Summary

- SmartCentres REIT has a payout ratio of just over 90% and will need to boost its rental income to mitigate the impact of increasing interest rates.

- SmartCentres has time as the vast majority of its debt has a fixed yield.

- About 40% of the GLA is up for renewal in the next three years. It will be interesting to see if SmartCentres can hike the rent.

Introduction

The past two years I really liked SmartCentres REIT (TSX:SRU.UN:CA

SmartCentres REIT SRU.UN

SmartCentres has its primary listing on the Toronto Stock Exchange, where it’s trading with SRU (or in some cases SRU-UN or SRU.UN v) as the ticker symbol. The average daily volume is almost 300,000 shares and the current market capitalization is approximately C$4.5B. I will use the Canadian Dollar as base currency throughout this article and where applicable, I will refer to the REIT’s primary listing in Toronto.

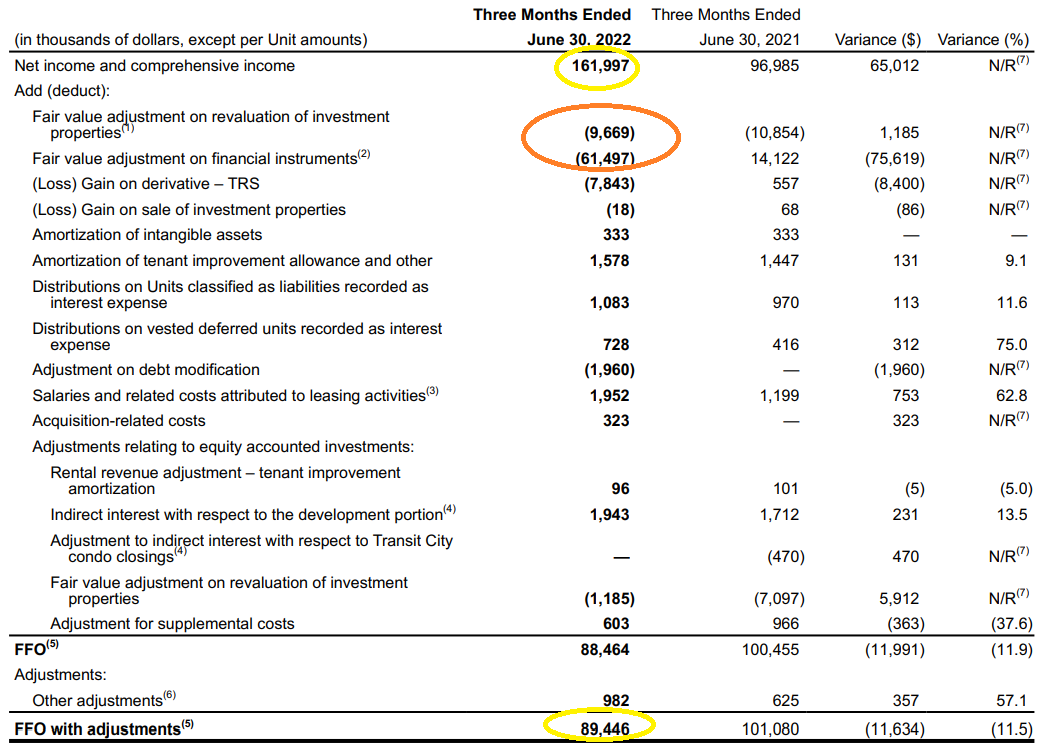

The FFO result remains strong

The FFO result of a REIT obviously remains one of the most important metrics. The income statement is unreliable as it usually contains the impact of the revaluation of properties and as such, FFOs are the best cash flow metric available to investors. The FFO calculation of the second quarter clearly shows why you cannot invest in REITs based on the reported net income. As you can see below, we started out with a net income of almost C$162M while the FFO with adjustments was less than C$90M (this is highlighted in the yellow circles below).

The main culprit? During the second quarter, the REIT recorded a C$10M valuation gain on the assets while there was a C$69M gain on the value of derivatives and other financial instruments. While this is a totally valid contribution to the net income, these are non-cash and non-recurring items.

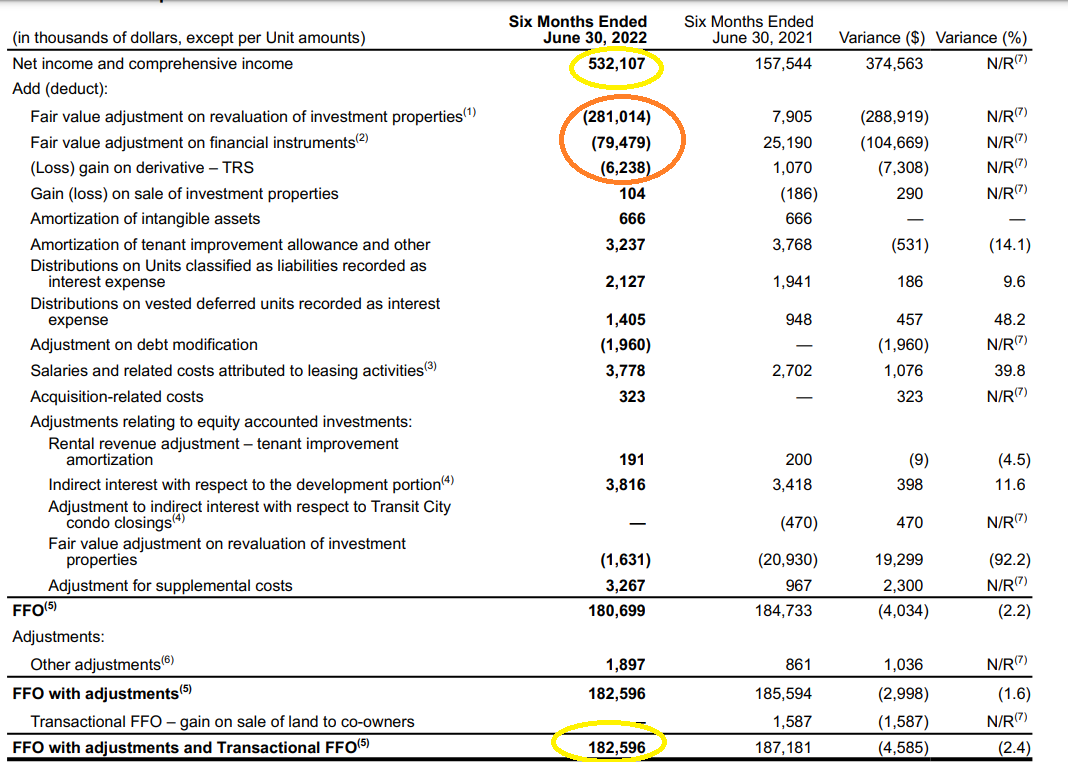

The difference becomes even more clear in the image below which shows the results for the first half of the year. As you can see below, in excess of half of the reported net income was generated by the adjustment of the fair value of the investment properties with the gains on derivatives and financial instruments accounting for in excess of 15% in additional profits. The bottom line is what really matters, and the FFO in the first half of the year was approximately C$182.6M.

There are currently 170.2M units outstanding (consisting of 144.6M trust units and 25.6M Smart LP units) but the per-share calculation also includes the units classified as financial liabilities. When the dust settles, SmartCentres currently has approximately 178.1M units outstanding. The FFO/share in the first half of the year was C$1.02.

The dividend is still covered, but let’s keep an eye on interest rates

SmartCentres is currently paying a monthly distribution of C$0.15417 per share, which works out to C$1.85 per year. Based on the current share price of C$26.41, the dividend yield has increased to exactly 7%.

As the annualized FFO/share is approximately C$2.04, the distribution is well covered as the payout ratio is approximately 90.7%. This means there is cash left on the table enabling SmartCentres to fund a [small] portion of its development pipeline with the retained cash. The C$0.19 per year it doesn’t pay out as a distribution represents C$34M per year. Not bad, but as SmartCentres has big development plans.

Those developments are mainly funded with debt. That’s great when debt is cheap, but as interest rates are moving up the total debt pile of in excess of C$5.1B will definitely have an impact. Fortunately SmartCentres was smart enough to lock in interest rates on the majority of its debt but as you can see below it will have to refinance some debt in the coming years.

2023 and 2024 should be pretty benign with C$348M and C$276M in required refinancings. 2025 will be a more important year with C$900M in maturities.

An average interest rate increase of 100 base points will result in a C$51M increase in the interest expenses. While this would push the distribution ratio into the triple digit percentage as the FFO/share would drop to C$1.80 (or even slightly lower), the situation is obviously more nuanced. First of all, due to the fixed rate nature of the debt, interest rate increases will only gradually trickle down to the financial results. Even if the interest rate of the debt maturing in 2023 and 2024 would increase by 300 base points, the distribution would still be fully covered.

SmartCentres has time. And it will undoubtedly focus on hiking the rent in the next few years (while also keeping an eye on tenant retention). The current net rental income is approximately C$500M per year and more new properties are being completed which will drive the net rental income. But even excluding adding new properties to the asset base, a net rental income increase of 5% in 2023 followed by 3% in both 2024 and 2025 would add approximately C$57M in net rental income and this will go a long way to mitigate the impact from higher interest rates in 2025 when almost 20% of the current outstanding debt has to be refinanced.

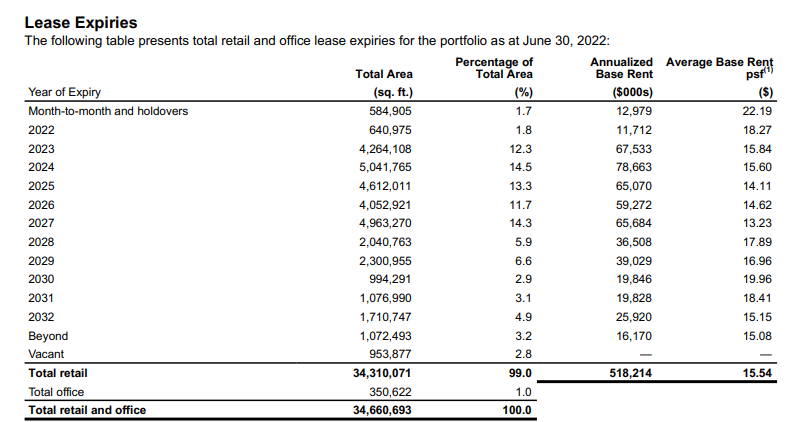

The key factor to keep the net rental income high is keeping the tenants happy. And in the 2023-2025 time frame, approximately 40% of the GLA is up for renewal. But as you can see below, the average base rent is relatively low so this could be a good opportunity for SmartCentres to try to hike the rent although we can be sure Walmart, the largest tenant, will try to push back as well. That’s why I only assume a 5%-3%-3% rental income increase in the next three years despite a higher inflation rate.

Investment thesis

I’m more cautious on SmartCentres now. While I believe the distribution to be safe and while I do believe SRU has a good chance to increase its net rental income ahead of feeling the impact of higher interest rates, I think the development portfolio will see additional delays. Financing may be harder to come by, but it will for sure be more expensive to come by as well and as residential developments usually have a low capitalization ratio (3.5-5.5%), SmartCentres may reconsider its uncommitted development pipeline.

I still have a long position in SmartCentres, but I am reluctant to add to my position as I am still preserving my cash position. In a case like this, I would usually write out of the money put options but the option premiums are pretty low due to the low volatility levels.

Image by jimaro morales from Pixabay