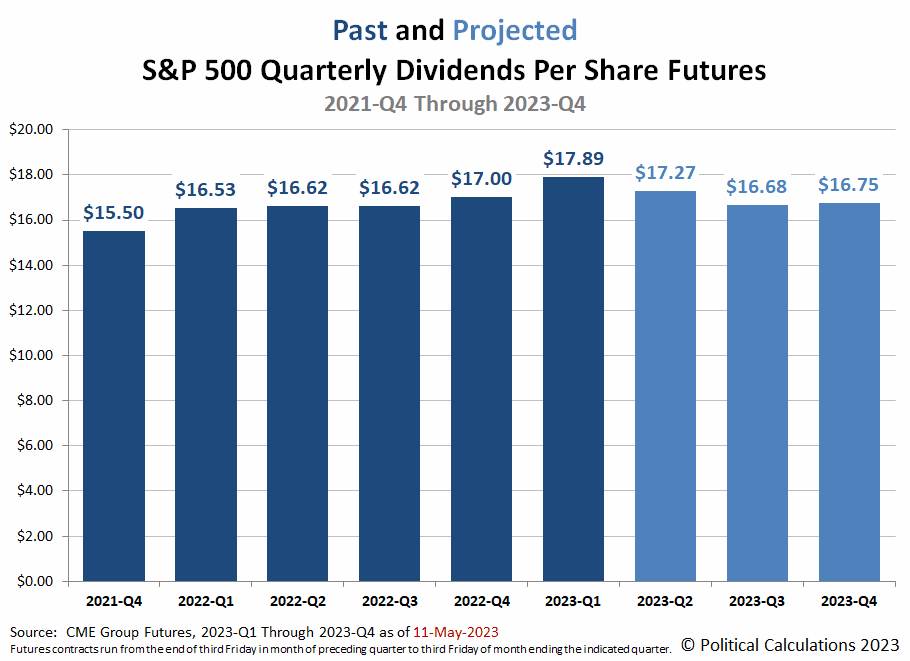

- After the Silicon Valley Bank run in the first quarter of 2023, dividend futures quickly collapsed.

- When we last presented 2023’s dividend futures, the dividends expected in 2023-Q4 had recovered to $16.41 per share as the risk of more bank failures appeared to be concentrated within a handful of regional banks.

- Starting from where we left off on 6 April 2023, 2023-Q4’s dividend futures continued to rise, eventually peaking at $16.95 on 24 April 2023.

After the Silicon Valley Bank run (OTC:SIVBQ

That collapse can best be seen in the CME Group’s quarterly dividend index futures for the S&P 500 (SPX

Since then, the outlook for 2023-Q4’s dividends has more sustainably improved. When we last presented 2023’s dividend futures, the dividends expected in 2023-Q4 had recovered to $16.41 per share as the risk of more bank failures appeared to be concentrated within a handful of regional banks.

Flash forward to today, the following animated chart covering the period from 6 April 2023 through 12 May 2023 reveals that recovery has continued, but has followed a rocky road.

Starting from where we left off on 6 April 2023, 2023-Q4’s dividend futures continued to rise, eventually peaking at $16.95 on 24 April 2023. But the specter of more bank failures returned with the First Republic Bank(OTCPK:FRCB

That mostly brings us up to date. Individually, the failures of Silicon Valley Bank, First Republic Bank, and Signature Bank (OTC:SBNY

The fifth largest bank failure in U.S. history occurred in August 2009 with the collapse of Colonial Bank, which held $20 billion in assets. 2023’s bank failures have so far been in a league of their own. It’s no wonder the prospects for more bank failures are weighing on the outlook for the S&P 500’s dividends.

Photo by Rifath @photoripey on Unsplash