- Energy Transfer is in value territory, trading at a single-digit P/E

- The dividend yield is well above average

- Strong insider buying & ownership offer an optimistic perspective

Some analysts argue that the oil sector is experiencing the tobacco market treatment in the 1990s. The public sentiment is negative, yet most are still consuming those products.

However, despite all the efforts and sustainability plans, global economies are still very much addicted to oil and natural gas – enabling companies like Energy Transfer LP (NYSE: ET) to pay out hefty dividends to their shareholders.

New Deals and Acquisitions

The company recently signed a 20-year agreement with Shell to supply 2.1M metric tons of liquified natural gas per year from its Lake Charles project in Louisiana. First deliveries are expected to begin as early as 2026.

Meanwhile, last month company signed an agreement to acquire Woodford Express, LLC – for approximately US$485m. This acquisition will provide 450 million cubic feet per day of cryogenic gas processing and treating capacity in Oklahoma, as well as more than 200 miles of low and mid-pressure gathering lines.

These assets are already integrated into Energy Transfer’s network that now includes nearly 120,000 miles of pipelines across 41 states in more or less every major production basin in the U.S. Remember, you can always get a snapshot of Energy Transfer’s latest financial position by checking our visualization of its financial health.

A Look into the Energy Transfer’s Dividend

Energy Transfer is an attractive stock from the dividend perspective, with a high yield and with an established history of dividend payments.

Here are the key takeaways from the dividend value, sustainability, and history perspectives:

The yield of 7.7% is strong, and it is higher than the industry’s average

The cash payout ratio is very sustainable at 42% – especially given the diversified structure of ET’s earnings

While the dividend was cut in 2020 amidst the energy price collapse, sluggish 10-year dividend growth is more concerning.

What About the Growth Prospects?

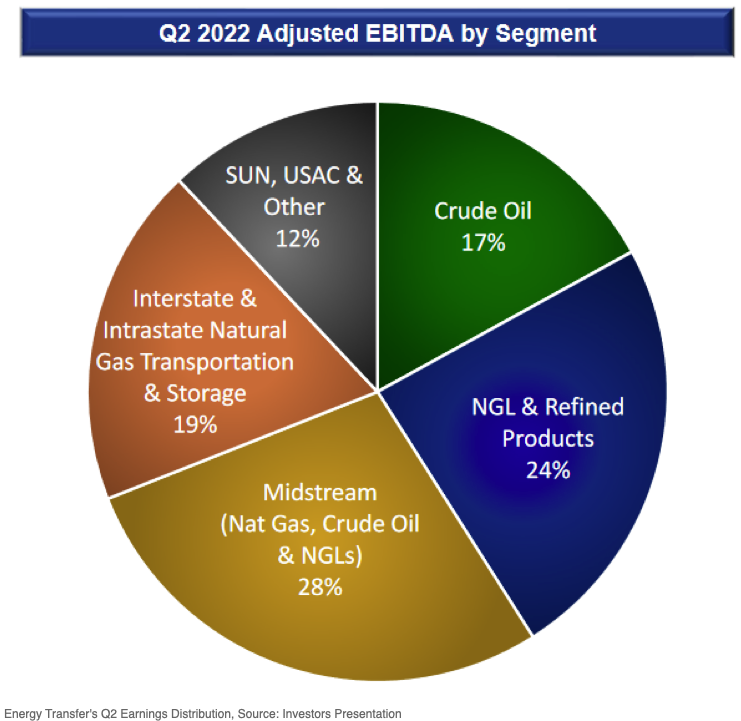

Energy Transfer looks deeply intertwined in the U.S energy network. It carries one-third of all crude oil and almost one-quarter of all natural gas in the U.S. Yet, it has rather diverse earnings, as shown by its adjusted EBITDA by segment. The majority of these earnings (90%) come from fixed-fee contracts.

Current expansions include:

Permian Basin processing expansion: Permian Bridge Pipeline, Grey Wolf and Bear Processing Plants

Oasis pipeline modernization: will add 60,000 mcf/d of takeaway capacity

Gulf Run pipeline project:135-mile interstate pipeline with an extended capacity of 1.65 bcf/d.

Orbit Pipeline JV: New ethane export terminal on the U.S Gulf Coast (joint venture with Satellite Petrochemical USA Corp to provide them with approx. 150k barrels per day of ethane).

Strong Insider Buying

According to our data, in the last 12 months, ET experienced only insider buying.

Since January 2021, insiders bought a total of 23.4 million shares totaling US$192m, bringing the total insider ownership to approx. 13%.

Conclusion

Energy Transfer is an exciting combination of a high yield at an attractive valuation. On top of it, the company is working on some interesting expansions and is deeply entrenched in the U.S as well as the global energy market. Finally, insiders have only been buying for the last 18 months.

With all combined, this produces a solid opportunity for all yield-seeking investors.

Photo by SELİM ARDA ERYILMAZ on Unsplash