A majority of the top 10 dividend-yielding names are undervalued.

Mentioned: Gilead Sciences Inc (GILD), Altria Group Inc (MO), Archer-Daniels Midland Co (ADM), Verizon Communications Inc (VZ), T-Mobile US Inc (TMUS), DISH Network Corp (DISH), AT&T Inc (T), APA Corp (APA), Koninklijke Philips NV (PHG)

As you may recall from our previous dividend-themed articles, when we screen for top dividend-paying stocks among the holdings of our Ultimate Stock-Pickers we try to find the highest-quality names that are currently held with conviction by our top managers. We do this by taking an initial list of the dividend-paying stocks held in the portfolios of our Ultimate Stock-Pickers and then narrow it down by concentrating on firms that we believe have sustainable competitive advantages that should allow them to generate the excess returns necessary to maintain their dividends over the longer term. We also look for firms where there is lower uncertainty on our analysts’ part regarding their future cash flows. We accomplish this by screening for holdings that are widely held (by five or more of our top managers), are yielding more than the S&P 500, have wide or narrow economic moats, and have uncertainty ratings of either low or medium.

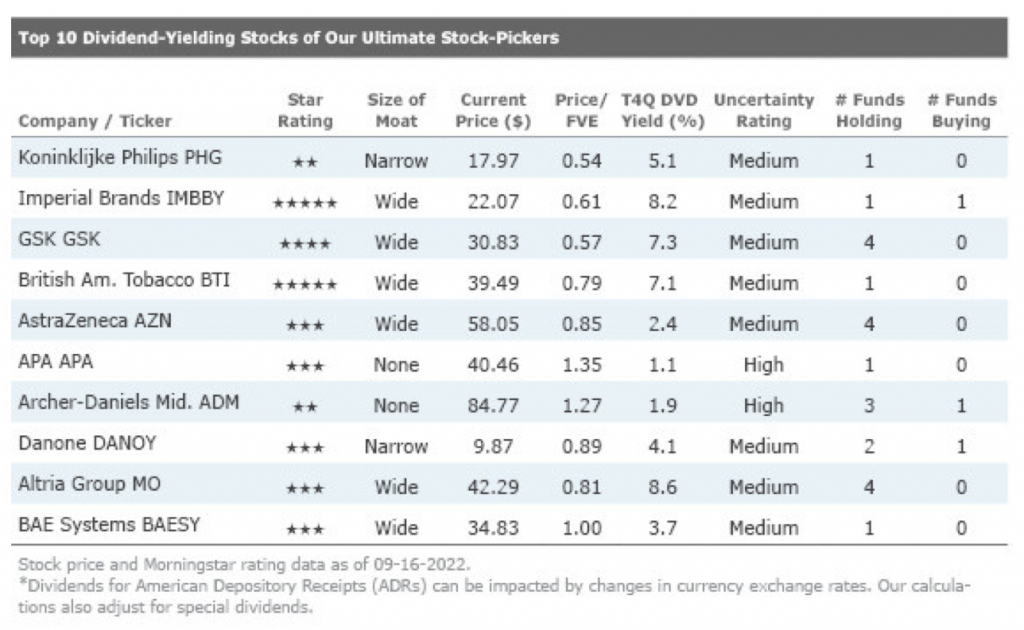

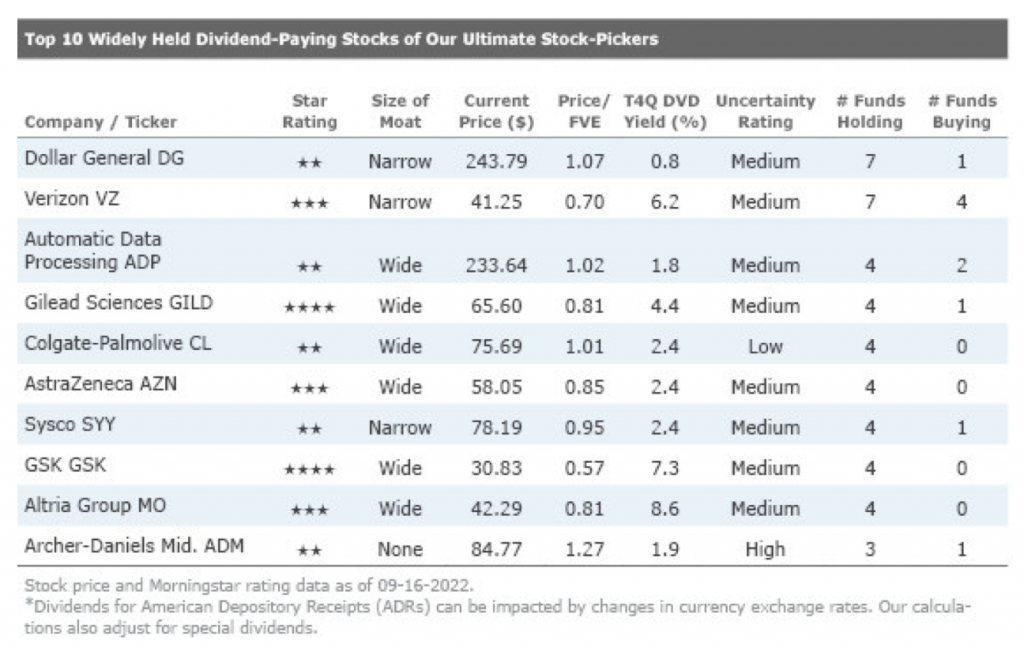

Once our filtering process is complete, we create two different tables—one that reflects the top 10 stocks with the highest dividend yields and another that lists stocks that are widely held by our Ultimate Stock-Pickers and pay dividends in excess of the S&P 500, which is currently yielding 1.69% as of September 2022. We note that the dividend yield calculations in each of our two tables are based on regular dividends that have been declared during the past 12 months and do not include the impact of any special (or supplemental) dividends that may have been paid out (or declared) during that time.

Looking back to our list of top 10 dividend-yielding stocks from last time around, we note that the new list is mainly composed of names that were not present on the list that we published in March 2022, aside from Altria Group (MO) and GSK PLC (GSK). New names include Koninklijke Philips (PHG), Imperial Brands (IMBBY), British American Tobacco (BTI), AstraZeneca (AZN), APA (APA), Archer-Daniels Midland (ADM), Danone (DANOY), and BAE Systems (BAESY).

In the last edition of the Ultimate Stock-Pickers article discussing dividend yielding stocks, we noted the recovery of the global economy from the COVID-19-induced demand slowdowns. Given the recent volatility in the stock market, based on our aggregate price to fair value estimates, we view the majority of sectors as undervalued today, with investors still focused on “pandemic-proof” sectors, such as healthcare and consumer defensive.

Searching for yield in this type of environment can be risky. Price risk remains elevated as does the risk that companies may not be able to sustainably maintain current dividends due to economic strain. Although the market has recovered as the pandemic has waned, the majority of the stocks on our dividend-yielding list remain undervalued. Most notably, wide-moat GSK and narrow-moat Koninklijke Philips are trading at over a 40% discount to fair value. The average price to fair value estimate for the top dividend-yielding stocks was 0.9, indicating that we view these high-yielding stocks as currently undervalued. The top 10 dividend-yielding stocks are overweight in the consumer defensive sector, which contributed five names to the top 10 list. The mix is similar for our top 10 widely held dividend-paying stocks list, which includes five consumer defensive stocks, three healthcare stocks, one communication services stock, and one industrials stock.

Looking more closely at the two lists, Altria Group, Archer-Daniels Midland, AstraZeneca, and GSK appeared on both top 10 lists.

Interestingly, all the top 10 widely held securities were held by three or more funds. This period’s list of widely held dividend-paying stocks was less undervalued than the top dividend-paying stocks. Five of the 10 stocks were materially undervalued, while four were fairly valued, and one was trading at a premium.

We continue to believe that the best way for investors to protect their capital is to invest in quality businesses that are trading at attractive prices. Our valuation shows that wide-moat-rated GSK is trading at a significant discount to fair value, so we will focus on it in this edition of Ultimate Stock-Pickers. We also highlight wide-moat-rated Gilead Sciences and narrow-moat-rated Verizon Communications.

GSK

Wide-moat-rated GSK currently trades at a 43% discount to Morningstar analyst Damien Conover’s $50 fair value estimate. In the pharmaceutical industry, GSK ranks as one of the largest firms by total sales. The company wields its might across several therapeutic classes, including respiratory, cancer, and antiviral, as well as vaccines. GSK uses joint ventures to gain additional scale in certain markets like HIV.

The magnitude of GSK’s reach is evidenced by a product portfolio that spans several therapeutic classes. The diverse platform insulates the company from problems with any single product. Additionally, the company has developed next-generation drugs in respiratory and HIV areas that should help mitigate both branded and generic competition. We expect GSK to be a major competitor in respiratory, HIV, and vaccines over the next decade.

On the pipeline front, GSK has shifted from its historical strategy of targeting slight enhancements toward true innovation. It is also focusing more on oncology and immune system, with genetic data to help develop the next generation of drugs. The benefits of these strategies are showing up in GSK’s early-stage drugs. We expect this focus will improve approval rates and pricing power. In contrast to respiratory drugs, treatments for cancer indications carry much stronger pricing power with payers.

From a geographic standpoint, GSK is strategically branching out from developed markets into emerging markets. Its vaccine segment positions the firm well in these price-sensitive markets. While this strategy is likely to create some challenges, like the potential legal violations that arose in early 2013 in China, we believe the fast-growing emerging markets will help support long-term growth and diversify cash flows beyond developed markets.

Patents, economies of scale, and a powerful distribution network support GSK’s wide moat. GSK’s patent-protected drugs carry strong pricing power, which enables the firm to generate returns on invested capital in excess of its cost of capital. Further, the patents give the company time to develop the next generation of drugs before generic competition arises. While GSK holds a diversified product portfolio, there is some product concentration with its largest drug, Triumeq (for HIV), representing close to 10% of total sales, but we expect new products will mitigate the generic competition that likely won’t emerge until 2027 or later. Also, GSK’s operating structure allows for cost-cutting following patent losses to reduce the margin pressure from lost high-margin drug sales. Overall, GSK’s established product line creates the enormous cash flows needed to fund the average $800 million in development costs per new drug.

Gilead Sciences

Wide-moat-rated Gilead Sciences currently trades at a 19% discount to Morningstar analyst Karen Andersen’s $77 fair value estimate. Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. The acquisitions of Corus Pharma, Myogen, CV Therapeutics, Arresto Biosciences, and Calistoga have broadened this focus to include pulmonary and cardiovascular diseases and cancer. Gilead’s acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of combination drug Harvoni, and the Kite, Forty Seven, and Immunomedics acquisitions boost Gilead’s exposure to cell therapy and noncell therapy in oncology. Gilead Sciences generates stellar profit margins with its HIV and HCV portfolio, which requires only a small salesforce and inexpensive manufacturing. We think its portfolio and pipeline support a wide moat, but Gilead needs HCV market stabilization, strong continued innovation in HIV, solid pipeline data, and smart future acquisitions to return to growth.

Gilead is building a pipeline outside of HIV and HCV through acquisitions. The acquisition of Kite (CAR-T therapy Yescarta) has brought only slow sales growth, but the 2020 acquisitions of Forty Seven (CD47 antibody magrolimab) and Immunomedics (breast cancer drug Trodelvy) add to the oncology pipeline. Lead NASH program selonsertib failed in a phase 3 trial, but Gilead is exploring combination therapy with other mechanisms in NASH. Gilead’s Veklury is also a leading treatment for SARS-CoV-2; it generated $5.6 billion in sales in 2021, although sales are poised to decline in 2022.

We assign Gilead a wide economic moat rating. We think patent protection on newer HIV regimens and Gilead’s continued dominance in the hepatitis C market will be enough to ensure strong returns for the next couple of decades. Gilead’s expertise in infectious diseases and single-pill formulations is a part of its research and development strategy, which we see as one of the strongest intangible assets supporting the firm’s wide moat. We think the firm does face environmental, social, and governance risks, particularly related to potential U.S. drug price-related policy reform (Gilead sees more than 70% of its sales from the U.S. pharmaceutical market) and ongoing potential for product governance issues (including litigation). While we have factored these threats into our analysis, we don’t see them as material to our valuation or moat rating.

Gilead’s moat was formed by its leadership position in the treatment of HIV, with patented products that form the backbone of today’s treatment regimens. Despite numerous competitors, the company has established leading market share and spectacular profitability with its convenient, effective, and safe treatments. Gilead serves 80% of treated HIV patients in the United States. Management has done an excellent job of maximizing sales of the TDF molecule, which is present in Viread, Truvada, Atripla, Complera, and Stribild. That said, key patents are beginning to expire in Europe, and next-generation products could struggle to provide sufficient differentiation for reimbursement in all key markets.

Verizon Communications

Narrow-moat-rated Verizon Communications currently trades at approximately a 30% premium to Morningstar analyst Michael Hodel’s fair value estimate of $59. Verizon is primarily a wireless business (nearly 80% of revenue and nearly all operating income). It serves about 93 million postpaid and 23 million prepaid phone customers (following the acquisition of Tracfone) via its nationwide network, making it the largest U.S. wireless carrier. Fixed-line telecom operations include local networks in the northeast, which reach about 25 million homes and businesses, and nationwide enterprise services.

While Verizon is primarily focused on the wireless business, where the firm has taken steps to ensure it remains well positioned in the traditional wireless business, building fiber deeper into major metro areas, acquiring a huge chunk of spectrum in 2021 and ramping up spending to put that spectrum to use. We believe Verizon will deliver consistent results over the long term, but growth will likely be modest. Rivals AT&T (T) and T-Mobile (TMUS) offer comparable services and sell at similar prices, which we expect will diminish Verizon’s market share lead over time.

Verizon has long prided itself on network quality, investing consistently in both wireless and fixed-line technology. The firm has built its brand reputation around these networks, attracting a large and loyal customer base. In the wireless business, the firm holds roughly 40% of the U.S. postpaid phone market, about one third greater than either AT&T or T-Mobile. Leading scale enables Verizon to generate the highest margins and returns on capital in the industry, despite heavy investment. The merger of T-Mobile and Sprint has also improved the industry’s structure, leaving three players with little incentive to price irrationally in search of short-term market share gains. We believe Dish Network (DISH), which plans to become the fourth nationwide carrier, is too small to have much impact.

Verizon’s moat stems from cost advantages in its wireless business and the industry’s efficient scale characteristics. Verizon has reorganized its business along customer lines, but we still believe the firm is best understood along wireless and fixed-line dimensions. The wireless business produces about 70% of total revenue and accounts for a similar portion of invested capital but contributes nearly all of Verizon’s profits. Verizon’s restructuring has made it difficult to parse returns on capital, but we have pegged its wireless returns on invested capital at about 16%, or about 18% excluding goodwill prior to 2021. With heavy investment to acquire additional spectrum in the C-band auction, we estimate wireless returns on capital declined 3-4 percentage points last year, still leaving Verizon ahead of its cost of capital.

Photo by Ishant Mishra on Unsplash