Summary

- The news is often structurally designed to make you lose money.

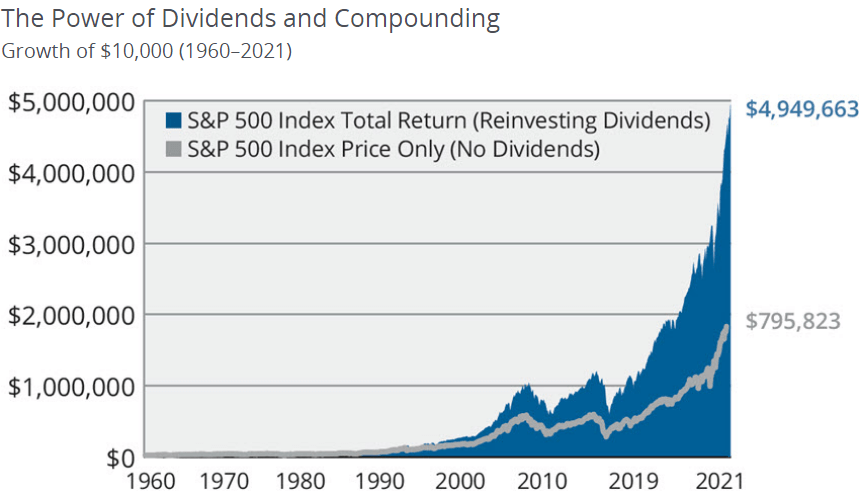

- Still looking for proof that dividends are resilient? Look at the dividend rain in the global markets.

- No charts, no patterns, no stressful market timing, HDO is building passive income in every market cycle while enjoying our golden years.

Your portfolio represents your future, so it’s only natural to want to monitor how your investments are doing. How often do you check your portfolio?

In the short term the stock market behaves like a voting machine, but in the long term it acts as a weighing machine. – Warren Buffett

The financial markets have frequent periods of high volatility, driven by various parameters surrounding global economies. And Mr. Market has a fair share of panic attacks during those times that make the weekday 9:30 am-4 pm ET a roller coaster for faint-hearted investors. The question is, do you take action based on the price swings or the earnings reports provided by the company? The former may make you a good trader; the latter is the quality of a good investor. What you want in life should dictate your approach to the financial markets.

What is Most Important in Life?

Since you are reading this article, it is safe to assume you are here to make money. But is money the ultimate objective of your life?

Life is short. Focus on what matters and let go of what doesn’t.

The truth is that some of the most precious commodities can’t be found at the bank and can’t be ordered online. While I am not a life coach, I can confidently say that the following are among the true assets of every human.

Time – This parameter is finite in our lives. Even the wealthiest person cannot buy one more second in their day.

Health – Good health is a prerequisite to a happy retirement. The 91-year-old Oracle of Omaha advises youngsters to prioritize their physical and mental health, as the human body is irreplaceable, and you only get one shot at taking good care of it.

You only get one mind and one body. And it’s got to last a lifetime. But if you don’t take care of that mind and that body, they’ll be a wreck 40 years later… it’s what you do right now, today, that determines how your mind and body will operate 10, 20, and 30 years from now. – Warren Buffett

Relationships – Our relationships are our bedrock, our foundation. We need to nurture them with the love and attention they deserve.

And guess what, money is known to wreck all three essentials discussed above. To have adequate time and energy to care for your health and invest in your relationships, your sources of income should be passive and recurring.

Investing for “Passive” Income

We approach the financial markets as net buyers of passive income. We are not trying to time the market to buy the bottom and sell the top. Our approach doesn’t involve staring at stock charts with multiple screens and setting stop-loss and stop-limit orders to navigate the trading cycles.

It has always struck me as like having a house that you like, and you’re living in, and, you know, it’s worth $100,000 and you tell your broker, ‘You know, if anybody ever comes along and offers $90 [thousand], you want to sell it.’ – Warren Buffett

We follow a more repeatable and reliable method of producing returns through dividends paid by high-quality companies. When fear rules the market, we buy hand over fist to augment our income stream. These stocks may not be the coolest kids on the block, but they do the job pretty darn well. Dividend stocks are like the Volvos of the investing world. They’re not fancy at first glance, but they have a lot going for them when examined deeper under the hood. Slowly but steadily, they have the potential to produce market-beating returns.

A well-diversified portfolio produces income during bull and bear markets and immunizes your financial position from market volatility. In fact, it incentivizes me to reinvest dividends to automate the growth of my passive income and lets me stay calm when the seas are rough.

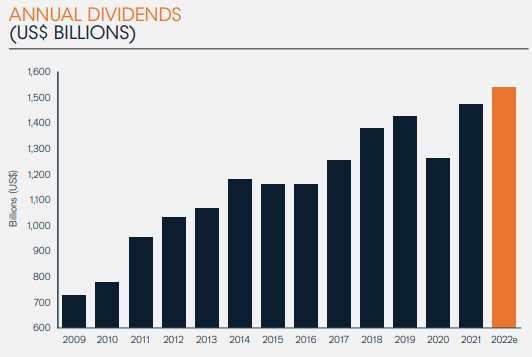

It is Actually Raining Dividends

Look no further if you need proof that dividends are rewarding during good and bad times. Dividend payments in the U.S. rose 10.4% on an underlying basis to a new record of $141.6 billion during Q1 2022. Nearly every U.S. company in the Janus Henderson Global Dividend Index increased their payments or held them steady. In Q2, the S&P 500 cash dividends were up 14.1% YoY, setting a quarterly record. While the market sentiment is bearish, we see records being set in the dividend world. Analysts project this trend to continue for the rest of the year.

In the past five years, the world’s five most critical dividend-paying sectors have been banks, oil producers, pharmaceuticals, telecoms, and insurance companies. At High Dividend Opportunities, we invest in these shareholder-friendly sectors in various ways to produce reliable retirement income.

The HDO model portfolio comprises 45+ securities for steady and dependable income and has seen several dividend hikes through this bear market. We invest in several CEFs (Closed-End Funds), BDCs (Business Development Companies), REITs, MLPs, mineral royalties, midstream corporations, and wide-moat businesses in the telecom and pharmaceutical sectors. PIMCO Dynamic Income Opportunities Fund’s (PDO) 8% distribution increase, America First Multifamily Investors’ (ATAX) 12% raise, and Dorchester Minerals’ (DMLP) whopping ~29% raise are just a few examples of our growing portfolio income. We are winning this retirement battle against inflation without fear or anxiety about the news headlines, and you can do this too.

Gambling is Not a Retirement Plan

The markets today are not for the faint-hearted. We continue to see several pump-and-dump schemes, the meme stock frenzy, and investment thesis developed based on the theory of short squeezes. This method of gambling with your money benefits some big players.

Wall Street makes money, one way or another, catching the crumbs that fall off the table of capitalism. They don’t make money unless people do things, and they get a piece of them. They make a lot more money when people are gambling than when they are investing. – Warren Buffett

In other words, Wall Street loves chaos, and there is no better chaos generator than continuous commentary about uncertainties, recessions, and forecasts of the worst possible outcome. Remember that no one can predict economic parameters, and anyone trying to is gambling.

Nobody can predict interest rates, the future direction of the economy, or the stock market. Dismiss all such forecasts & concentrate on what’s happening to the companies you’ve invested in. – Peter Lynch

We have some analysts warning us about a brutal recession, and others say the market has already bottomed in June. If you are using the news to inform your investment decisions, you are most likely letting big Wall Street firms take your money. Don’t gamble away your retirement savings – hard cash from dividends is how you can win in this bear market.

Conclusion

There are many ways of making money. Several professions today were unheard of just ten years ago. The internet has broken geographical barriers and increased avenues for entrepreneurs to pursue their strengths with attractive monetary incentives. But nothing beats the convenience of passive income; after all, who will say no to a paycheck sent to them on a quarterly (or monthly) basis for spending no time or doing any work?

Welcome to the income method. We believe in transforming our portfolio into a machine that produces steady paychecks. We diversify our assets across multiple securities that are structurally designed to pay large dividends to shareholders.

We may be in a bear market, but it has been raining dividends in my portfolio, and the intensity is set to increase. Grab a bucket before everyone realizes it.

Photo by Sophia Müller on Unsplash