Summary

- On 10 March 2023, federal bank regulators shut Silicon Valley Bank. Their action followed a run on its deposits.

- The failure of Silicon Valley Bank represents the second largest bank failure in U.S. history and was quickly followed by the third largest, Signature Bank, just two days later.

- These failures changed the outlook for U.S. stock market investors, which can be quantified by how they’ve changed the expected future for dividends, as measured by the CME Group’s S&P 500’s Quarterly Dividend Index Futures.

On 10 March 2023, federal bank regulators shut Silicon Valley Bank (OTC:SIVBQ). Their action followed a run on its deposits. The failure of Silicon Valley Bank represents the second largest bank failure in U.S. history and was quickly followed by the third largest, Signature Bank (OTC:SBNY), just two days later.

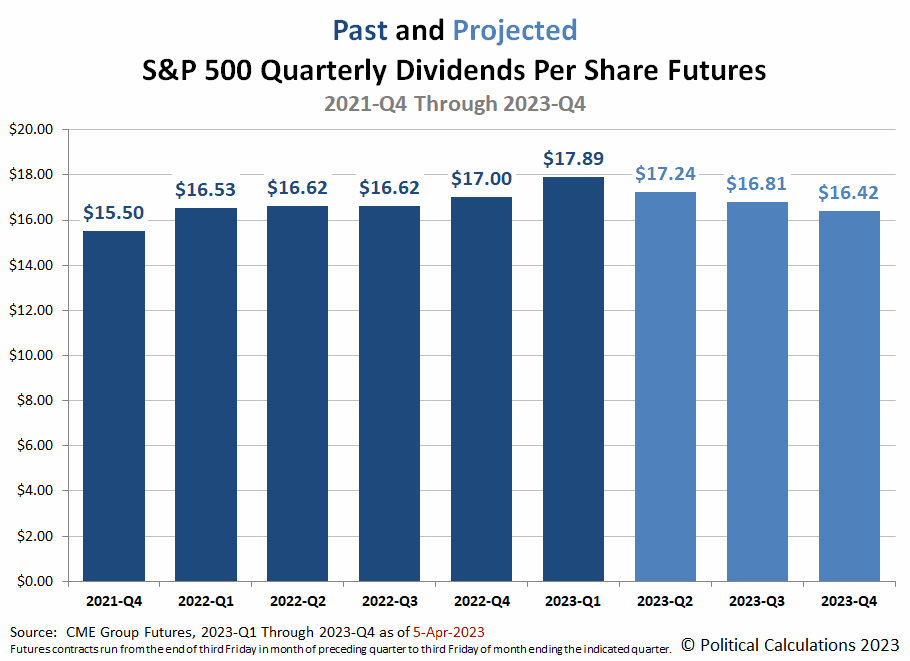

These failures changed the outlook for U.S. stock market investors, which can be quantified by how they’ve changed the expected future for dividends, as measured by the CME Group’s S&P 500’s Quarterly Dividend Index Futures. Previously, we’ve animated how they evaporated in the week following the failure of Silicon Valley Bank.

But in the weeks since, the outlook for the S&P 500‘s expected dividends has improved. That improvement is shown in the following animated chart tracking how the amount of dividends expected for the S&P 500 in each upcoming quarter through the end of 2023 has changed since 17 March 2023.

Perhaps the easiest way to quantify how that outlook has changed is to look at the expectations for 2023-Q4’s dividends per share, because the numbers are easy to work with. On 10 March 2023, investors expected the companies that make up the S&P 500 index would pay a quarterly dividend of $16.99 per share.

One week later, on 17 March 2023, the amount of dividends expected to be paid by S&P 500 companies in the fourth quarter of 2023 had fallen to $16.00 per share.

But now, through 6 April 2023, investors anticipate the S&P 500’s dividend payout for 2023-Q4 will be $16.47 per share. In the three trading weeks since 17 March 2023, dividends have recovered a little over 47% of how much they lost in the week immediately after the second and third largest bank failures in U.S. history.

It’s still a long way from a complete recovery, which appears unlikely at this writing. We’ll check in again on how that future is changing sometime in mid-May 2023.

Photo by Robert Bye on Unsplash