- Dividend Aristocrats are among the most consistent companies in the world in terms of generating FCF.

- Dividend stocks come in all shapes and sizes but dividend growth stocks are among my favorite type to invest in.

- These companies have strong cash flow, consistent dividend growth, and potential for future growth.

When it comes to dividend stocks, they come in all shapes and sizes:

- Low Yield

- Moderate Yield

- High-Yield

- Dividend Growth

My favorite type are dividend growth stocks, as they can fit into any one of the other three categories and they put the power of compounding into overdrive.

Companies that can show their ability to grow their free cash flow year in and year out and grow their dividends is a company I want to invest in. Dividend Stocks that grow their dividend year in and year out can earn themselves a spot on a few different lists

- Dividend Achievers list = 10+ Consecutive years of dividend growth

- Dividend Aristocrats list = 25+ Consecutive years of dividend growth

- Dividend Kings list = 50+ Consecutive years of dividend growth

Today, we are going to discuss four stocks that are well on their way to becoming dividend aristocrats. All four of these companies are high-quality, generate high amounts of free cash flow, and all four have increased their dividend for 20 or more consecutive years.

4 Future Dividend Aristocrats

Future Dividend Aristocrat #1 – Microsoft Corporation (MSFT

Microsoft is a diversified technology company, one of the largest companies in the world and they have a diverse portfolio of both hardware and software products. The company currently has a market cap of $2.4 trillion and over the past 12 months, shares of MSFT are up 26%.

Microsoft is a fantastic company that has converted a lot of its income streams to subscription based models. This allows more for that coveted recurring revenue that technology companies strive for these days.

The other thing technology companies covet these days is Artificial Intelligence and Microsoft is a leader here with their investment in ChatGPT. This is an area of the business CEO Satya Nadella mentioned in the recent earnings call that the company would continue to gradually increase their spending in this area. A lot of cash will go into it, but the potential is massive.

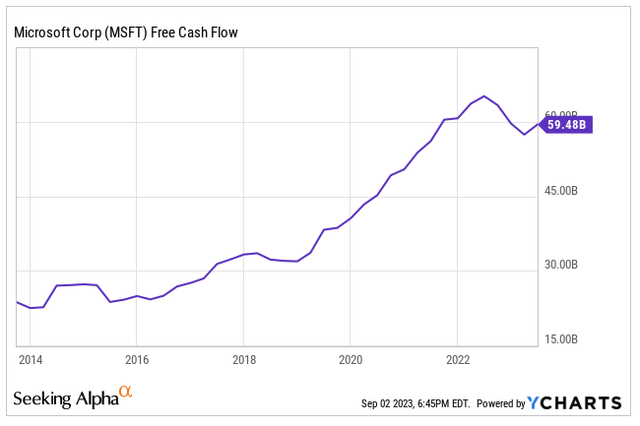

Looking at this chart below, you can see how well the company has done at growing their free cash flow over the years. During the pandemic, they saw a lot of demand pulled forward, which pushed free cash flow to a record $65 billion, and over the past 12 months they now sit closer to $60 billion.

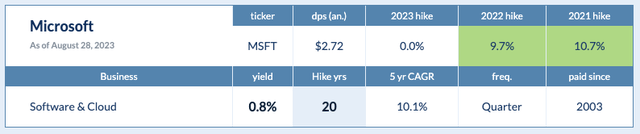

Growing cash flow certainly helps a company grow its dividend, which is exactly what Microsoft has done now for 20 CONSECUTIVE years, putting them within 5 years of becoming a Dividend Aristocrat.

The company has a 5-yr DGR of 10.1%, but a yield of only 0.8%. Part of the reason the yield is so low is due to the strong performance the stock has seen over the years. Sure you are growing the dividend at 10% clip but over that same 5-year period, MSFT shares have climbed nearly 200%. The dividend is also plenty safe with a low payout ratio.

Analysts are still high on the stock, even after the performance we have seen thus far in 2023 with analysts having an average 12-mo PT of $390, implying 18.5% upside from current levels.

Future Dividend Aristocrat #2 – Qualcomm (QCOM

Qualcomm operates as a semiconductor company with some extremely powerful and in demand chips, chips that for years have helped power Apple’s (AAPL

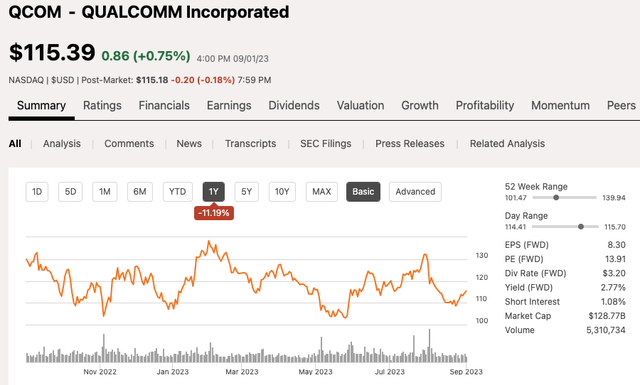

QCOM relies heavily on the handset sector, as Apple and Samsung are two large customers for them, but that sector has seen a slowdown this year. Apple sales have faltered and that has trickled down to q\QCOM as well. During the company’s latest earnings call, management hinted at the fact that they believe that handset sales have bottomed, which would certainly be a positive if true.

However, QCOM has continued to diversify itself over the years, as to not rely too heavily on handsets. They have their hands in AI, but one of their fastest growing segments, although it is still a small piece of the overall business, is their Automotive segment.

The stock has fallen out of favor in the near-term giving long-term investors searching for some chip exposure an opportunity. The stock trades at a Next Twelve Month Earnings multiple of just 13.9x, which is extremely cheap for a company like QCOM. That is a below market multiple.

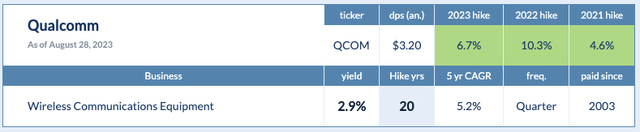

The dividend has been growing, but at a slower pace than I prefer to see, but it is still growing nonetheless. Part of this is due to the uneven cash flow cycle the company has gone through, partly due to the uneven handset sales they have seen.

QCOM currently sports a dividend yield of 2.9% and they have grown their dividend for 20 CONSECUTIVE years, making them less than 5 years away from becoming a Dividend Aristocrat. The company has a 5-year dividend growth rate of 5.2%.

Analysts are high on the stock with a 12-mo PT of $138, implying 19% upside from current levels.

Future Dividend Aristocrat #3 – Lockheed Martin (LMT

Now we are moving away from the Technology sector and over to the Defense sector. Lockheed Martin is one of the largest Defense contractors in the world today. The company has a market cap of $113 billion and over the past 12 months the stock is up 6%.

Defense budgets can be bumpy, depending on the administration, but in reality, over time, they continue to rise, which benefits, not only the safety of our country, but benefits a company like Lockheed Martin.

When you think of military defense in the skies, you probably think of:

- Blackhawk Helicopters

- F-16s

- F-22 Raptors

- F-35

- And an array of different missiles, in air, on land, or at sea

Lockheed has their hands in a slew of different areas from both military and the commercial side of things. LMT wins orders on a regular basis, but they cannot build them as fast as they gain new orders which results in a backlog. These are orders they have agreed to, but have not yet built. During the company’s latest earnings release, Lockheed reported a record backlog of $158 billion, which is something that will take the company years to work through.

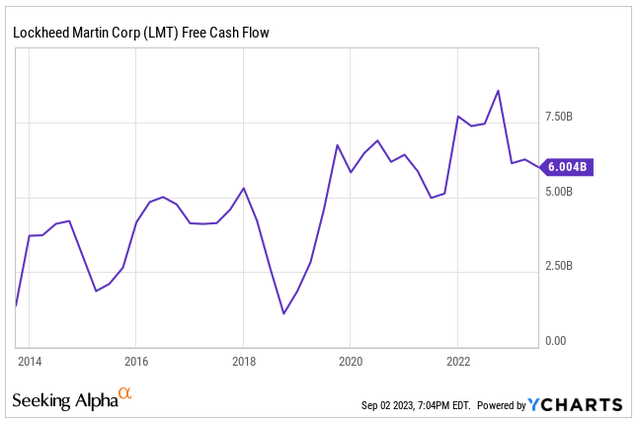

Looking here, you can see how the company has grown their FCF over the years, not smooth, but growing nonetheless, to more than $7.5 billion at the end of 2022 and sitting at $6 billion the past 12 months.

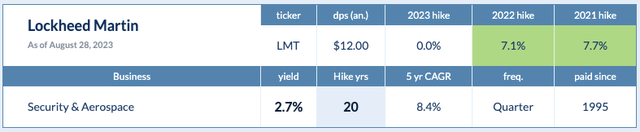

Lockheed currently sports a dividend yield of 2.7% and they have grown their dividend for yet again, 20 CONSECUTIVE years, making them less than 5 years away from becoming a Dividend Aristocrat. The company has a 5-year dividend growth rate of 8.4%.

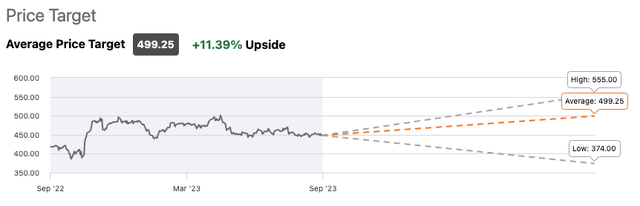

Analysts believe there is still some room to run for the stock as they have a 12-mo PT of nearly $500, implying 11% upside from current levels.

Future Dividend Aristocrat #4 – L3Harris Technologies (LHX

Our fourth stock on today’s list is yet another defense contractor. L3Harris is not as well known as the big 4 defense contractors which are:

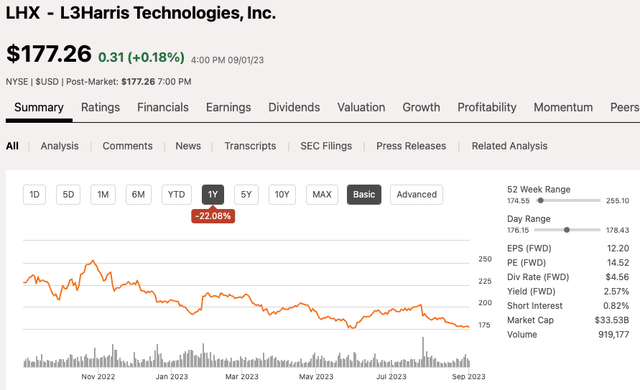

L3Harris has a market cap of $33.5 billion and over the past 12 months, shares of LHX are down more than 20%.

Like Lockheed, L3Harris provides mission critical solutions for both government and commercial customers. The company operates within 3 segments:

- Integrated Mission Systems

- Space & Airborne Systems

- Communication Systems

Revenues grew in every segment in the latest earnings report, but where the company fell a little short was operating income. As revenues continued to climb year over year, so did the backlog, which ended the quarter totaling $25 billion, a 25% increase year over year.

Part of the selling pressures of late have been due to the company closing and getting congressional approval to acquire Aerojet Rocketdyne for $4.7 billion, which increases the company’s missile defense portfolio and rocket engines. In late July, they finally received FTC approval. We will have to see how this impacts the company’s free cash flow moving forward.

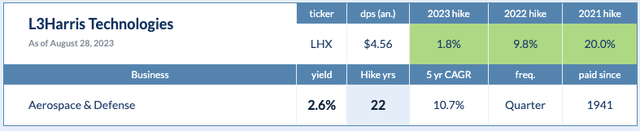

Currently, the company pays an annual dividend of $4.56 per share which equates to a dividend yield of 2.6%. However, the company has the longest active streak of growing their dividend out of the companies we have looked at today, increasing it for 22 consecutive years and counting. The company is also growing their dividend the fastest with a 5-year DGR of 10.7%. That average was much higher until the company did a small hike recently of less than 2%, which could have been due to the Aerojet acquisition.

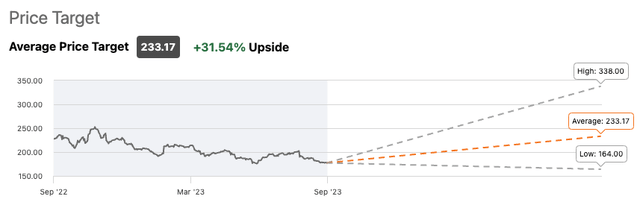

Analysts are high on the stock as they have a 12-mo PT of $233, implying 31% upside from current levels.

Investor Takeaway

To become a Dividend Aristocrat, not only do you need to increase your dividend for 25 consecutive years or more, but you would likely need to have a stable business that can generate consistent free cash flow that allows you to grow your dividend. This is one reason investors choose to invest in dividend aristocrats because they tend to be more consistent, not always, but generally.

All four of the dividend stocks we looked at today, two technology and two defense contractors, are high-quality companies that are still showing signs of growth.

Technology has had a huge run, but both MSFT and QCOM are involved in AI to some degree, which provides some upside from that standpoint. The invasion of Ukraine and other NATO allies looking to bolster their military defense bodes well for future growth in this area, benefitting both LHX and LMT.

Photo by Randy Fath on Unsplash