As broader market averages (DJI

T is lower in 2022 by 5.5% which is roughly a quarter of the losses that major indices have seen. Meanwhile, the stock offers a forward dividend yield of 6%. So does AT&T represent a top dividend pick?

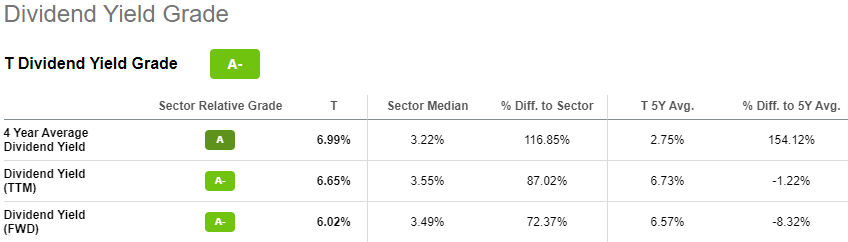

Dividend Yield:

AT&T (T

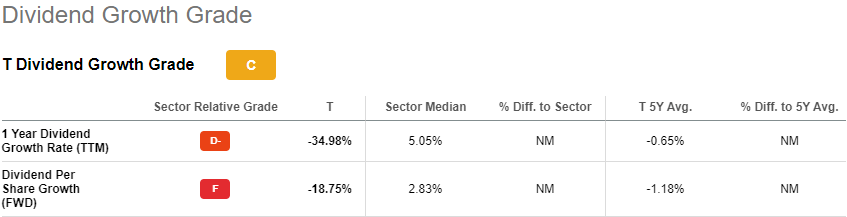

Dividend Growth:

While the firm has historically offered a strong payout to shareholders, T is not known for expanding its dividend dramatically over time. AT&T received a C- from Seeking Alpha’s Quant grades on this front. In addition, AT&T comes up significantly short when measured against the sector median for integrated telecommunication services stocks.

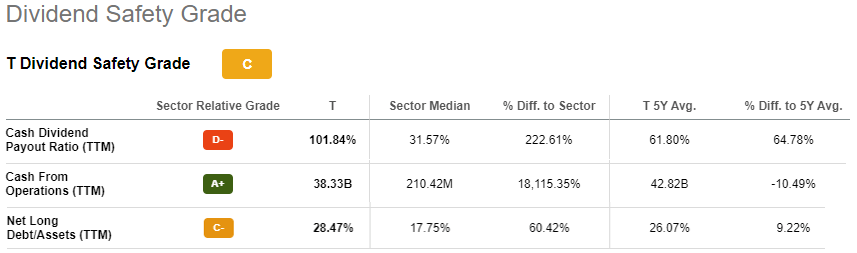

Dividend Safety:

AT&T’s dividend safety may not be as high as many investors would hope for but the result is still fairly solid. According to Seeking Alpha’s metrics the stock received a C for this key area of concern.

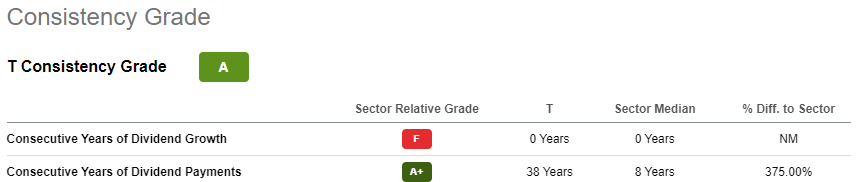

Dividend History:

While its dividend growth levels are lower than most, investors can depend that at the very least they will be sure to receive one. Seeking Alpha labeled AT&T with an A on its consistency to pay out dividends. On this measure, it has blown away the sector median for 30 years running.

What Others Say:

Looking beyond the company more broadly, Stone Fox Capital, a Seeking Alpha contributor, views AT&T as a Buy. The firm argued that “the wireless giant could become a huge cash flow machine again on a reduction of 5G capital spending in the sector.”

At the same time JR Research, another SA contributor, is a little more cautious about the stock, viewing it as a Hold. JR Research highlighted that AT&T’s Q3 earnings commentary calmed investors’ fears that it could miss its FY22 free cash flow guidance. But it also stated “Now is not the time to be greedy.”

Other Choices:

AT&T is not the only telecommunication stock that an investor can target. Other potential names in the sector include Verizon Communications (VZ

An investor can also diversify their approach to AT&T by looking into exchange traded funds.

AT&T sits inside of 256 ETFs, but the three largest weightings are held in the John Hancock Multifactor Media and Communications ETF (JHCS

Moreover, for dividend investors that are unsure of AT&T and are looking for broad exposure to the safety of dividends, there are many general dividend funds to consider. Look to ETFs such as (VIG