Summary

- Most investors know they’re supposed to buy stocks low.

- Unfortunately, the superficially scary appearance of low stock prices holds people back from buying.

- Overweighting dividend stocks may provide an edge in the mental aspect of investing: focusing on yield lessens the importance of price movements.

- A great way to get started with dividend investing is through the Vanguard Dividend Appreciation ETF.

- This fund has an above-average yield but focuses on dividend appreciation, so it avoids the mistake of chasing high yield.

There’s a popular academic theory that says that dividends don’t matter. Dividend irrelevance theory, part of Modigliani and Miller’s (“MM”) capital structure theories, says that dividends don’t influence total return. Dividend or no, you’ll get the same result in the end.

The truth of this theory depends on the tax policies shareholders and companies are subject to. In a country with no dividend or capital gains tax, MM’s theory should hold true, provided that retained earnings will simply sit as cash balances. If a company has lucrative investment opportunities in front of it, then paying dividends could actually hurt it: this is the very reason why Berkshire Hathaway (BRK.B) has never paid a dividend.

However, there are reasons for companies to pay dividends in practice. One is taxation. In a country with no dividend tax and steep capital gains tax, it makes a lot of sense for companies to pay out dividends: an investor’s total return is on an after-tax basis. Another reason is a lack of investment opportunities. If your existing operations are your only foreseeable source of cash, then you might as well pay a dividend: shareholders can’t use cash on the balance sheet.

Just as there are valid reasons for companies to pay dividends, there are valid reasons for investors to desire them.

One of the big ones is psychology. Successful investing often involves holding during volatility, and the presence of a dividend can provide some psychological reassurance that volatility isn’t the end of the world.

Ben Graham famously wrote in The Intelligent Investor that “investment is most intelligent when it is most businesslike.” By that he meant that, as an investor, you should seek strong business performance relative to your purchase price, not short-term stock market gains. The soundness of Graham’s advice was later confirmed by the investing careers of Warren Buffett and Charlie Munger–who spent years preaching value investing in public–as well as Walter Schloss, Bill Ackman, Li Lu and others.

The idea that you should invest long term is ubiquitous at this point. Read any financial media publication any day of the week, and you’re more likely to hear about long-term investing than day trading. However, long term investing can be difficult emotionally. You might be able to spot a cheap stock with good prospects, but the downward price trajectory could easily steer you off course. All the Warren Buffett quotes in the world don’t change the fact that, if you’re scared, you’re scared.

This is where dividends come in handy. One of the tricks Graham recommended in The Intelligent Investor was to simply think about “company earnings and dividend returns” while ignoring stock prices. This trick seems like it could work: if the entire goal of your investment is to maximize dividends, then you should be more able to withstand a low stock price than the average day trader is. In fact, you may even see an ever-rising yield as a good thing–provided you have funds available to invest.

All of the above points serve to introduce a fund that I think could help people with the psychological aspect of investing:

The Vanguard Dividend Appreciation Fund (NYSEARCA:VIG). VIG is a fund that invests in dividend growth stocks. The fund has only a 2.1% yield, but it’s geared toward stocks that raise their payouts over time. This is important because, for a long-term investor, it’s not last year’s yield that matters, but next year’s. Dividend investing is generally a pretty good strategy, but it’s possible to trip yourself up chasing after unrealistically high yields. The VIG fund sets you off on the right foot by getting you invested in dividend stocks with high performance, not just high yields.

The VIG Portfolio

As I wrote a few paragraphs back, dividend investing can give an investor a psychological edge. Simply thinking about stocks as income producing investments can help take your mind off of their prices. However, if you just throw all your money into one high-risk dividend stock, you risk a permanent loss of capital. In this scenario, buying and holding is not a virtue: selling bad assets is better than holding them. So for dividend investing to work, you need to hold quality stocks, not questionable “high yield” stuff.

It’s here that VIG’s portfolio really stands out. VIG consists primarily of “dividend aristocrats”: stocks that have raised their dividends every year for at least 25 years. Some top holdings include:

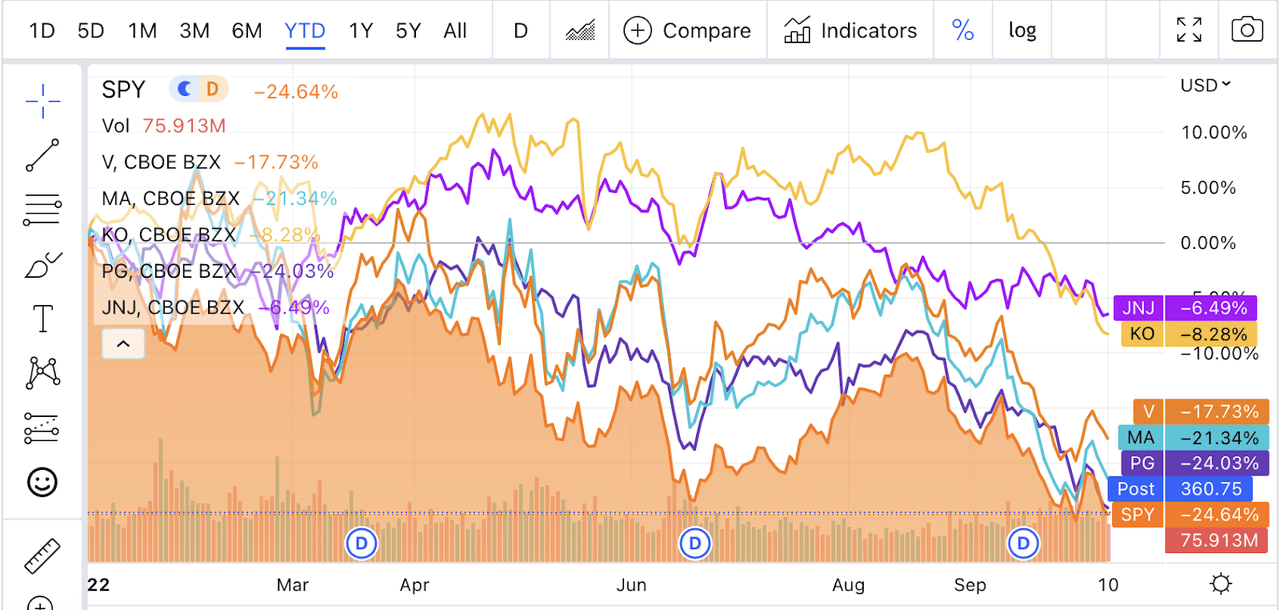

The first thing you’ll notice is that this is a veritable laundry list of out-performers. Below I’ve included a screenshot of the five stocks above compared to the S&P 500. As you can see, all five of the stocks named above are beating the S&P 500 year-to-date. I’m not cherry picking either; the above are 5 randomly chosen stocks from the 10 highest-weighted stocks in VIG’s portfolio.

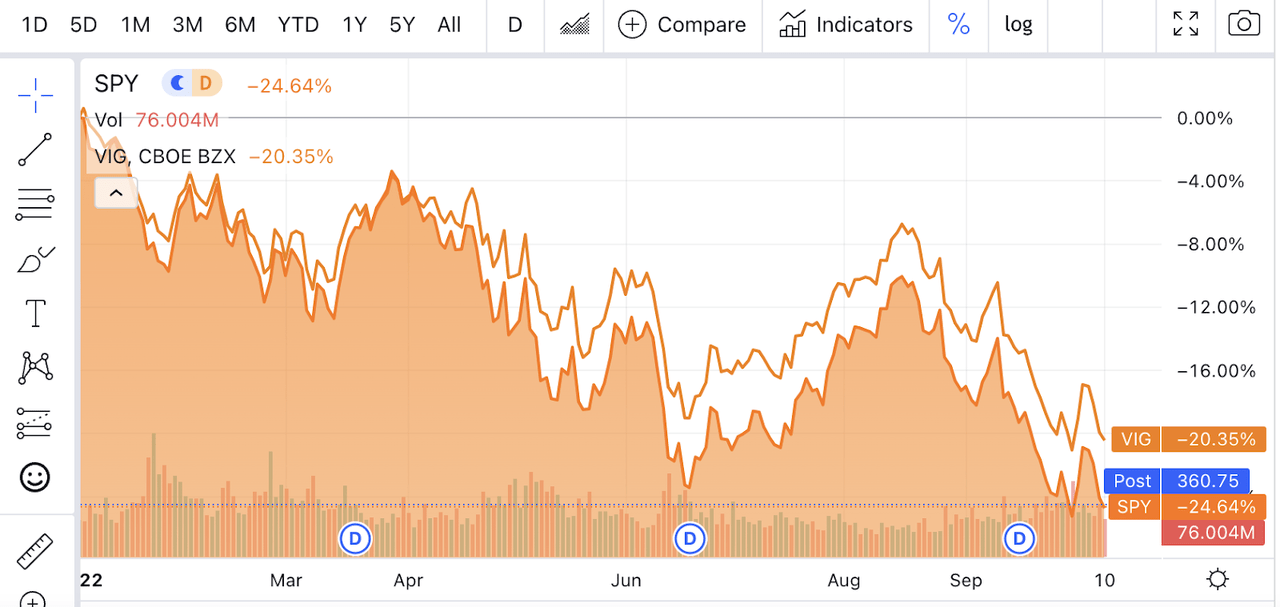

Furthermore, VIG itself is beating SPY this year, as the chart below shows:

Will VIG outperform on a longer-term basis?

That’s difficult to say with certainty, but there’s a decent chance that that will happen. According to Sure Dividend, dividend aristocrats matched the S&P 500’s return over the last decade, while having lower volatility. In other words, they delivered superior risk-adjusted returns. “Risk adjustment” means adjusting returns for volatility: if Stock ‘A’ gets a 100% return with little volatility and Stock ‘B’ gets a 100% return with high volatility, then stock ‘A’ has the higher risk adjusted return.

Now, the Vanguard Dividend Appreciation ETF is not identical with the dividend aristocrats. To be a dividend aristocrat you need 25 consecutive years of dividend hikes, to be part of VIG you only need 10 years of dividend growth. VIG’s standard is laxer, but that could be a virtue: a dividend cut 25 years ago doesn’t mean much if your growth, balance sheet, profit margins and payout ratio were pitch-perfect for the next 24. At any rate, the core idea is the same: both VIG and the aristocrats are baskets of dividend growth stocks.

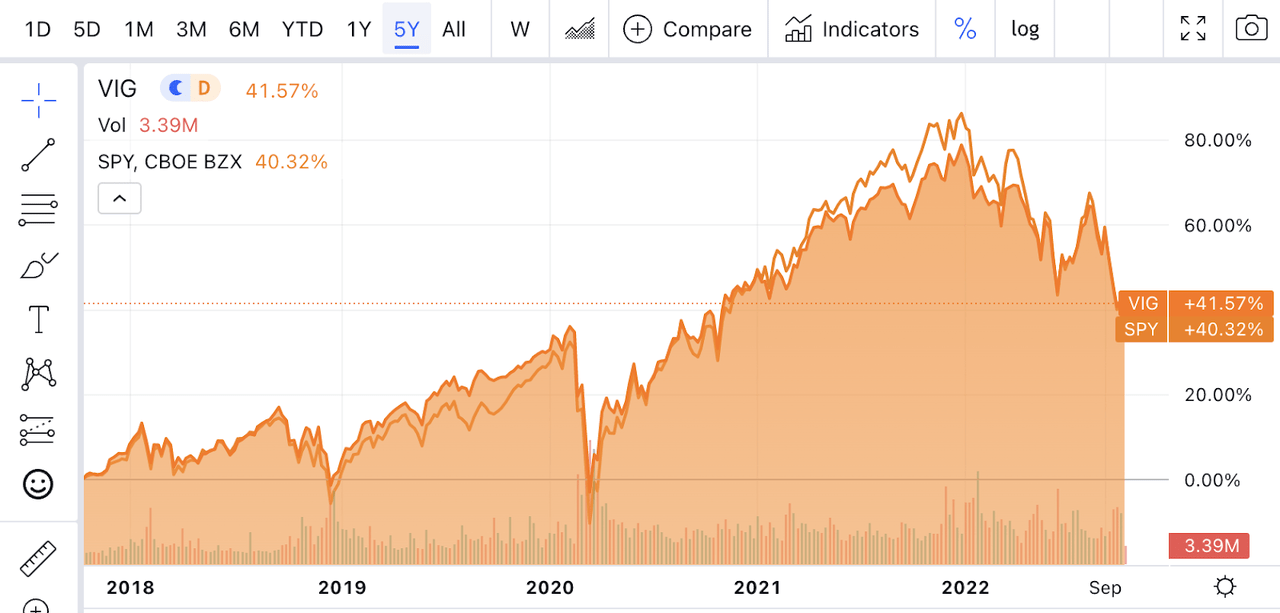

If I’m right that VIG possesses the same virtues that the dividend aristocrats do, then it should deliver adequate performance long term. Indeed, past history suggests that it will. The chart below shows that VIG has delivered a 1.2% higher price return than the S&P 500 over the last five years. If you include dividends, then VIG’s outperformance increases, as VIG has a higher yield than the S&P 500. If you pull the chart back to 2007, VIG loses the superior price return (over 15 years its price return lags that of the S&P 500 by 0.5%), but dividends likely push VIG’s total return higher: the fund’s yield is 23.5% higher than that of the index.

Past returns don’t predict future returns, but there are plausible reasons to think that VIG’s outperformance could continue.

First, think about what exactly makes a dividend growth stock. How can a company pay a dividend that keeps going up long term? Over a 1- or 2-year period, a bad business can pay dividends by borrowing. But over 10 years, that’s unlikely to happen: people will eventually stop lending to a company that’s persistently losing money. If they do keep lending to it, they’ll demand high interest rates, which will impede dividend-paying ability. So, dividend growth investing selects for quality and longevity.

Second, take a look at VIG’s portfolio. It is almost identical to the dividend aristocrats, except with fewer years of dividend growth required. With the dividend aristocrats, you’re already outperforming on a risk-adjusted basis. VIG’s looser dividend growth requirement may give it the flexibility to buy some quality stocks that wouldn’t quite make the cut as dividend aristocrats. For example, with VIG, you get Microsoft (MSFT), a massive outperformer that started paying dividends in 2003. MSFT is not a dividend aristocrat, but would any dividend investor want to pass it up? Probably not: its performance has been fantastic.

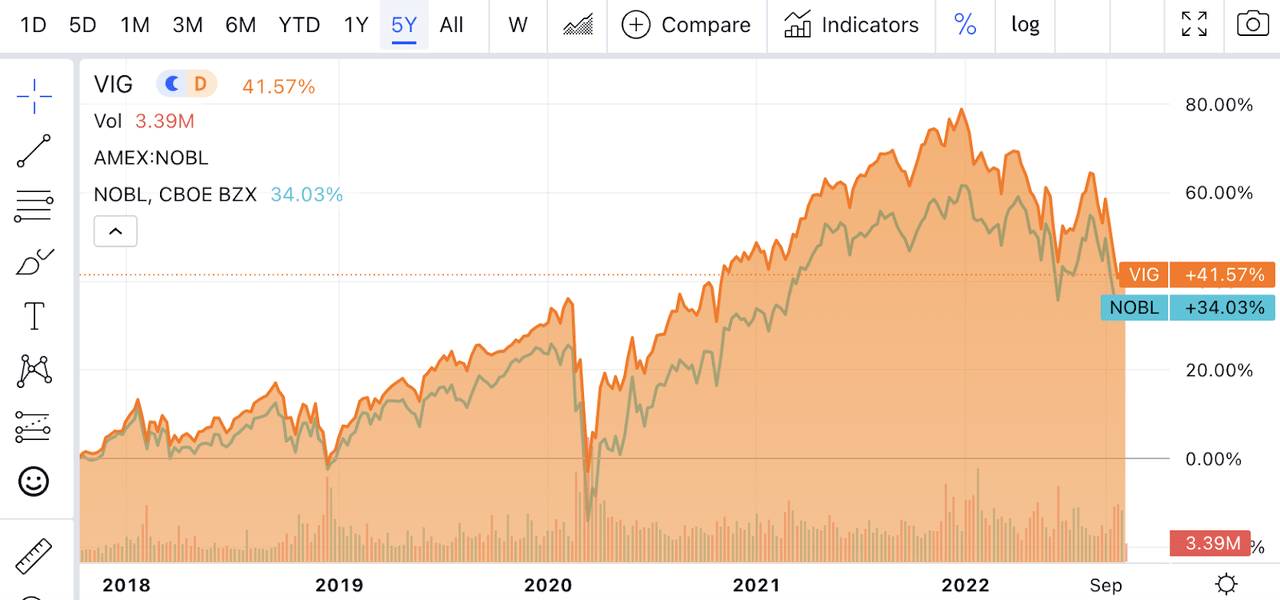

Because it includes stocks like Microsoft, VIG is beating the ProShares S&P 500 Dividend Aristocrats ETF (NOBL) over the last 5 years. In fact, it’s beating it by a lot: VIG is 7.5% ahead of NOBL over a half decade.

By loosening the dividend growth requirement from 25 years to 10, VIG gets some dividend tech stocks in the mix, and that boosts its returns compared to the dividend aristocrats, which largely exclude tech.

Fees

Having looked at VIG’s portfolio, we can turn to its fee structure. VIG has a 0.06% management fee, which is so small you’ll barely notice it. To prove that VIG’s fee won’t hurt you too much, we can look at the performance of a hypothetical $1000 invested in VIG that gets a price return of 10% a year. For simplicity’s sake, I’ll exclude dividends here and focus entirely on fund assets.

| Before fee | Fee | End amount |

| $1100 | $0.66 | $1099.34 |

| $1209 | $0.725 | $1208.27 |

| $1329 | $0.79 | $1328.20 |

| $1461 | $0.876 | $1460.12 |

| $1606 | $0.96 | $1605.03 |

If you didn’t have that 0.06% fee in there, you’d end up with $1610. So, you lose a mere $5 over an entire five-year holding period as a result of VIG’s management fees.

The Big Risk

It’s pretty clear that VIG has a long track record of out-performance, and a very low fee. It looks like a buy based on historical performance. But it is very important to keep one major risk in mind:

Dividend cuts.

If a stock in VIG’s portfolio cuts its dividend, then it gets removed from the portfolio. This is risky in two ways: one, the fund’s yield could go lower if a removed stock is replaced with one with a lower yield; two, removing stocks due to dividend cuts may reduce total return. Sometimes, companies freeze their dividends because politicians force them to. For example, in 2020, Canadian banks were banned from hiking their dividends. That obviously isn’t a strike against a company’s fundamentals in itself, but it could result in a company being removed from VIG

The Bottom Line

The bottom line on VIG–and dividend investing in general–is that it gives you a mental edge. When you own dividend stocks, you can adopt the mindset of simply investing for cash flow, which can ease your nerves during bear markets. If you hold speculative growth stocks, it might be harder to keep your wits during a drawdown: when there’s no cash flow apart from sales proceeds, a declining price looks a lot scarier.

Of course, dividend growth stocks can disappoint. If you put all your money into a low-quality dividend stock, you can lose it all. If you invest in a diversified portfolio of dividend growth stocks, on the other hand, you’ll do well. Just ask anyone who bought VIG 5 years ago and held to today!

Photo by Aditya Vyas on Unsplash