Summary

- PepsiCo just became a member of the ultra-prestige Dividend King club as it paid out its 50th annual dividend increase to investors.

- PepsiCo has been an outstanding value creator for shareholders as it paid $46.69 per share in dividends since June 1996 and appreciated by 400%.

- I want to be a shareholder of PEP, but its valuation is too rich for a profitability methodology, so it has gone on the dividend watchlist as I wait for a better entry.

On 6/30/22, a new Dividend King was crowned as PepsiCo (NASDAQ:PEP) paid its first quarterly dividend of $1.15, marking its 50th consecutive annual dividend increase. Out of all of the publicly traded companies, only 45 have earned the title of Dividend King. To be considered a Dividend King, a company must have 50 or more consecutive years of dividend increases. When I think about an undeniable track record, 50 years fits the mold. For half a century, PEP has increased its dividend to shareholders on an annual basis, which means its business has needed to thrive and generate additional revenue and EPS to support its dividend growth. Many investors like dividend-paying companies because they tend to be more stable as years of financial projections, must be accurate to consider paying out a portion of its earnings to shareholders in the form of a dividend.

The markets were just rocked by Jerome Powell’s speech from Jackson Hole as the S&P 500 dropped -141.46 (-3.37%) on Friday, 8/26, while the Nasdaq declined by -497.56 (-3.94%). As rock bottom rates leading to what has been considered free money becomes a distant memory, companies like PEP continue to become more attractive. Regardless of the economic environment or political climate, does anyone see PEP disappearing? Companies such as PEP are a staple throughout society as there is a good chance one of its brands can be found in every home across the country.

A New Dividend King Has Been Crowned

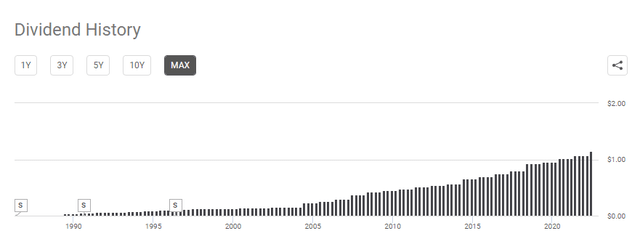

50 years is a long track record for anything, especially paying dividends to shareholders. The last time PEP split its shares was on 5/28/96, as it conducted a 2/1 split. In June of 96, shares of PEP traded for roughly $35. For every share you had purchased, you would have collected 105 quarterly dividends amounting to $46.69 per share, and your shares would have appreciated by $140.04 or 400.11%. Yes, 26 years is a long time to hold an investment, but when you think about it, PEP has generated fantastic returns for its shareholders. It may not be the most exciting stock in the world, but over the past 26 years, it’s generated 133.4% of its share value in dividends while appreciating by 400%.

Today, PEP has grown into a company that pays $4.60 per share in an annual dividend. This is a forward yield of 2.63%. PEP has generated $6.68 of EPS per share in EPS over the Trailing Twelve Months (TTM), placing its payout ratio at 68.86% of its EPS. PEP has provided shareholders with a 5-year dividend growth rate of 7.39%. PEP can be classified as both a Dividend King and dividend growth stock as it fits the criteria for both premises.

Anyone looking for income in their portfolio could find a place for PEP. An S&P index fund which I use the SPDR S&P 500 Trust (SPY) as my example yields 1.56%. Vanguard has created the Vanguard Dividend Appreciation ETF (VIG), which yields 1.84%, and PEP can be found as the 10th largest holding. ProShares has created an ETF dedicated to Dividend Aristocrats. Dividend Aristocrats have increased their dividend annually for a minimum of 25 years. The ProShares S&P 500 Dividend Aristocrat ETF (NOBL) has a dividend yield of 1.72%. PEP has proven to be a stable company that has grown its revenue, EPS, and its dividend over an extended period of time. Its yield surpasses many different types of ETFs, some focused on dividend growth, and its yield is almost double what you can find in the S&P. From a dividend perspective, PEP’s dividend is of the highest quality and could be a solid addition to any income portfolio.

A Dividend King Has Been Crowned, But I Am Staying On The Sidelines

There is no question that PEP is one of the highest quality companies in the world and that its products will be loved by consumers for decades to come. I want to add PEP to my income portfolio, but I am having an issue with its valuation. PEP looks attractive from a price-to-sales and price-to-earnings ratio, especially compared to The Coca-Cola Company (KO). PEP trades at a P/S ratio of 2.96x compared to KO’s 6.61x and trades at a 26.36 P/E compared to a P/E of 28.69 for KO. I don’t think paying 26.36x earnings is unreasonable for a company of PEP’s stature. From these metrics, PEP looks like a buy, especially with what seems like extended volatility circling the markets.

| Price to Earnings | |||

| Ticker | Market Value Per Share | Earnings Per Share | P/E Ratio |

| KO | $63.11 | $2.20 | 28.69 |

| PEP | $175.04 | $6.64 | 26.36 |

| Price to Sales | |||

| Ticker | Market Value Per Share | Revenue Per Share | P/S Ratio |

| KO | $63.11 | $9.55 | 6.61 |

| PEP | $175.04 | $59.19 | 2.96 |

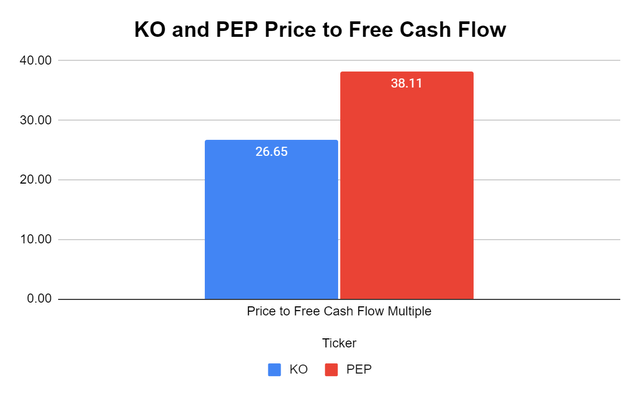

My issue with PEP is the valuation I would be paying for its profitability on a net income and free cash flow (FCF) basis. In the TTM, PEP has generated $11.16 billion in cash from operations and spent $4.82 billion on CapEx, placing its FCF at $6.34 billion. PEP is currently trading at a 38.11x FCF multiple as its market cap is $241.57 billion. Any value investors consider 20x FCF value territory, while I have a personal range of 18-26x FCF depending on the industry. KO is trading at 26.65x its FCF. KO has generated $11.65 billion in cash from operations and sent $1.4 billion in CapEx in the TTM, placing its FCF at $10.24 billion. While shares of PEP look to have a larger value proposition than KO on a P/S and P/E basis, the story changes when I start looking at overall profitability.

From a net income perspective, KO and PEP generate almost the same level of profits as KO has net income of $9.57 billion over the TTM, and PEP has generated $9.24 billion. PEP has almost double the amount of revenue produced as it generated $81.86 billion in revenue compared to $41.32 billion from KO. KO has a profit margin of 23.16%, while PEP’s profit margin is 11.28%. This is critical for me because it indicates that KO is much better at allocating capital to drive dollars to its bottom line. KO is focusing on high-margin profitability items rather than expanding into low-profit sectors. I think both companies have the ability to expand their businesses in the future, but as each company grows, KO should do a better job of operating at higher margins and increasing its FCF and net income.

| Net Income Conversion Ratio (TTM) | |||

| Ticker | Total Revenue | Net Income | Profit Margin |

| KO | $41,322,000,000.00 | $9,571,000,000.00 | 23.16% |

| PEP | $81,862,000,000.00 | $9,236,000,000.00 | 11.28% |

Conclusion

I want PEP to find a place inside my income portfolio, but its valuation is just too high at the moment. If Jerome Powell’s hawkish speech that rocked the markets on Friday continues to eat away at the market’s recovery, there will be better opportunities to add quality names to portfolios. PEP is an outstanding company that generates billions in FCF and net income. After 50 years of annual dividend increases, it’s hard to dispute PEP’s track record. I have added PEP to my dividend watch list and will be looking to add this name to my portfolio in the future.

I think PEP is a strong hold if you own it. I can’t think of a reason to sell if you’re a long-term investor. PEP has generated tremendous appreciation over the years while paying a solid dividend. For me to start a position, I would like to see PEP’s share price decline causing the valuation to become more attractive. I may be looking at this too conservatively, but I would want to see a decline of -25.49%, which would place PEP’s market cap at $175.04 billion. PEP would trade at 27.62x FCF at this level, putting its share price at $126.83 and its dividend yield at 3.63%. This could be wishful thinking, but at the moment, I would rather add to my position in KO than start a position in PEP as to how KO trades vs. its profitability.

Photo by Ja San Miguel on Unsplash