized for working capital movements and one-time events, is currently around 80%. This is already relatively high, so it is not surprising that dividend growth has slowed in recent years. However, given the reliability of the company’s cash flows, the balanced maturity profile and the modest weighted average interest rate on long-term debt (4.0%, p. 44 2021 10-K), the dividend appears very secure, although no overly generous dividend increases should be expected.

The investment bank Houlihan Lokey has a very high-quality balance sheet. The company does raise capital from time to time through the equity markets to fund acquisitions. Still, the company’s weighted average diluted shares have increased by only 15% since its 2015 IPO, as the company regularly buys back its own shares.

The only financial debt I found on HLI’s balance sheet at the end of fiscal 2022 is a $0.5 million loan payable to former shareholders (p. 42, fiscal 2022 10-K). Accordingly, Houlihan’s debt is dwarfed by its free cash flow, which was $636 million in fiscal 2022 after conservatively accounting for stock-based compensation ($92 million). The company uses mostly leased property and equipment, and accordingly, operating leases are the most significant item on the liability side of the company’s balance sheet, after accrued salaries and bonuses. As a side note, IFRS 16 is mandatory for accounting periods beginning in January 2019 and operating leases have been accounted for as an off-balance sheet item until then.

Houlihan’s dividend payout ratio is very modest at only 18% of free cash flow in fiscal 2022. Due to the already very solid free cash flow, expected strong earnings growth and impeccable balance sheet, double-digit dividend growth can be expected in the future.

The Fallacy Of Measuring Inflation Protection By Dividend Yields

While both Altria and Houlihan Lokey are similarly profitable from a free cash flow margin standpoint, the former appears to be the better inflation protector from a dividend yield standpoint, even though its payout ratio is significantly higher. With a share price of $41.60 and a current quarterly dividend of $0.94 per share, the stock currently yields 9.04%, seemingly outpacing the August 2022 rate of inflation of 8.3% by 74 basis points. In stark contrast, with a share price of $76.90 and a current quarterly dividend of $0.53, Houlihan Lokey yields just 2.76% – a difference of 554 basis points from last month’s inflation rate.

However, investors who favor Altria over Houlihan Lokey only because of its seemingly inflation-beating dividend yield of 9% at present are subject to a common misconception. Allow me to give a simple example:

When a car moves, it travels a certain speed, usually measured in miles per hour. For those of you who remember basic physics, velocity represents the first derivative of position with respect to time. When a car accelerates (or decelerates), its velocity changes. The change in velocity is the second derivative of position with respect to time, or the first derivative of velocity with respect to time.

As everyone can imagine, a car with the highest top speed does not necessarily mean that it also has the highest acceleration. It clearly makes no sense to compare speed and acceleration.

Returning to stock investments (cars can also be very nice investments too!), it is therefore important to understand that inflation is the equivalent of acceleration in the previous example, i.e., the first derivative of a price function with respect to time. In contrast, the dividend yield is just an expression of the payout of a given stock relative to its price. The correct equivalent of the inflation rate (the change in the prices of goods and services over time) is the dividend growth rate (the change in payout over time).

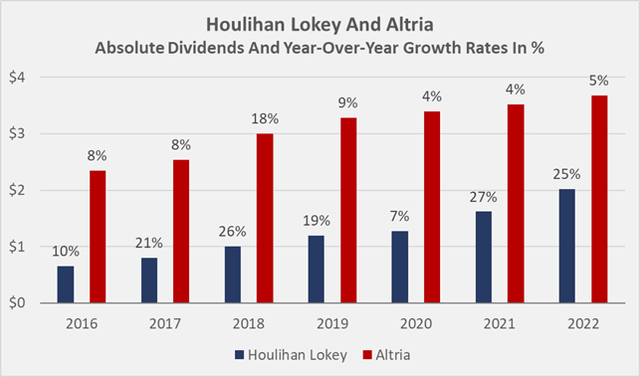

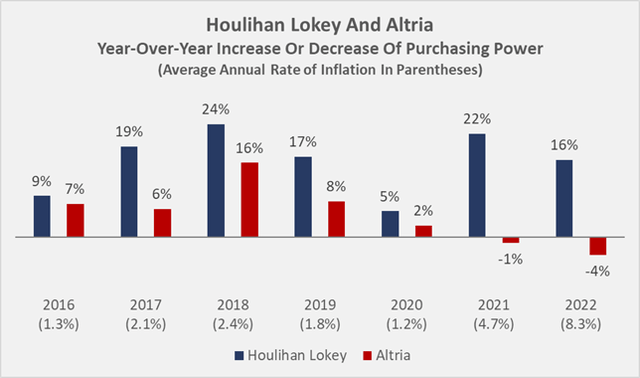

From this perspective, Altria doesn’t look so great anymore, even though its dividend yield is certainly enticing. Its dividend growth rate has declined in recent years, while Houlihan Lokey has had a very different trajectory (Figure 3). Note that I only compared data between 2015 and 2021 (so growth rates can only be determined from 2016 onward), as HLI only went public in 2015.

Taking into account the ex-post average annual inflation rate, we see that both companies’ dividends provided an excellent hedge against inflation between 2016 and 2020, but this was mainly due to the generally very low inflation rate (in parentheses in Figure 4). Starting in 2021, Altria investors lost purchasing power as the company increased its dividend at rates below the average annual inflation rate.

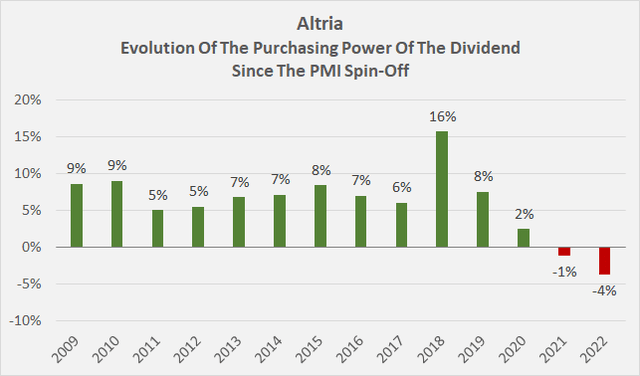

However, I want to make it clear that the two companies are just examples to illustrate my point. Altria’s business model is very robust, and the company has tremendous pricing power. Aside from recent missteps related to diversification in the modified risk products segment, I believe the company is well managed. While it’s true that investors have not been able to beat inflation in 2021 and 2022, things look much better over the longer term. Since the spinoff of the international business, the purchasing power of long-term investors from Altria’s dividend income has increased every year except 2021 and 2022 (Figure 5).

The purchasing power of Altria’s payout has more than doubled since 2009. This underscores the importance of owning stocks for the long term, as opposed to dollar-denominated investments such as bonds (with the exception of TIPS). Thanks to much stronger dividend growth, HLI investors have seen the purchasing power of their dividends nearly triple since the IPO – certainly a much better performance than Altria, considering HLI only went public in 2015. The positive effect of dividend growth stocks outpacing inflation on purchasing power is, of course, enhanced by dividend reinvestment.

A Model Portfolio That Continues To Beat Inflation – And Offers A Solid Yield To Boot

In my own portfolio, I hold shares of both Altria and Houlihan Lokey. In the previous sections, I have outlined why I believe both companies are solid investments, even though Altria’s dividend growth has not outpaced inflation in recent years.

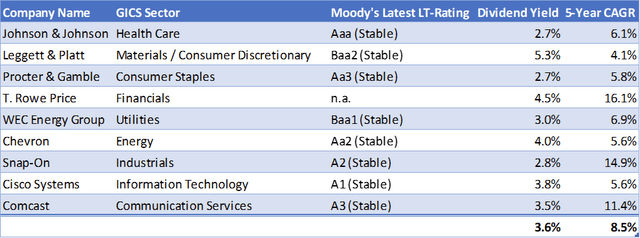

I think it is important to emphasize the importance of portfolio weighted dividend yield and compound annual growth rate (CAGR). In my portfolio, I target a starting yield in the mid-three percent range and a dividend CAGR of 8% to 10%. The model portfolio below (Table 3) is intended to illustrate how an investor starting today can earn a substantial income nearly equal to that of long-term government bonds, but with the added bonus of substantial dividend growth and capital gains. Most industries according to the Global Industry Classification Standard (GICS) are included. The weighted average dividend yield and dividend CAGR shown in the table are based on the assumption that all stocks are held in identical dollar amounts. With the exception of Snap-On (SNA) and WEC Energy Group (WEC), I currently own all of the stocks in my portfolio and have published articles on several of these companies if you would like to look into them further.

Key Takeaways

- Investors who want to hedge against inflation should not fall for the widespread misconception that a stock must have a dividend yield that is higher than the current inflation rate.

- In this way, it is easy to fall for value traps, as high dividend yields are often the result of a falling share price, which in turn can be a sign of weak operating results or a company in decline.

- Instead, investors should focus on the dividend growth rate, which is the right measure if you have inflation protection in mind.

- It is important to rely on companies with wide moats, preferably exhibiting monopolistic tendencies, or other signs of very stable, recurring free cash flow.

- However, just because a company has the operational capabilities and pricing power to beat inflation does not necessarily translate into dividends.

- Altria and Houlihan Lokey have historically outpaced inflation. When inflation rates for 2021 and 2022 are taken into account, Altria investors have lost purchasing power. However, over the long term, investors in both companies should be very pleased with their returns from an income perspective.

- A weighted average starting dividend yield of 3.5% and a weighted average five-year dividend CAGR of 8% to 10% seem like a good starting point for the portfolio. I believe it is important to mix high yield stocks with low dividend growth with low yield stocks (<3%) with high dividend growth rates.

Photo by Sara Kurfeß on Unsplash