While most investors are losing money with their portfolios, some companies are doing well.

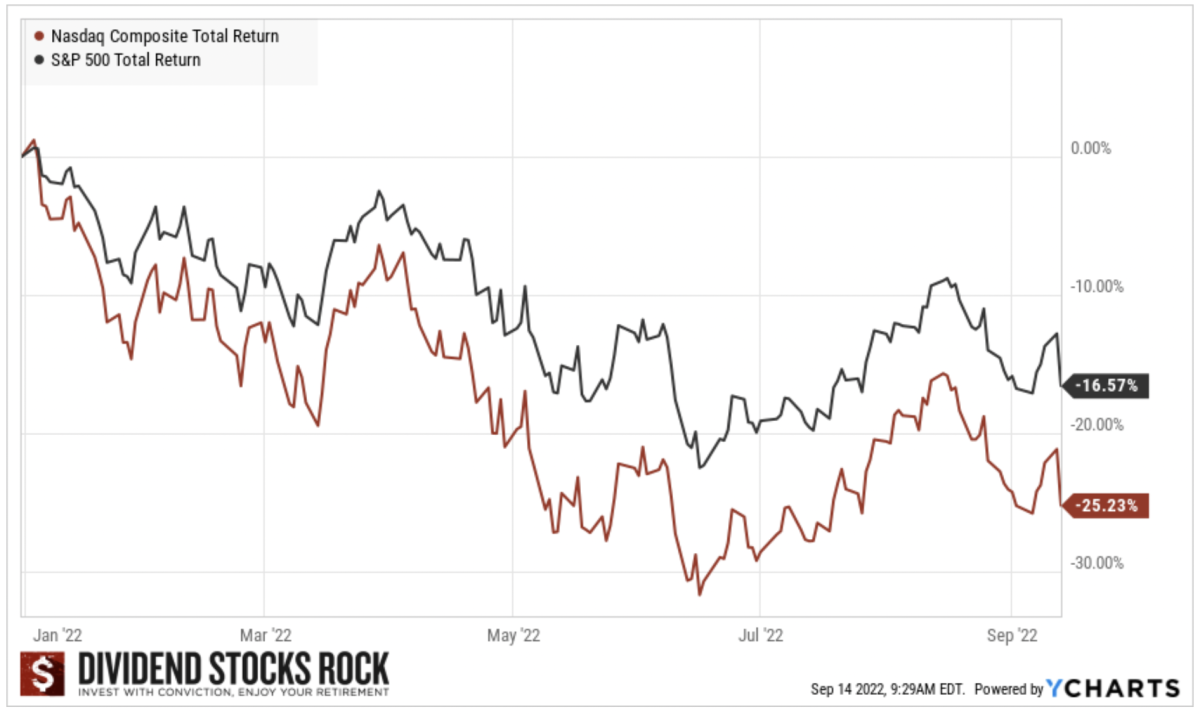

Where can you invest in a bear market? The S&P 500 is flirting with -20% (including dividends), while the NASDAQ is clearly in bear territory. While most investors are losing money with their portfolios, some companies are doing well.

We’ll look at three dividend stocks making investors smile in 2022.

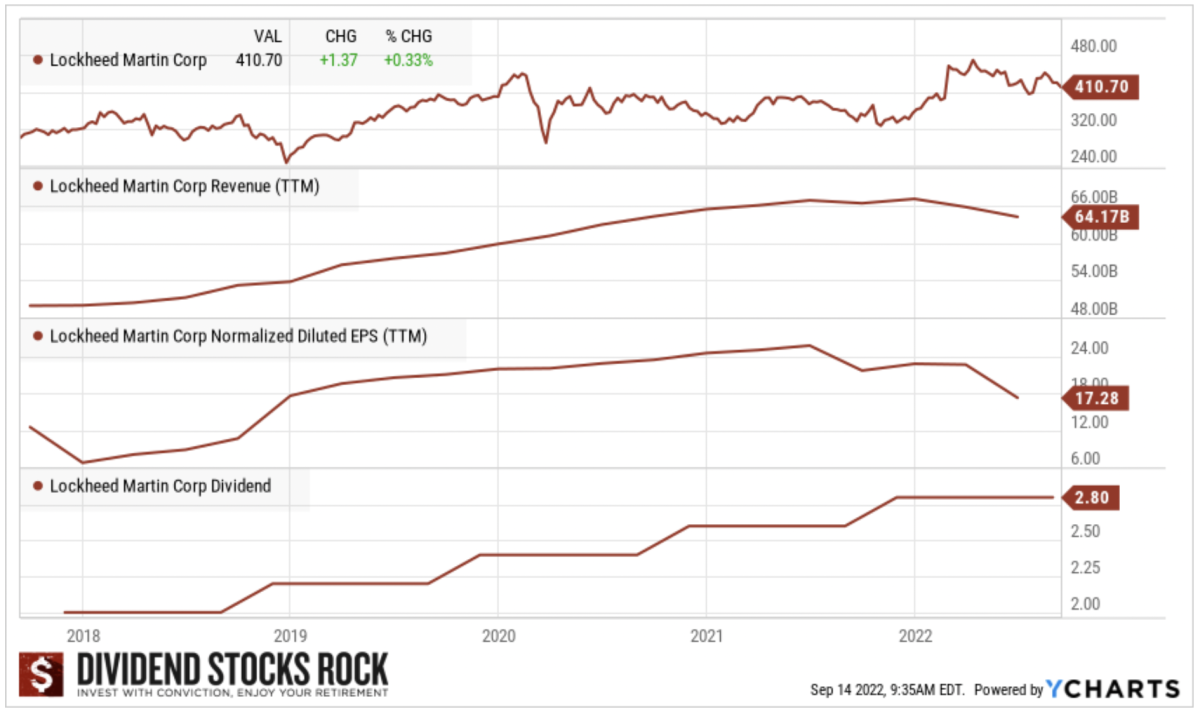

Lockheed Martin (LMT) +17% YTD

Let’s start with a dividend grower showing almost 20% total return this year. Lockheed Martin lagged the market in 2021, but got a boost of love from the market once Russia declared war. The company traded at a low P/E for a while, but there is still room for growth. As of September, the forward P/E ratio is at 15. Not bad for an overvalued market, right?

Investment Thesis

LMT operates in a semi-monopoly (who else is making F-35’s?), thus it only has one large customer. The company experienced significant difficulty in growing its revenues prior to the acquisition of the Sikorsky Aircraft helicopter division, and it is unsure whether LMT will be able to grow Sikorsky helicopter revenues in such a competitive environment. Even the cost and performance of their F-35 program has been criticized. There is also a new recent large player in the market with the merger of Raytheon and United Technologies. LMT has a large pension plan burden which weighs heavily on the company’s balance sheet. Finally, LMT could face reduced margins caused by higher inflation (with 62% of sales from fixed contracts).

Lockheed Martin is part of our Dividend Rock Stars list.

Potential Risks

LMT operates in a semi-monopoly (who else is making F-35’s?), thus it only has one large customer. The company experienced significant difficulty in growing its revenues prior to the acquisition of the Sikorsky Aircraft helicopter division, and it is unsure whether LMT will be able to grow Sikorsky helicopter revenues in such a competitive environment. Even the cost and performance of their F-35 program has been criticized. There is also a new recent large player in the market with the merger of Raytheon and United Technologies. LMT has a large pension plan burden which weighs heavily on the company’s balance sheet. Finally, LMT could face reduced margins caused by higher inflation (with 62% of sales from fixed contracts).

Dividend Growth Perspective

LMT has increased its dividend each year since 2004. It seems that it is navigating the perfect storm: as conflicts are rising around the globe, Congress has accepted Lockheed Martin’s efforts to seek out international opportunities. We expect LMT to not only grow its earnings in the coming years, but also to increase its revenues. LMT just rewarded shareholders with a dividend increase from $2.60 to $2.80. Shareholders can expect a high single-digit dividend growth rate along with continued growth in the market value of the company.

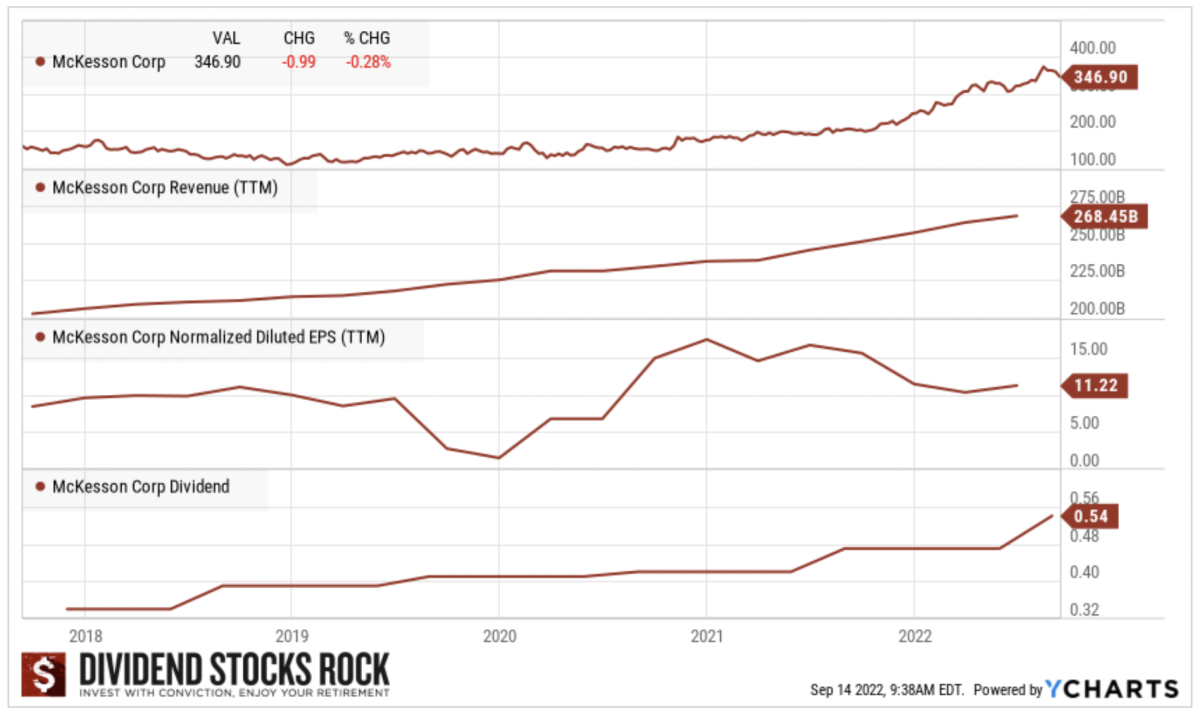

McKesson Corp (MCK) +40% YTD

While LMT’s performance (almost 20% up this year) is great, that’s nothing compared to our second stock: McKesson Corp (MCK) at +40%.

As the largest player in a complex environment, McKesson enjoys strong barriers to entry. The Company is focused on advancing health outcomes for patients everywhere. Its size allows the company to enjoy economies of scale through its wide distribution network.

Investment Thesis

The company is in a dominant position with one third of the pharmaceutical distribution market. Through its wide distribution network, MCK generates economies of scale and makes it difficult for its peers to compete. MCK basically takes away the complexity of dealing with pharmaceutical products for its customers. Therefore, businesses can focus on what they do best and let MCK deal with regulations. The company counts major players such as Walmart and CVS as customers. MCK has evolved through mergers, acquisitions, and spin-offs. To reduce margin pressures, the company has made several vertical acquisitions. After many transactions, MCK is now in the process of exiting its European businesses. The idea is to streamline its business and maintain a better focus. Our biggest concern right now is the high stock price.

Potential Risks

McKesson is currently enjoying a good rebound on the stock market. Still, keep in mind that shares once traded at over $200 not too long ago (2015). MCK is still operating in a highly competitive market with razor-thin margins. This forces the company to grow through additional acquisitions. The more vertical acquisitions the company makes, the more risk of integration it will face. In a move to simplify its business, MCK is selling its European segment. Being a giant in a highly regulated environment isn’t always a plus. In the event of a regulation shift, the company may suffer greatly. Finally, MCK and fellow “Big Three” pharma distributors ABC and CAH recently signed a settlement with 46 of 49 participating states to resolve most of the outstanding opioid litigation claims. MCK will have to pay $7.4B over 18 years.

Dividend Growth Perspective

MCK has increased its dividend consecutively every year since 2017. Its dividend streak isn’t impressive, but the company has been offering an increase here and there since 2009. Since both payout ratios are kept low, you can expect more increases moving forward. In any case, you shouldn’t pick MCK for its dividend growth potential or its yield. The company offers, at best, a 1% yield (0.5% now) with mid-single digit growth potential. The play on MCK is about its ability to dominate the pharmaceutical and medical distribution markets.

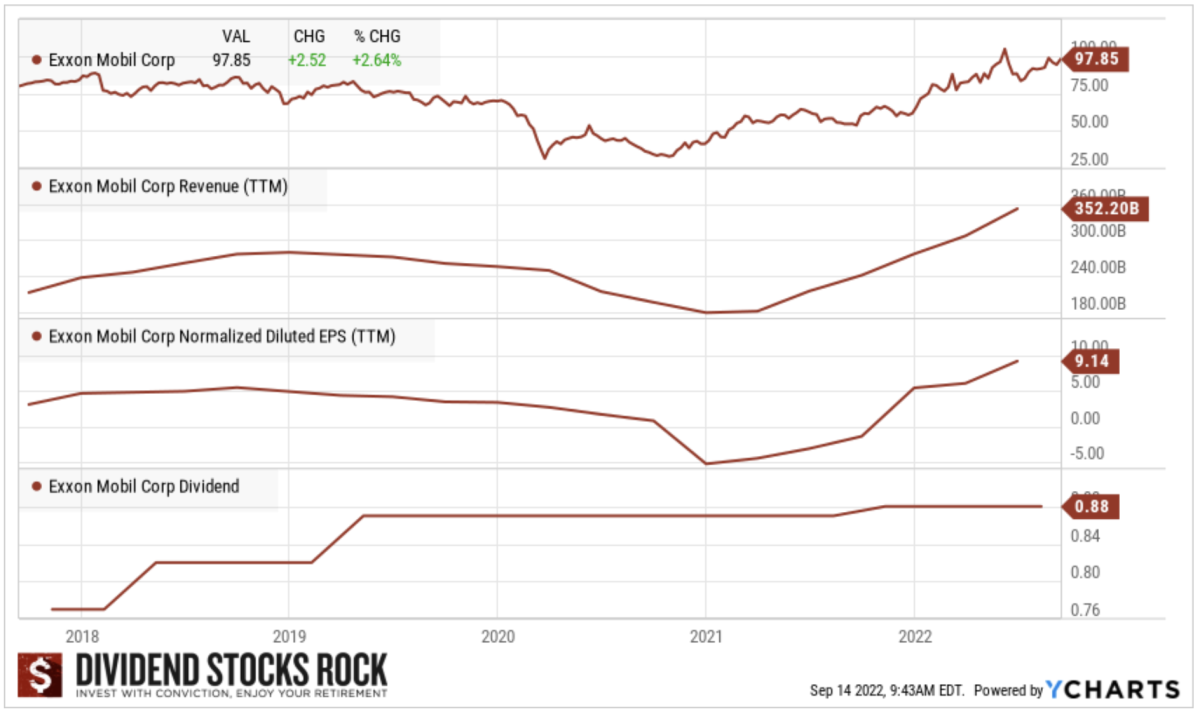

ExxonMobil (XOM) +60% YTD

Let’s end this article with a bang: Exxon Mobil at +60%! It’s no secret; that the energy sector has been THE place to invest since we discover the first covid vaccine. We decided to highlight a classic dividend grower in this industry.

Investment Thesis

XOM has been a cash flow generating machine for several decades. Cash flow from operations used to cover much more than dividend payments, however the pandemic changed the landscape of the oil industry. Management has reaffirmed its commitment to its shareholders during the pandemic. Exxon’s massive investment in oil and gas production in the past was hefty, but surely boosted XOM’s long-term reserves, allowing XOM to have about 50% of its production to come from long-term reserves. This should be a great cash flow source and should support future dividend payments if we see an economic recovery. With stronger prices for crude oil, XOM is reaping the benefits of its past investments, and has been driving the stock price up. The short term might have some upside.

Potential Risks

While XOM has proven its ability to navigate difficult circumstances many times, the company remains subject to commodity price fluctuations; we have seen how oil prices affect share prices. XOM’s business model requires continuous reinvestment in new projects to find additional oil and it is a capital-intensive business with high debt levels. Future projects may not be as profitable considering the current state of the oil industry. Profitability is also dependent on the price level of crude oil. As opposed to many of their competitors, Exxon Mobil decided to double down on its investment in oil exploration/production.

Dividend Growth Perspective

XOM has a history of successfully adapting to a challenging environment. Unfortunately, it has become more difficult than ever for XOM to sustain a capital-intensive business and increase its dividend at the same time. The increase in oil pricing may have given the oil giant a short-term break, but that will eventually end. Cash from operations has been funding dividends, capital investments, and debt reduction better in the last few quarters. Though rising oil prices and recovering demand bode well for the company in the short term, renewables are the future. The dividend is generous, but we don’t know when it will return to more aggressive growth.

Another pick in the energy sector could be…

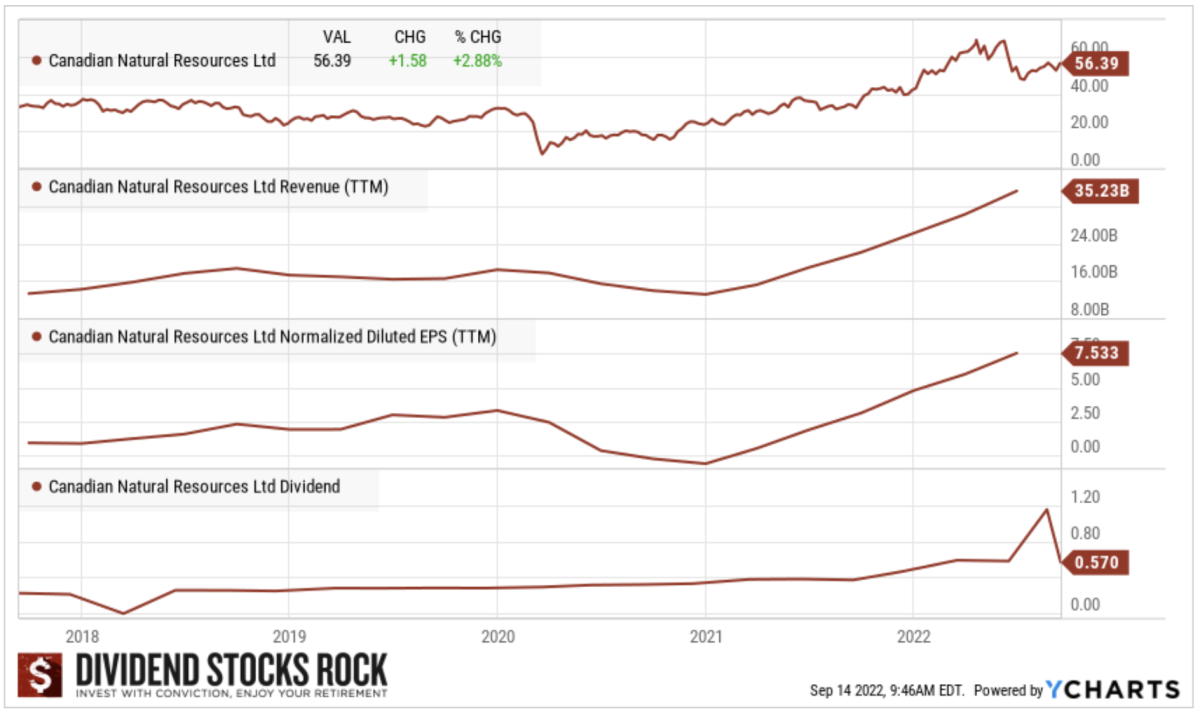

If you are willing to look on the North side of the border, you’ll find several great Canadian energy stocks trading on the NYSE. One of them is Canadian Natural Resources (CNQ), with 25 consecutive dividend increases.

In a world where the West Texas Intermediate (WTI) trades at $75+ per barrel, CNQ would be a terrific investment (here is your cue since the WTI is trading way over $70 lately!). It is sitting on a large asset of non-exploited oilsands and reaches its breakeven point at a WTI of $35. What cools our enthusiasm is the strange direction oil has taken along with the fact that oilsands are not exactly environmentally friendly. Many countries are looking at producing greener energy and electric cars. This could slow CNQ’s ambitions. However, CNQ is very well positioned to surf any oil booms. The stock price has more than doubled in value since the fall of 2020. It has previously invested very heavily, and it is now generating higher free cash flow because of past capital spending. CNQ exhibited resiliency in 2020, and this merits a star in their book!

The pandemic accelerated the inevitable: global shortage and high inflation

It was already in the books as an inverted demographic pyramid led to a lack of qualified workers. Too many just-in-time facilities were stopped for too long, creating delays everywhere. Billions of dollars injected by central banks inflated demand when there was no offer. It’s the perfect storm.

What is coming up this fall? More inflation and more interest rate hikes! What do you think the market will do?

I know I didn’t paint an optimistic picture here, but it’s the cold, harsh reality. It doesn’t mean you have to suffer your way through the fall. It doesn’t mean that you should endure losses and dividend cuts.

Photo by Austin Distel on Unsplash