Summary

- Starwood Property Trust has diverse revenue streams.

- It recently completed a high level of investment activity and maintains plenty of liquidity.

- The big dividend yield is covered and the stock trades at a discount to undepreciated book value.

There are plenty of high yield options on the market today, however it pays to be picky. For one thing, investors should consider those stocks that have long dividend track records and a seasoned management team. The pandemic over the past 2 years has provided an excellent litmus test on those companies that are built to withstand adversity, all while maintaining a solid income stream for their investors.

This brings me to Starwood Property Trust (NYSE:STWD

Why STWD?

Starwood Property Trust was founded over 30 years ago, and is led by long-time CEO and Chairman, Barry Sternlicht, who has been in the real estate business for decades. Since its founding, STWD has deployed over $90 billion in capital and currently manages a portfolio of $27.5 billion in total assets.

Unlike pure-play commercial mortgage REITs such as Blackstone Mortgage Trust (BXMT

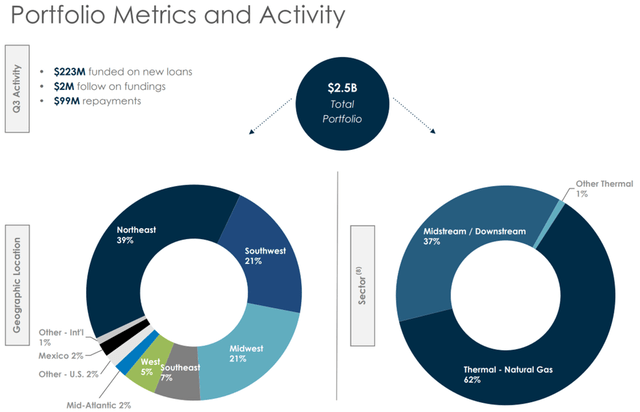

As shown below, the infrastructure portfolio is well-diversified by geography, with healthy exposure to the more stable midstream and downstream segments, as well as cleaner sources of energy like thermal and natural gas.

Nonetheless, commercial lending remains STWD’s core bread and butter, representing 60% of its investment portfolio, with $16.4 in total assets. This portfolio is conservatively put together, with a weighted average loan to value ratio of 61%. This means that borrowers have significant skin in the game, thereby helping to reduce the chances of a complete default. The commercial lending portfolio is also well-diversified, with multifamily being the biggest segment (34% of portfolio) followed by office (23%), hotel (17%), and mixed use (9%).

Meanwhile, STWD just completed a staggering $1.3 billion of investment activity during the third quarter, $0.9 billion of which was in commercial lending. It also managed to grow its undepreciated book value by $0.18 since the second quarter to $21.69, and has plenty of balance sheet capacity. This is reflected by STWD’s modest debt to equity ratio of 2.4x and with $1.3 billion available liquidity.

Also encouraging, most of the new loan commitments (92%) are senior secured first mortgage loans and are 99% floating rate, helping to ensure that STWD capture upside with the expectation of continued rate hikes from the Federal Reserve, albeit potentially at a slower pace given the somewhat lower rate of inflation in October.

Management highlighted the potential benefit from continued rate increases, as well as the strength of its platform in recovering principal on loans on non-accrual during the recent conference call:

Our earnings continue to be positively correlated to rising interest rates. This is the first quarter where base interest rates have surpassed 100% of our floors, leading to a $14 million increase in net interest income from higher base rates, which was offset by the benefit from our floors last quarter and higher interest expense from the timing of debt draws this quarter.

Company-wide, inclusive of floating rate assets and liabilities in all of our business lines, a 100 basis point increase in base rates would increase annual earnings by $42 million or $0.13 per share. Since quarter end, one-month SOFR has already increased 76 basis points.

With respect to our three existing nonaccrual loans, we continue to utilize the breadth and experience of the Starwood platform to actively work towards the path of full repayment of the $465 million we currently have outstanding. We are confident in the underlying real estate and ultimately believe these loans are fully recoverable. The $348 million of equity that we have invested in these loans would significantly contribute to our earnings power once we are able to resolve them and reinvest the funds.

Plus, STWD yields an attractive 9.0% at the current price of $21.23 and the dividend is well by distributable EPS of $0.51 during the third quarter, resulting in a 94% payout ratio. STWD is also attractively valued at present, trading at 0.98x of undepreciated book value. Sell side analysts have a Strong Buy rating on the stock with an average price target of $25.19, translating to a potential 28% total return including dividends.

Investor Takeaway

STWD is a well-rounded and high yielding commercial real estate lender that’s doing just fine in the current environment, and is positioned to benefit from rising rates. It just completed a $1.3 billion investment spree during the third quarter. It has ample liquidity, a conservatively managed loan portfolio, and pays a covered dividend yielding 9.0%. Lastly, I see value in the stock for income investors, as it still trades at a discount to undepreciated book value.