Summary

- Dividend-focused ETFs have underperformed the S&P 500 benchmark in terms of absolute average total return since 2004.

- Dividend ETFs such as SDY and VIG have shown lower volatility in returns compared to the S&P 500.

- International dividend ETFs, such as IDV, have consistently underperformed in comparison to their US counterparts.

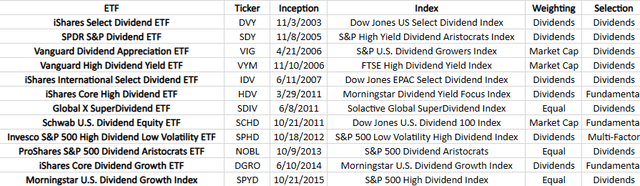

Many arguments have been had related to the advantages, or disadvantages, of dividend-focused investing. For some, it is a matter of focusing on dividends for current income needs. For others, it’s a belief that certain properties of dividend-paying assets provide for better long-term performance. Lastly, there are those who contend overall total return is the end game and it doesn’t matter where it comes from, dividends or not. The following analysis attempts to provide insight into the relative total return performance of several popular dividend-themed ETFs to the market benchmark, the SPDR S&P 500 ETF Trust (NYSEARCA:SPY

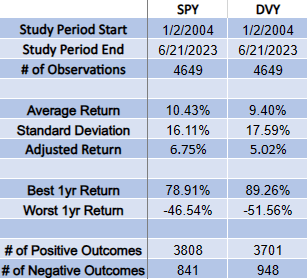

In a major deviation from what the majority of financial sites present for historical performance measures, I derive annual return figures by taking every possible 1 year return period in the time frame in question. So over a 10-year period, instead of using a single start date and a single end date to calculate performance, I use 2,266 start and end date combinations. Each one of these is considered an equal probability outcome giving a much fuller representation of performance over the period.

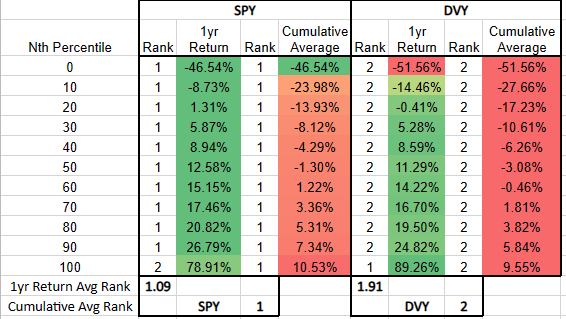

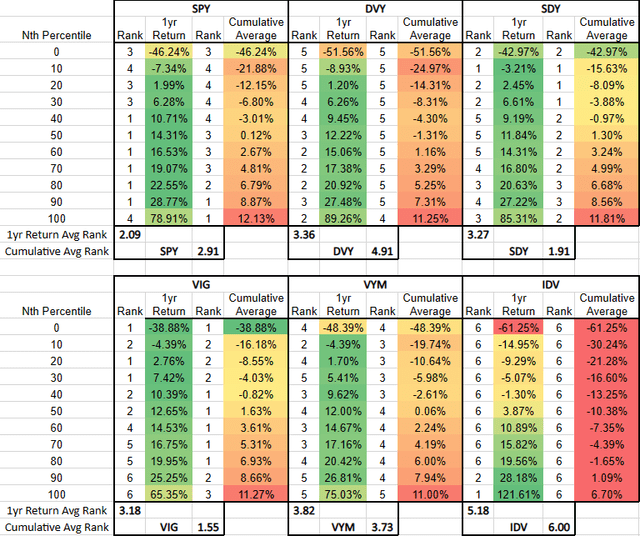

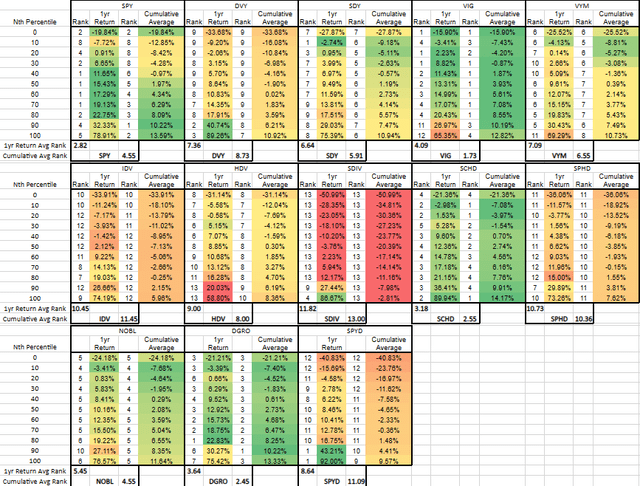

The distribution of returns is also detailed through percentile tables and is used to further massage data in an effort to find underlying trends. Percentiles are divided into deciles and individually ranked. The ranks are averaged to find an overall rank for both the 1-year return and cumulative average, which gauges consistency in returns.

I also use adjusted returns to directly compare ETF performance while taking into account volatility. Adjusted return is the return squared divided by standard deviation.

So let’s get started.

The Beginning

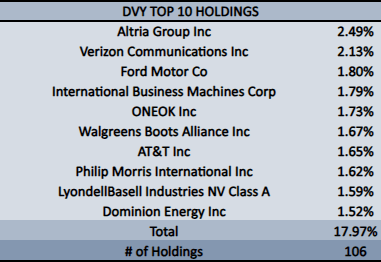

The iShares Select Dividend ETF (DVY

DVY carries a current dividend yield of 3.73%, more than doubling SPY’s 1.50%. It definitely produces more current income but how has it performed over the long term respective to total return? The following table helps us gain some insight.

The results show that SPY outperformed DVY since the beginning of 2004, having a higher average return, lower standard deviation, and higher adjusted return. In fact, investors in SPY would have enjoyed an extra 1% annualized return over the 20+ year period on average. On a $100,000 initial investment, that’s an extra ~$22,000 worth of return.

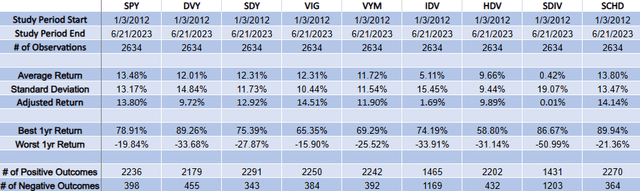

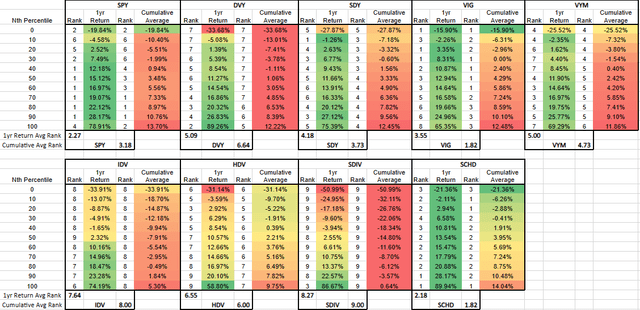

The following table shows 1-year return percentile data. Note that the cumulative average is the running average of 1-year returns anchored to the 0th percentile. Keying in on where this metric turns positive gives insight into how consistent returns have been, with a lower number being better.

The data shows that SPY outperformed DVY in all percentile deciles except the maximum 100th percentile. In the early stage, SPY has proven superior but more dividend-focused ETFs are set to emerge.

Dividend ETF Market Grows

From nearly the end of 2005 to mid-way through 2007, four popular dividend-themed ETFs hit the market.

In late 2005, the SPDR S&P Dividend ETF (SDY

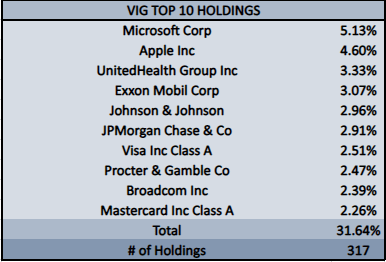

Roughly six months after SDY launched, Vanguard launched its Dividend Appreciation ETF (VIG

Toward the end of 2006, Vanguard launched another dividend ETF geared toward high yield. The High Dividend Yield Index Fund ETF (VYM

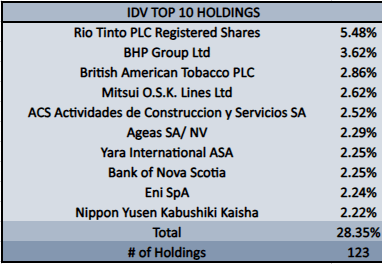

In mid-2007, the first popular international dividend ETF came online with the iShares International Select Dividend ETF (IDV

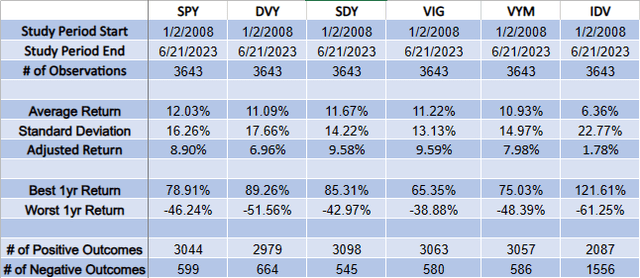

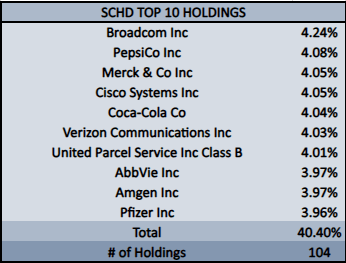

The performance of these ETFs along with DVY and SPY are shown in the following table for the period starting in 2008.

Although SPY still retains the top spot in terms of absolute average total return at 12.03%, a couple of dividend ETFs edge it out in terms of volatility-adjusted performance. IDV comes in last, showing no love for the international scene. The following data shows percentile data for this batch of ETFs.

The distribution of returns further supports SPY’s superior absolute total return performance where it ranks first in many percentile deciles. On the flip side, the generally higher cumulative averages for SDY and VIG point to the lower volatility in returns experienced by these funds.

Rebounding From The Great Recession

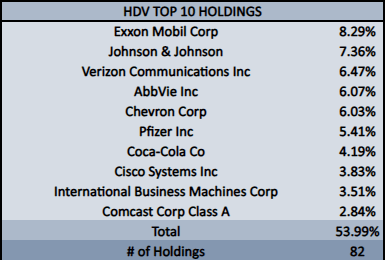

It took a couple of years, but the first popular dividend ETF to launch post the Great Recession came in the first half of 2011. iShares Core High Dividend ETF (HDV

A few months later, Global X got into the game with its Global X SuperDividend ETF (SDIV

October 2011 saw the launch of the very popular Schwab U.S. Dividend Equity ETF (SCHD

The total return performance over this period largely retains SPY’s superior absolute total return performance, only getting edged out by SCHD. The following table outlines performance for the period 2012-present.

Adjusted return sees both VIG and SCHD beating SPY. SDIV is by far the worst performer, followed by IDV. This again shows no love on the international scene. Percentile returns for the period are shown in the following table.

When looking at decile rankings, SPY again ranks in the top spot over this period for absolute 1-year returns. VIG and SCHD tie in cumulative average ranking.

Dividend ETFs Continue To Emerge

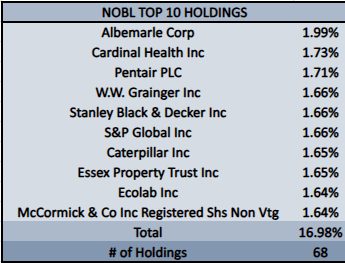

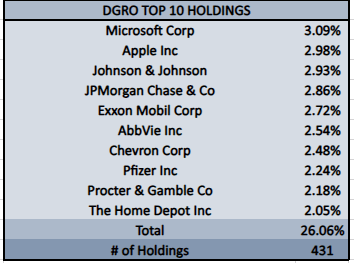

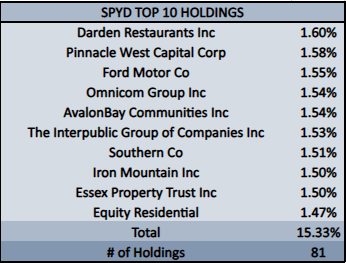

In October 2013, ProShares launched its S&P 500 Dividend Aristocrats ETF (NOBL

June 2014 saw the launch of iShares Core Dividend Growth ETF (DGRO

The last dividend ETF covered was launched in October 2015. The SPDR Portfolio S&P 500 High Dividend ETF (SPYD

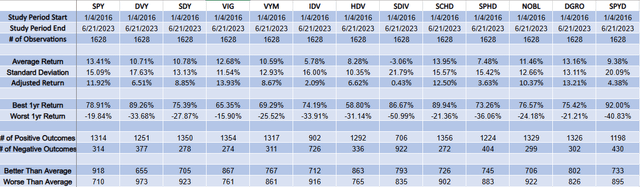

The following table shows a complete performance analysis of all dividend ETFs covered in the article from 2016-present compared to SPY. This marks the latest time period with enough data for a worthwhile comparison.

For absolute average total return, SPY’s 13.41% is only beaten by SCHD’s 13.95%. When looking at adjusted returns, SPY is overtaken by three funds including VIG, SCHD, and DGRO. The worst-performing fund is SDIV and is the only one with negative returns. Other poorly performing funds include IDV, SPHD, and SPYD. The following group of tables shows percentile returns data for all funds.

The benchmark SPY continues to rank in the top spot looking at averaged decile 1-year returns. VIG, SCHD, and DGRO all have strong showings when it comes to cumulative averages.

Conclusion

Do Dividend-Themed ETFs Provide For Better Total Return Over SPY? Based on the analysis over multiple time frames, I would have to say no. At best, a dividend ETF like SCHD may have marginally better total return than SPY but taking the evidence as a whole it appears that SPY is the best choice over the long term without regard to risk. Factoring in risk draws a somewhat mixed conclusion with several dividend ETFs showing better adjusted returns and may justifiably tilt investors in that direction. It is apparent that dividend ETFs based on the dividend growth philosophy do outperform other dividend ETFs and suggest dividend growth is a key factor in providing quality control in a portfolio.

Photo by Austin Distel on Unsplash