Summary

- The energy sector has been the leading sector, and perhaps the only sector working for over a year.

- There is no greater source of free cash flow.

- Oil and gas companies are paying down debt, buying back shares and rewarding shareholders with generous dividends with accelerating payments.

- Many of the oil and gas companies have delivered 25%, 30% and 35% or more dividend increases in 2022.

The oil and gas sector has delivered incredible share price appreciation. That has only been outdone by the outrageous flow of dividends and special dividends. Currently there is no greater source of free cashflow, earnings and dividend growth. By way of oil and gas stocks, investors are treated to an inflation hedge that can also boost the total portfolio yield. Let’s have a look at the dividend growth for oil and gas stocks.

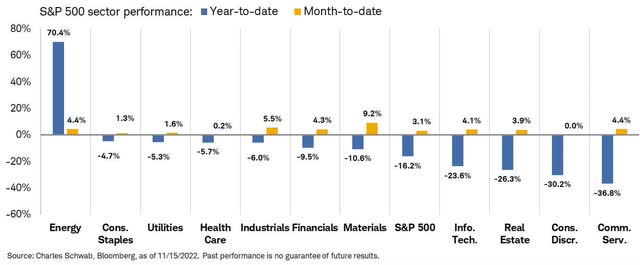

Once again, nothing has been working like oil and gas. In fact, it’s basically the only thing working. Here’s the sector returns to October 15, 2022.

The Canadian oil and gas sector is also up about 70% in 2022. The Canadian energy (oil and gas) sector is up 335% over the last two years. I put Canadian oil and gas stocks on the table in October of 2020. I harvested some wonderful capital gains and then moved to an energy dividend approach, given that I am in semi-retirement.

The oil and gas stocks can provide a robust inflation hedge. The sub sector was part of the all-weather stock portfolio for retirees. We can arrange certain kinds of stocks for economic conditions. Of course the idea with an all-weather portfolio is to have assets that will work in each of the possible economic conditions. To those who follow historical asset returns and economic regimes, it is no surprise that the oil and gas sector is the only thing working in 2022.

My readers were not caught off-guard.

The Canadian oil and gas dividend portfolio

I built around a core of the larger cap oil and gas plays. In early November, Canadian Natural Resources (CNQ) (CNQ:CA

One might suggest they have more free cashflow than they know what to do with. But they DO know what to do. Hand it over to shareholders.

Another one of the biggies in Canada, Suncor (SU) (SU:CA

If we want to consider the Big 3 in Canada, we will also include Imperial Oil (IMO) (IMO:CA

Cash bonanza, indeed.

Tourmaline joins the Big 3

I would also include Tourmaline (OTCPK:TRMLF) (TOU:CA

Here’s the recent dividend history for Tourmaline.

| Announce | Pay | ||

| 2022-12-14 | 2022-12-30 | $0.25 | 11.11% |

| 2022-11-08 | 2022-11-18 | $2.25 | Special dividend |

| 2022-09-14 | 2022-09-29 | $0.225 | |

| 2022-08-04 | 2022-08-12 | $2.00 | Special dividend |

| 2022-06-14 | 2022-06-30 | $0.225 | 12.50% |

| 2022-05-11 | 2022-05-19 | $1.50 | Special dividend |

| 2022-03-14 | 2022-03-31 | $0.20 | 11.11% |

| 2022-01-24 | 2022-02-01 | $1.25 | Special dividend |

Again, more ridiculousness.

I hold the above 4 stocks. I also own Birchcliff Energy (OTCPK:BIREF) (BIR:CA

Birchcliff doubled the dividend to 0.01 in early 2022. The dividend was doubled to 0.02 in June. I bought Birchcliff well in advance of the special dividends. The company had pre-announced their intention to reward shareholders with generous special dividends. From that Seeking Alpha post.

Birchcliff also declared a special cash dividend of $0.20/share and said it expects to show a cash surplus at the end of Q1 2023 after paying the dividend.

That special dividend was paid on October 28th.

Freehold Royalties increased its dividend by 33.3% in March and then added another increase of 12.5% in August.

Pine Cliff Energy introduced a dividend in June of 2022. A 20.5% dividend boost was offered in August.

The starting yields

If you were to pick up the stocks in mid November 2022, here are the yields. This does not include special dividends.

| Company | Starting Yield |

| Canadian Natural Resources | 4.1% |

| Suncor | 3.86% |

| Imperial Oil | 2.34% |

| Tourmaline | 1.25% |

| Birchcliff Energy | 0.74% |

| Freehold Royalties | 6.3% |

| Pine Cliff Energy | 7.1% |

Energy investors looking for dividends might also take a look at Whitecap (OTCPK:SPGYF) (WCP:CA

I am more than happy with my energy dividends and energy performance, it is giving the portfolio a nice boost in 2022. Those stocks work well with my Canadian Wide Moat 7 that includes pipelines. I have some nice inflation protection and very generous yield. My Canadian moat and energy stock combo has delivered over 8% total returns of the last year, with a generous and growing dividend stream.

I also hold the Ninepoint Energy Income Fund that holds Canadian and U.S. oil and gas stocks. The fund collects dividends and writes covered calls. The income is increasing wonderfully and the fund manager Eric Nuttall suggests there is much more to come. The mispricing of energy stocks creates opportunity for a skilled fund manager.

The U.S. oil and gas dividends

Of course, there is incredible opportunity in the U.S oil and gas sector as well. You can see from that index ETF link that the space offers a solid 3.25% yield that is growing fast. The dividend has seen a 20.6% boost in 2022.

Investors might build around the biggies such as the highly-rated Exxon Mobil (XOM

Check out the Top Oil and Gas Exploration Stocks on Seeking Alpha.

Know where to hold them

U.S. investors should be aware of withholding taxes for Canadian listed stocks. Be sure to check out the tax implications for U.S. investors owning Canadian stocks.

And here’s a note from Freehold Royalties on their tax treatment.

Non-Resident Tax

Shareholders who are not residents of Canada for income tax purposes are encouraged to seek advice from a qualified tax advisor in their country of residence regarding the tax treatment of dividends.

Non-Resident Withholding Tax

Dividends paid or payable to non-residents of Canada are subject, on the date of payment, to a withholding tax of 25%, as prescribed by the Income Tax Act (Canada). This withholding tax may be reduced in accordance with reciprocal tax treaties. In the cast of the Tax Treaty between Canada and the U.S., the withholding tax for U.S. residents is prescribed at 15%.

U.S. Residents

The majority of Freehold’s revenue is derived from non-operated royalty interests. Based on the nature of our assets, our dividends are not “qualified dividends” for U.S. tax purposes.

In consultation with its U.S. tax advisors, Freehold believes that it should be classified as a passive foreign investment company (“PFIC”) under U.S. federal income tax principles. As such, dividends are subject to the provisions of U.S. federal income taxation applicable to PFICs.