Lured by the prospect of steady income, investors are pouring billions into these inflation hedges without always understanding how they work

Dividend stocks have become the new darling on Wall Street, and investors looking for income are pouring billions of dollars into them.

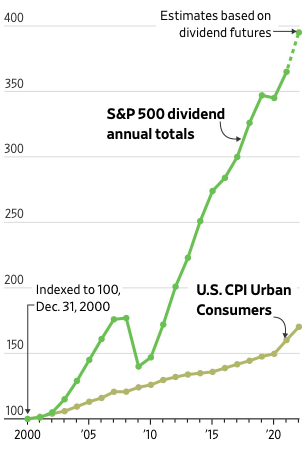

Dividends Pay Off

Dividend growth vs. inflation (as measured by the CPI) since 2000

Note: Data is as of July 29, 2022.

Sources: S&P Dow Jones Indices (dividend); Labor Department (CPI); CME (futures)

These securities are considered a good buffer during times of market volatility. They also are seen as an inflation hedge, considering that S&P 500 dividend growth has outpaced inflation since 2000.

But buying dividend stocks takes savvy. To be successful, individuals need to understand the mechanics of how the stocks work, and the metrics used to evaluate performance.

In the second quarter of 2022, dividend payouts by U.S. companies in the S&P 500 set a record despite rising interest rates, inflation and an economic slowdown. They totaled $140.6 billion, up 14% from $123.4 billion in the year-earlier quarter, according to S&P Dow Jones Indices. “It’s expected this trend will continue in Q3 and through year’s end,” says Anu Ganti, senior director of index investment strategy at the company.

That’s good news at a time when bond-market yields remain low and volatility in the bond market has become the new normal. “People aren’t accustomed to that kind of roller-coaster ride in the bond market,” says Ross Frankenfield, managing director of Harbor Capital Advisors Inc. “Many are turning to dividend stocks to fill the fixed-income void instead.”

Here are some answers to common questions about dividend stocks.

What is a dividend stock?

It is a share of a company that regularly distributes a portion of its earnings to shareholders in the form of cash or additional stock. Not all companies choose to distribute profits in the form of dividends to shareholders; some reinvest profits back into their organizations.

Companies have the right to set their own distribution schedules and issue dividends when they see fit. Many issue them quarterly or semiannually.

Keep in mind there are other types of dividends that companies distribute. These include a property dividend, where property is distributed to shareholders as a return on investment, and a liquidating dividend, distributed when a company that is dissolving distributes all or a portion of assets to shareholders.

Investor interest in dividend stocks has been slowly gaining momentum over time. According to S&P Dow Jones Indices and Bureau of Economic Analysis data, dividends as a share of personal income climbed to 7.3% in the first quarter of this year from 3.2% in the first quarter of 1980. Interest income as a share of personal income declined to 9.2% from 16.2% over the same period.

How do you choose one to invest in?

There are key metrics that can be used to evaluate any dividend stock. Financial advisers suggest you look at its dividend yield, which is calculated by dividing the annual dividend per share by the share price. The yield measures how much income investors receive for each dollar invested in the stock.

A high yield isn’t always a good thing, however—sometimes it is the result of a falling stock price. So, you also need to look at the stock’s underlying fundamentals.

But above all, you want to make sure that the company has a strong balance sheet and that its prospects for earnings-per-share growth are strong. That is a sign that the company will be able to maintain its dividend payments in the future.

“The dividend payout ratio is a good indicator of a company’s dividend track record,” says Andrew Crowell, financial adviser and vice chairman of wealth management at D.A. Davidson. “It is the ratio of the total amount of dividends paid out to shareholders relative to the net income of the company.”

A range of 35% to 55% is considered healthy from an investor’s point of view and indicates the company has money left over to reinvest for growth, he says.

What are the common mistakes investors make?

The biggest mistake is assuming a stock with a high dividend yield is a good bet. As explained above, that isn’t always true as it could be the result of a falling stock price.

There may be a valid explanation for the stock drop, but investors need to understand and monitor the company’s fundamentals to be sure the company’s growth prospects are on track. High dividend yields also don’t mean much if they aren’t sustainable.

“High-yield stocks are potentially at risk of dividend reductions or suspensions as our economy decelerates,” says Mr. Frankenfield. “These companies are often called ‘melting ice cubes.’ ”

What type of dividend stocks have the best performance?

The best performers in terms of stock performance and yields are dividend growth stocks that have solid cash-generating businesses—and a long history of raising dividends. There are 64 companies in the S&P 500, known as dividend aristocrats, that have raised their dividends every year for the past 25 consecutive years. They are large-cap companies with solid cash-generating businesses, and they compose the S&P 500 Dividend Aristocrat Index.

Among them are International Business Machines Corp., IBM -0.13%▼ with a dividend yield of 5.12%; and Exxon Mobil Corp., XOM -0.35%▼ with a dividend yield of 3.68% as of Aug. 31.

“The annual dividend payout ratio for dividend aristocrats is 30% to 50%,” says Mr. Crowell. “This allows them to retain enough cash if business stalls, or the economy turns downward.”

What are the ways to invest in dividend stocks?

You can buy individual stocks, or you can buy a dividend-focused mutual fund or exchange-traded fund. The funds provide diversification across a basket of stocks in different industries.

According to Daniel Sotiroff, senior manager research analyst at Morningstar Inc., “many investors are leaving dividend mutual funds and turning to dividend ETFs because they have lower fees and better tax efficiency.” In the first eight months of 2022, $51.9 billion flowed into dividend ETFs, while $8.3 billion flowed out of dividend mutual funds, according to Morningstar.

Many of these funds have outperformed other segments of the market this year. The best performing dividend ETF so far this year is WisdomTree U.S. High Dividend Fund (DHS). It had a total return of 2.3% year-to-date through Aug. 31, Morningstar reports.

Can dividends be reinvested?

Yes. You can take your dividends in cash and use the funds to buy additional shares. Another option is to open a dividend reinvestment plan, known as a DRIP. With these plans, cash dividends are automatically reinvested to purchase more stock in the company. These vehicles use dollar-cost averaging and help investors accumulate more shares at a lower cost since there are no commissions or brokerage fees. You can set up a DRIP through the company itself or through a brokerage firm.

“Reinvesting dividends historically allows investors to outpace the S&P 500 with less volatility,” says Bryan Cannon, certified financial planner and chief executive officer of Cannon Advisors.

How is income from dividend stocks taxed?

How dividends are taxed depends on whether they are classified as qualified or nonqualified, based on certain IRS criteria, including how long the investor has held the stock. Other factors include your taxable income and the kind of account that holds the investment.

Qualified dividends are taxed at long-term capital-gains rates, which can be lower than ordinary income-tax rates in that they are capped at no more than 20%. Generally, dividends of common stocks of U.S. corporations and qualifying foreign corporations held by the investor for more than 60 days would “qualify” for the lower rate, says Mr. Cannon.

Income earners who fall in the lowest U.S. federal income brackets may end up not owing taxes on qualified dividends at all.

Nonqualified dividends, meanwhile, are taxed at ordinary income-tax rates, which can range from 10% to 37%, depending on an investor’s income level. Dividends that represent earnings (interest on invested assets) are typically nonqualified, says Tom O’Saben, director of tax content and government relations at the National Association of Tax Professionals. Examples include money-market earnings and real-estate-investment-trust income, he says.

Dividends on stocks held in retirement accounts such as traditional IRAs and 401(k)s aren’t subject to tax until funds are withdrawn. When withdrawn, they are taxed at regular income-tax rates, unless they are held in a qualified Roth IRA or Roth 401(k).

High-income taxpayers may also be subject to the net investment income tax of 3.8%. This surtax is levied on single filers with incomes of $200,000 or more and $250,000 for married people filing jointly, and $125,000 for married people filing separately.

GLOSSARY

Declaration date. The date a company announces it will be issuing a dividend in the future.

Ex-dividend date. The cutoff date on or after which purchasers of a stock won’t receive the next dividend payment.

Record date. The date a company makes final the list of shareholders who are eligible to receive the dividend payment. If you invest in the company’s shares after the record date, you won’t receive that dividend payment.

Payment date. The day the company credits dividends to shareholder accounts.

Dividend growth rate. The annualized average rate of increase in the dividends paid by a company. Growth rates can be based on any interval.

Dividend per share. The company’s total annual dividend payment divided by the total number of shares outstanding.

Dividend yield. A financial ratio that shows how much a company pays out in dividends each year relative to its share price.

Dividend payout ratio. The percentage of net income distributed to shareholders in the form of dividends.

Total return. The gain or loss generated from a stock, based on its price change and dividend payments.

Qualified dividend. A dividend that is taxed at capital-gains tax rates, rather than ordinary income-tax rates, because it meets certain IRS criteria, including how long the investor has held the stock. Capital-gains rates are 0%, 15% or 20%, depending on an investor’s income level.

Nonqualified dividend. A dividend that doesn’t meet IRS criteria for capital-gains tax treatment and is thus taxed at the investor’s ordinary income-tax rate, which can range from 10% to 37%, depending on income level.

Dividend rollover plan. A strategy in which an investor buys a dividend-paying stock shortly before its ex-dividend date and then sells shares after the dividend is paid, hoping to secure income.

Dividend reinvestment plan. A program that automatically uses the proceeds from dividend stocks to purchase more shares of the company.

Photo by Mathieu Stern on Unsplash