Summary

- We called upon Pizza Pizza to deliver a third hike, and they delivered the hike and the Pizza.

- 6.6% dividend yield and some solid inflation protection are good features here.

- We examine if the valuation fits for an upgrade.

All values are in CAD unless noted otherwise.

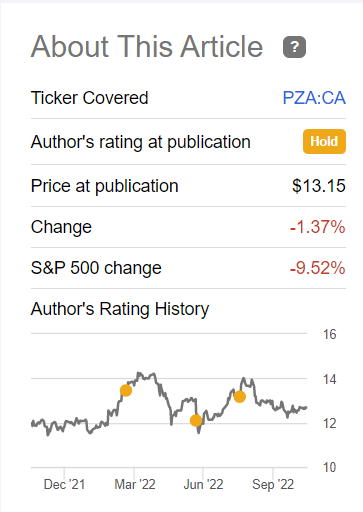

We maintained our buy under the price of $12 the last time we wrote about Pizza Pizza Royalty Corp. (OTCPK:PZRIF) (TSX:PZA:CA

The stock is still not cheap at over 15.5X earnings. Yes, you can pay more in general for unleveraged royalty plays, and PPRC qualifies. But there are challenges here and the 15-16X earnings mark is still too expensive. Investors should also keep in mind that we are seeing these multiples alongside the most inverted yield curve Canada has seen in decades. Caution is the name of the game. We are not looking to add to our position at this price and maintain a buy under $12.

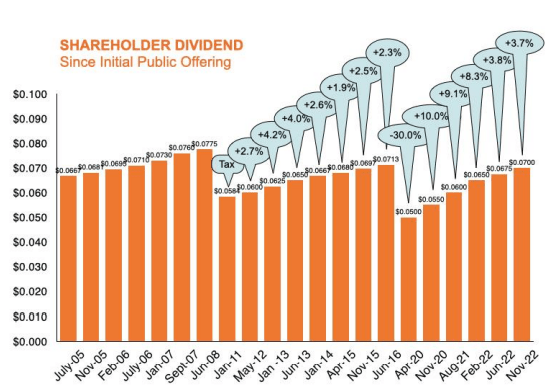

The hike that we expected came to pass with the release of the third quarter results. The monthly dividend now stands at 7 cents and is a hair’s breadth away from its pre covid levels of 7.13 cents. This was quite the journey back from the initial reduction to 5 cents when covid hit.

The price of the stock on the other hand has more or less remained the same since August, but it has handily beaten the general market malaise.

Let us review the third quarter results and see if this one is still a buy under $12 only or if it merits a raise based on the current numbers. But first, an overview of this company for the uninitiated.

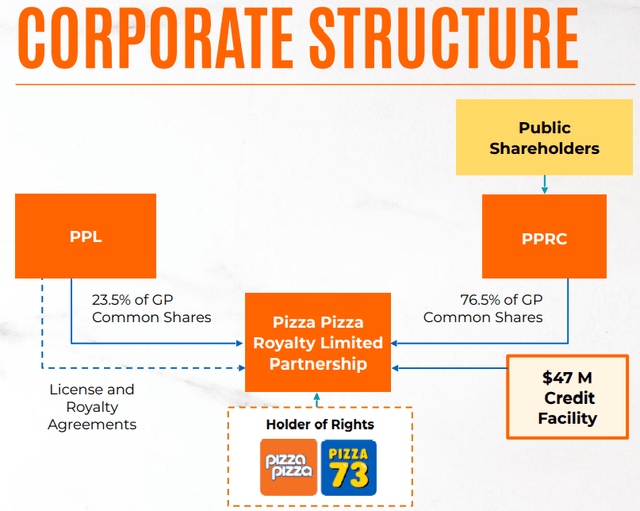

The Royalty Corp

The corporation receives royalty on the topline sales from two Canadian franchises, Pizza Pizza and Pizza 73. The restaurants in the royalty pool of the former pay 6% and the latter 9%. The pool is adjusted on the first day of each year based on the net new openings in the preceding 12 months. For 2022, it comprises 624 Pizza Pizza and 103 Pizza 73 restaurants. Pizza Pizza is located primarily in Ontario, whereas Pizza 73 is mainly in Alberta. Side note: An international operations agreement was entered into in 2021, however, there were no overseas restaurant openings as of the end of the last quarter.

As the corporation’s intake is based on the topline sales of the restaurants, it does not get impacted by their expense fluctuations. Pizza Pizza Corp’s expense categories are few and are comprised of administration, interest, and income tax. The bread and butter of the corporation is tied to the number and success of restaurants in the royalty pool, and that is where the efforts of the corporate structure are spent.

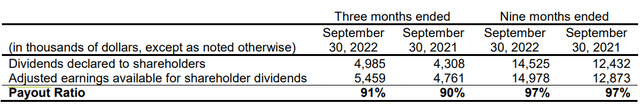

Historically, the company has had a very generous dividend policy, wherein it has distributed all available cash to shareholders, after allowing for reasonable reserves. The company has no capex, and that helps with paying out the bulk of its free cash flow.

The payout ratio has predictably dipped a bit in the last few years, with the company building a larger reserve to ensure a consistent dividend payment and avoid a large cut like in 2020. Despite the increased prudence, it still pays out over 90% of its earnings.

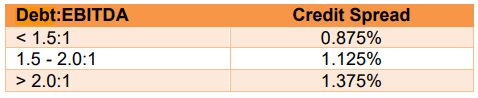

The working capital reserves continue to build due to the sub 100% payouts, which bodes well for their interest obligations and the maintenance of the dividend levels in times to come. The interest rate on the company’s $47 million credit facility is based on the Canadian Banker’s Acceptance rate plus a 0.875% to 1.375% credit spread based on its debt to EBITDA.

The Bankers’ Acceptance rate is fixed via interest rate swaps at 1.81% and the current applicable spread is 0.875%, making the interest rate 2.685%. This was 2.935% in 2021 due to a higher debt-to-EBITDA ratio.

Q3 Earnings

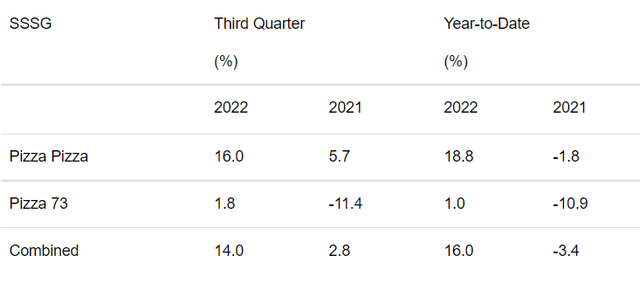

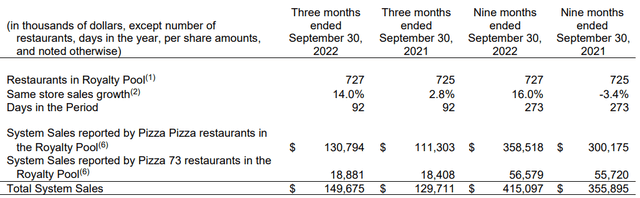

The corporation continues to have a strong year, with the royalty pool sales increasing by 15.4%. The same-store sales grew by 14% compared to 2.8% in the comparable quarter in the prior year. Pizza Pizza continues to be the stronger of the two brands.

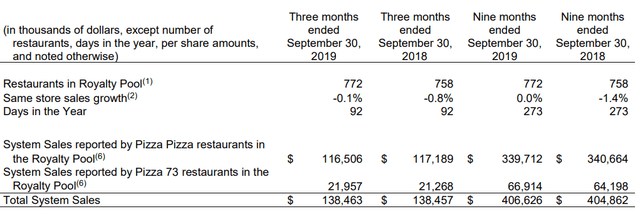

The Pizza Pizza brand successfully passed on the food and labor inflation costs to its customers and also had a boost to the customer traffic this year with the lifting of all COVID-19 related restrictions and restaurant reopenings. On the other hand, the Pizza 73 customers were impacted by the price increases and the traffic reduction offset the higher sales. It still had a positive performance, but it came off a low base. While they have a smaller number of restaurants compared to 2019, their sales are catching up with Q3-2022, beating the 2019 quarter.

Finally, while not reflected in the 2022 Royalty Pool, net 4 new Pizza Pizza restaurants were opened this year and 2 Pizza 73 restaurants were converted to Pizza Pizza locations. This will be reflected in the 2023 royalty pool.

Valuation & Verdict

Yet another successful quarter gets completed, and yet another predictable dividend hike is now behind us. Execution has been about as close to perfect as one can get in such a tough environment. The International arena looks promising, but it is too early to count those chicks. At close to 14X next year’s estimated earnings, the company is just getting inside our buy zone. We would now put that number at under $13.00 per share. The irony here is that the company is relatively less undervalued considering the bargains that are popping up on both sides of the border. Our thesis is based on inflation moderating a bit from here and recession not offsetting nominal sales growth. Downside risk is if the recession turns out to be severe and Pizza Pizza moves to an 11X multiple. We’re still giving this a Buy as it trades currently at $12.80 per share, and we think investors will likely get a 10-11% total return over the next 12 months from here.

Photo by mahyar motebassem on Unsplash