Summary

- I’ve been asked my thoughts on whether I invest in gold or silver, which I do not.

- Here’s my response on why I prefer dividend investments over non-dividend-paying companies or investments.

- This is primarily a simple article outlining the benefits and drawbacks of dividend investments, but we’ll also be looking at a screen of dividend kings.

Forget diamonds; dividends are forever.

Not a popular opinion, but I believe we can forget gold and silver investments too. Recently, and over the years, I’ve been asked about investing in gold or silver. I don’t see them as particularly attractive, despite historically holding their ‘value’ during times of inflation.

Dividend Primer

Most investors, especially the audience who is probably reading this, are quite familiar with dividends. This section is probably skippable for those readers. That doesn’t mean everybody is familiar.

I’ve run across people who ask what I do, and I mention I’m an investor and write articles for Seeking Alpha. If they press for more details, it invariable runs into mentioning I cover dividend stocks. You’d probably be surprised by the number of people asking me what a dividend is or how they work. We have to remember that a new investor can be born every day, and it’s important for us to teach the next generations about investing in general.

Dividends are a way for companies to distribute a portion of their profits to shareholders. They are typically paid out quarterly, but some are paid monthly, and there are now a couple of weekly paying dividend ETFs. Dividends can be either cash or stock dividends.

Cash dividends are generally preferred and the most commonly paid out. Stock dividends involve issuing additional shares of stock to shareholders. Stock dividends are often used as a way to distribute profits to shareholders without diluting the value of existing shares. In this way, every shareholder ends up holding an equal amount of the pie after the distribution of the new shares (i.e., ownership of the overall company remains consistent.)

The amount of dividends a company pays can vary depending on several factors. Primary factors can include the company’s profitability and growth prospects. These contribute to the company’s financial stability. Companies with a long history of paying dividends, such as utility and consumer staples companies, are considered more stable investments. These are sectors that are considered defensive or secular in nature. Secular simply meaning these types of companies within these sectors are not sensitive to economic cycles.

That’s compared to cyclical sectors, which can include energy, consumer discretionary and financials. These sorts of sectors tend to require a strong global or U.S. economy to continue delivering growth. These are sectors that are sensitive to economic conditions. With 2023 looking like we could have a recession, these are the sorts of areas that could be most impacted.

Who Can Benefit From Dividends?

For investors, dividends can provide a steady stream of income and can also be a sign of a company’s financial health. They are most often associated with being held by retirees, but that doesn’t always have to be the case. Simply put, dividend investments can really be for any investor.

Companies that pay dividends are often seen as more mature and stable than those that do not; they tend to be large-cap names. That can make them appropriate for all investors, and just because a company pays a dividend doesn’t mean that there isn’t any growth left. They are paying out the excess profits that they no longer need for R&D or growth through other means.

Of course, dividends are not guaranteed and can be cut or eliminated at any time. Additionally, a company’s stock price decreases on the ex-dividend date to reflect the dividend. This tends to be relatively short-lived. Sometimes on the ex-div date itself, shares climb back from the adjustment.

Why Dividends Matter

While dividends aren’t guaranteed to continue within any company, they are essentially a guaranteed return once paid. Hence, my opening of “forget diamonds, dividends are forever.”

Unless you reinvest the dividends, then that’s again subject to potential loss. So what I mean by this is that once a dividend is paid, it cannot be taken back by a company. If you buy shares of Microsoft (MSFT

The chances of MSFT going bankrupt and losing all your money are probably fairly minimal, but we are just using this as a simple example. This outlines one of the biggest reasons I invest in dividend-paying stocks and don’t find gold or silver investments particularly interesting.

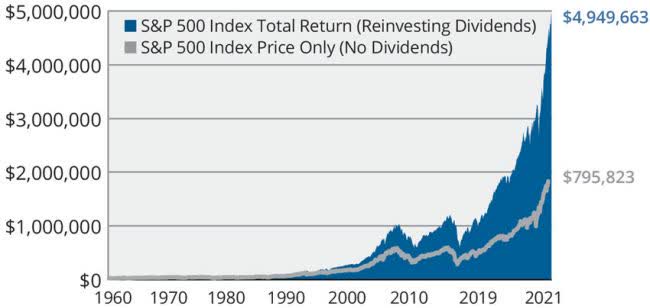

Historically, reinvestment has provided better total returns as you compound your position. That’s in general, though, when we look at the S&P 500 Index. When investing in individual positions, you have individual stock risk.

Another reason to consider dividend investments is you can’t pay bills with gold. However, that’s making an assumption. That being said, I’m somewhat curious how DTE Energy (DTE

It also is a passive way to generate income, for the most part. You are, of course, going to want to keep up with the financials and review quarterly reports. That’s particularly true when holding individual stocks, and especially for those dividends stocks that are going through some really rough periods, such as Intel (INTC

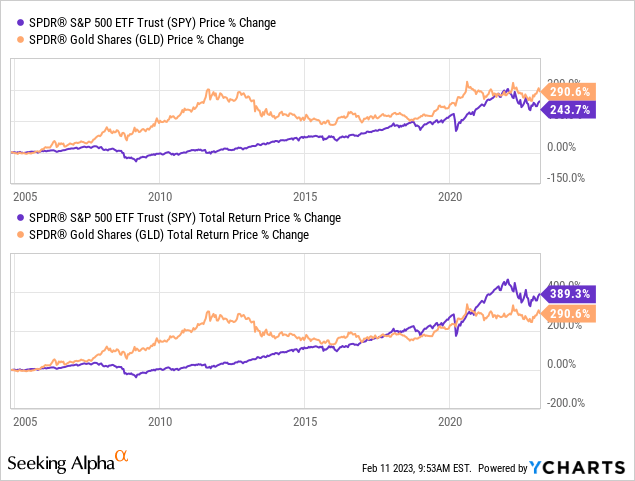

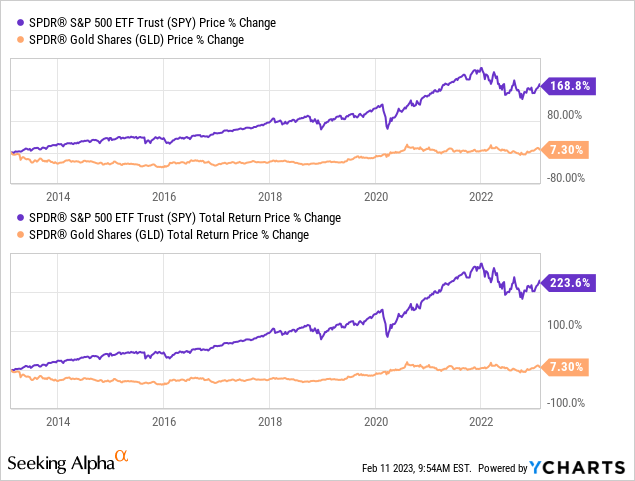

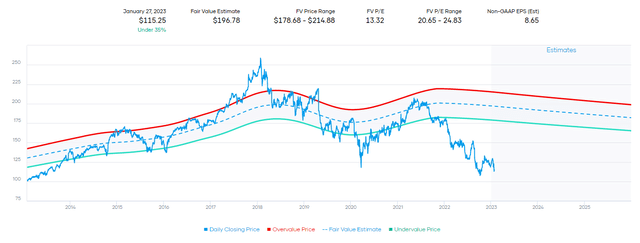

Though I concede that in terms of returns, gold has performed well. Below is a comparison of the SPDR S&P 500 (SPY

One might note the importance of the comparison in this chart as the top chart shows a simple price performance. That means the dividends are not being factored in. The bottom chart shows the total returns, meaning the dividends are factored in and assumed to be reinvested. That again confirms the important factor that dividends have, particularly when reinvested.

I’d also note that gold has shown to perform best in times of high economic stress, particularly during the GFC period. So a more tactical investor might find uses for gold investments, but I tend to keep things fairly simple. In the last ten years, GLD hasn’t provided hardly anything to investors.

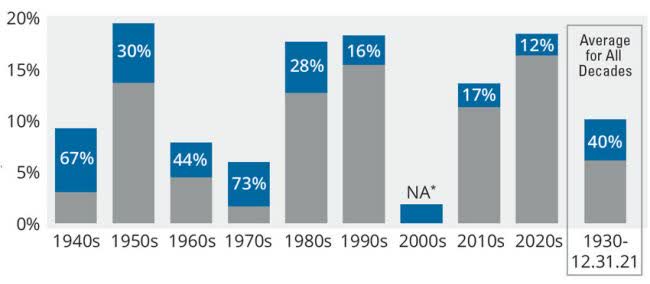

For a longer-term look at total returns from dividends, Hartford Funds shares a chart showing contributions in each decade going back to the 1940s.

Risks For Dividend Investors To Consider

It isn’t all good news, though. Dividend-paying stocks, like all equities, are subject to market fluctuations. Economic downturns or market corrections can cause the value of dividend-paying stocks to decrease. That’s the most basic and standard risk for any investment. Here are a few more that can be specific to dividend payers.

- Dividend cuts or elimination: Companies may reduce or eliminate their dividends at any time, which can be a sign of financial trouble. This can result in a decrease in income for investors who rely on dividends for income. That’s where watching something like an investment in INTC closely is important. It can also make those more conservative investors avoid these types of volatile names.

- Volatility: A company’s stock price may decrease when dividends are paid out, as investors may sell shares after the ex-dividend date. This can result in capital losses for investors. This is particularly a focus when companies pay out large specials. Investors can rush in, and then after the large special, the price is adjusted on the ex-dividend date, and it can experience further pressure by investors selling off shares. A recent example of this could be LyondellBasell Industries (LYB

at the end of last year. For longer-term investors, this is less of a concern. - Interest rate risk: Dividend-paying stocks may become less attractive to investors if interest rates rise, as bonds and other fixed-income investments may offer higher yields. This is particularly true in the last year as the Fed has ramped up interest rates, now risk-free short-term Treasuries yield 4%+. This can really have an impact on the utility sector, as it is often associated with income specifically. They don’t tend to offer a lot of growth. Therefore, bonds are a direct competitor for investment dollars.

- Changes in Tax laws: Dividends are taxed, and they are taxed at different rates depending on various factors. Additionally, just when you think you are well-versed in the tax code, tax laws can then change. This is also an important consideration when investing internationally or international investors investing in U.S. companies, which may have some special tax rules. Taxes are as unique as investments for each individual. For tax specific for your individual situation, it’s always best to reach out to a tax expert.

Dividend King Screen – Some Potential Candidates For Further Review

Within the dividend investing realm, there are different categories of these stocks. There are the dividend challengers, dividend contenders, dividend champions and dividend kings. The kings can be some of the most sought-after as they represent companies that have generated dividends for 50 years. Not only that, but they’ve increased those dividends for 50 years.

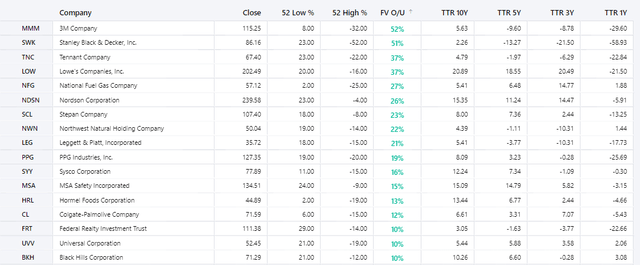

Here is a screen of 17 names that are dividend kings but also represent being undervalued by at least 10%. The undervalued here is simply their valuation against their historical valuation. Generally, this is represented by the P/E range of each position.

However, that isn’t always the case. Federal Realty Investment Trust (FRT

The top of the list might be the first ones to start looking at. However, the top two seem to represent some of the exact risks we listed above in the previous section.

We have 3M (MMM

I’m long MMM, and I am DRIPing, but it isn’t for the conservative investor anymore despite being a dividend king. This deep undervaluation relative to its history is due to lawsuits that are making the future quite uncertain. As of early January 2023, MMM has spent $450 million in defense costs due to the earplug litigation. With this likely to go on for years, this is only the beginning.

Not to mention that their latest earnings showed expectations for a weak outlook. As an industrial stock, this will be a name that relies on a strong economy and demand for its products. So there are multiple risks concerning MMM at this time. I’m more optimistic that MMM will work through this over the longer term. That’s why I’m accumulating now while it’s this beaten down.

SWK and Tennant Company (TNC

Conclusion

Dividend investing can be a great addition and a way to create a well-diversified portfolio. Essentially, dividend-paying companies can work for any investor. It doesn’t just have to be for retirees. Investing in dividend-paying stocks can be a great way to generate a steady stream of income and potentially earn higher returns over the long term. It’s a mostly passive way to generate income, and it’s easier to pay bills with cash than in the form of metals.

That being said, it’s important to be aware of the risks involved, which include the possibility of dividend cuts or elimination, volatility, and company-specific risks. Diversification and staying on top of the latest financial data are key to managing these risks.