Stocks with above-average payouts generally hold up better, but not all dividend strategies are created equal.

Mentioned: General Motors Co (GM), T. Rowe Price Equity Income (PRFDX), Invesco Diversified Dividend A (LCEAX), The Walt Disney Co (DIS), Shell PLC (SHEL), Schwab US Dividend Equity ETF™ (SCHD), iShares Select Dividend ETF (DVY), Vanguard Dividend Appreciation ETF (VIG)

If we’re not in a recession yet, we may be in one soon. The economic signals are mixed: Gross domestic product growth declined for the second quarter in a row, but employment, industrial production, and consumer spending continued trending up during the first half of 2022. But with the Federal Reserve aggressively hiking interest rates, the possibility of a recession in 2023 is a key worry for many investors.

Investors concerned about an economic slowdown may want to consider adding a stake in dividend-stock funds, which have historically held up relatively well during recessionary periods. In this article, I’ll look at whether dividend-paying stocks actually hold up better during periods of economic weakness. I’ll also provide some advice on how to use these effectively in a portfolio.

Stocks that pay above-average dividends are often thought of as safe havens during periods of economic uncertainty. Companies that generate cash can use this excess cash in three different ways, broadly speaking. They can reinvest in their business, use it to acquire or invest in other companies, or return it to shareholders in the form of buybacks and/or dividends. Companies that start paying dividends typically have enough excess cash flow to continue making payments year after year. Dividend programs are often thought of as a way of encouraging discipline and sound financial management because companies that commit to paying dividends are usually reluctant to change their policies.

Thus, companies that generate enough excess cash flow to pay regular dividends tend to be less risky because their financial results are inherently more stable. In addition, the dividend itself can provide a cushion against downside risk. All else being equal, companies that pay dividends will have less downside risk because dividend payments can partially offset price declines.

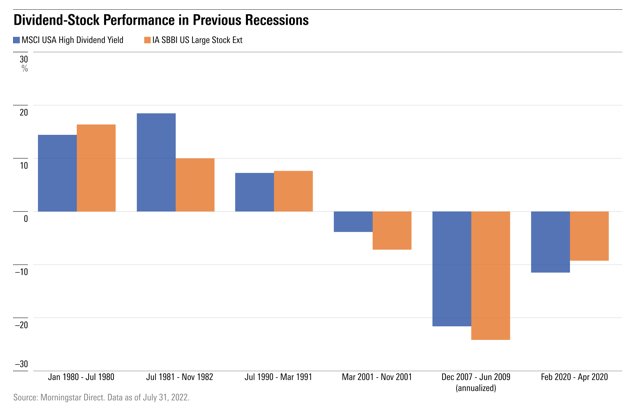

Dividend-paying stocks have held up better than average during some but not all recent recessions.

As shown in the chart above, dividend-paying stocks fared better than the market overall in the economic slowdowns that started in July 1981, March 2001, and December 2007. What’s more, they did so by significant margins in two out of these three periods. However, dividend-paying stocks fell slightly behind in the brief recession in 1980, which started after the Fed raised interest rates to rein in the rampant inflation of the 1970s. Dividend stocks also lagged during the short-lived recession in early 2020. The MSCI USA High Dividend Yield Index dropped 11.5% between February and April, about 2 percentage points worse than the market overall. Dividend stocks suffered in early 2020 partly because scores of companies (including major firms like Disney (DIS), Shell (SHEL), and General Motors (GM) either reduced or suspended their dividends as the sudden economic decline from the coronavirus dented profitability and cash flow. In addition, most dividend stock benchmarks are light on technology stocks and other high-growth, momentum-oriented stocks that led the market during most of 2020.

However, it’s important to note that dividend strategies aren’t monolithic. Broadly speaking, there are three different types of dividend funds. (Hat tip to my colleague Daniel Sotiroff, who defined parameters for these groups and sorted funds into each of the three for a previous article.)

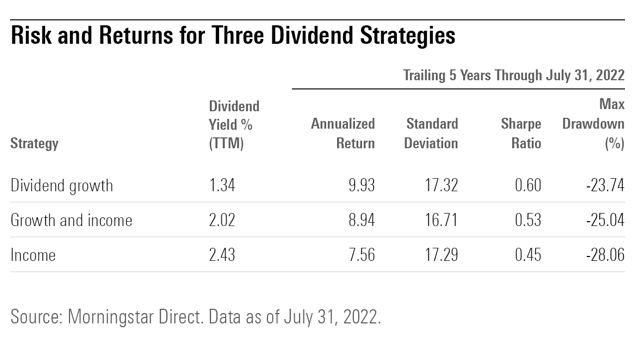

The first category, which Sotiroff labels income, generally focuses on stocks with the highest dividend yields without a lot of additional quality screens. Some larger funds following this approach include iShares Select Dividend ETF (DVY), T. Rowe Price Equity Income (PRFDX), and Invesco Diversified Dividend (LCEAX). Not surprisingly, funds with a high-yield focus tend to pay out the most generous yields, but there’s a performance trade-off. Over longer periods, these funds have shown more volatility (as measured by standard deviation) and have also suffered deeper drawdowns in down markets. Funds with the highest yields often tilt more heavily to the large-value square of the Morningstar Style Box and have relatively large weightings in yield-rich sectors, such as energy and utilities.

Growth and income funds, on the other hand, generally follow a more middle-of-the road dividend strategy by layering on quality screens or also incorporating the potential for dividend growth. Schwab U.S. Dividend Equity ETF (SCHD) is a prime example of this strategy. The fund aims to replicate the Dow Jones U.S. Dividend 100 Index, which features 100 stocks that have paid dividends for at least 10 consecutive years and boast the financial health to continue their streak. The benchmark also incorporates profitability measures, such as return on invested capital.

Funds in the third group, dividend-growth funds, are less concerned about current dividend yields and more concerned about dividend growth over time. (Not surprisingly, their names often include terms like dividend growth, dividend select, or dividend aristocrats.) Vanguard Dividend Appreciation ETF (VIG), which has about $64 billion in assets under management, is one of the larger examples of this approach. The fund tracks the Nasdaq US Dividend Achievers Select Index, which includes stocks from companies that have a record of increasing dividends over time.

On average, dividend-growth funds have paid out a trailing 12-month yield of only 1.3%, compared with 2.4% for the high-yield group. But they’ve also generated the most attractive long-term returns, as shown in the table below. Dividend-growth funds have not only generated the best total returns, but they have also posted the best combination of risk and return, as measured by the Sharpe ratio.

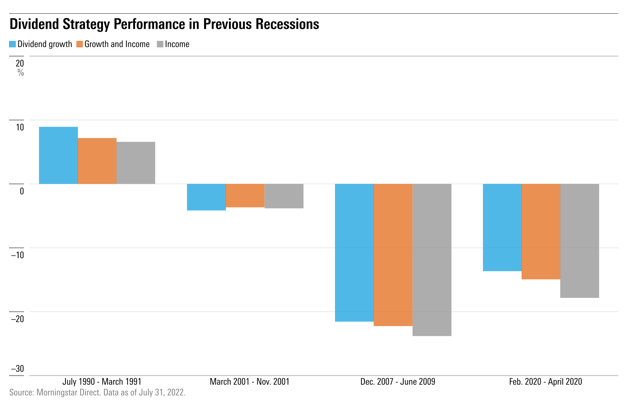

Dividend-growth strategies have also generally fared the best during recessionary periods. (I omitted the two earliest periods from this table because only a handful of funds were around back then.) With the exception of 2001, when their heavier weightings in technology stocks were a liability, dividend-growth funds fared the best of the three groups during the most recent recessionary periods.

Dividend-stock funds’ resilience during most recessionary periods adds to the case that they can make solid portfolio additions. But while yield is an obvious reason for investing in dividend-stock funds, more yield hasn’t been better. In fact, funds with the strongest yield orientations also tend to have lower portfolio quality, which has often led to lower risk-adjusted returns. Instead of reaching for the highest possible yield, investors worried about the possibility of a recession are better off emphasizing portfolio quality with yield as a secondary factor.

Photo by Yiorgos Ntrahas on Unsplash