Summary

- Dividend investing is struggling in the current macroeconomic environment due to high interest rates.

- The yield on T-Bonds disincentivizes investors from buying dividend companies, leading to a drop in their performance.

- Exceptions to this trend include investments with a high dividend yield on cost, undervalued companies with potential for capital gains, and companies with rapid growth in earnings and dividends.

Dividend investing is a strategy adopted by many investors and has proven to be successful throughout history: obtaining both capital gains and dividends manages to reconcile both long-term and short-term goals. However, like any strategy, there are times when it works best and otherswhen it experiences some difficulties.

The macroeconomic environment has a great impact on the effectiveness of this strategy, and as we will see in this article, we are currently in one of the periods when dividend investing is struggling.

Interest rates discourage investment in dividend companies

Typically, those who invest in dividend companies hope that the dividend yield will be as high as possible, as long as it is sustainable and not detrimental to revenue growth. But when is a dividend yield considered high?

Based on different risk aversions, there are investors who consider a dividend yield of 3% high, while others look only at companies with a dividend yield of at least 6%. So, the first determinant is subjective and is the preferences of the individual investor.

However, there is a second determinant, which is objective and applies to any investor: the risk-free rate. No investor would consider a dividend yield of 6% high if the yield on the 10-year T-Bond was 10%. Why invest in something riskier and less profitable? With due proportion, what has just been described is what has been happening in recent months.

The yield on T-Bonds has often been around 5%, which is disincentivizing investors from buying almost any dividend company, even the best ones. In particular, I am referring to the consumer staples sector since it is filled with dividend companies.

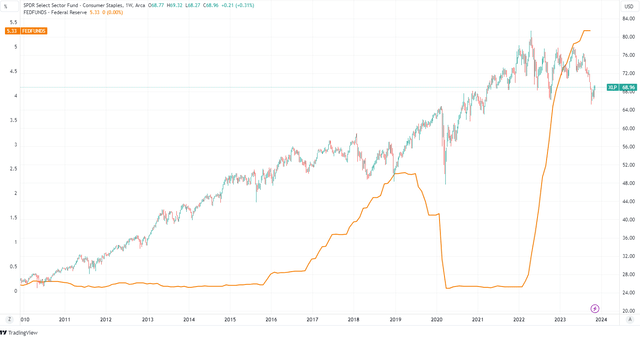

As we can see, historically, when rates are low investors tend to buy consumer staples (XLP

The YTD return of the XLP ETF was -7.15% while that of the S&P500 was 15.46%, so we are talking about two completely different performances. The same reasoning can be applied to other ETFs focused on high-dividend companies: for example, iShares Core High Dividend ETF (HDV

Going into more detail, well-known dividend companies are performing badly this year, despite 2023 being a bright year for the S&P 500 (SP500

At first glance they may seem like unjustified drops, but instead these performances make perfect sense. After all, why should I invest in Coca-Cola and get a dividend yield of 3.24% when 20-year T-Bonds yield 5%? Both in terms of risk and performance I am better off buying bonds.

Even assuming a company with a higher dividend yield, why should I settle for Realty Income’s 6.14% dividend yield if T-Bonds yield 5%? Certainly, the yield Realty Income offers is higher, but is it worth earning a spread of 1.14% to take on far greater risk? The answer to this question is given to us by the equity risk premium.

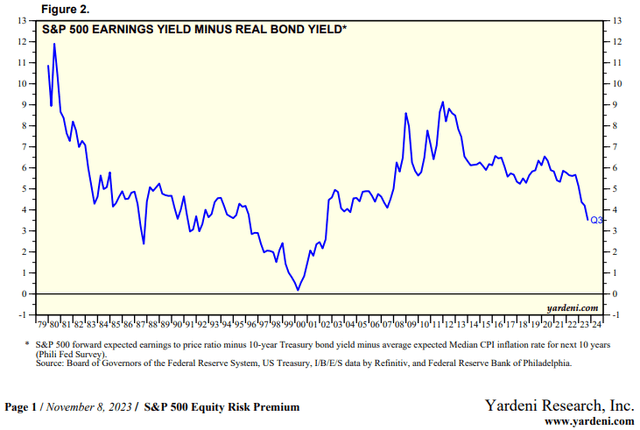

The equity risk premium represents the expected additional return of investing in stocks versus investing in risk-free bonds: it is a simple spread. Obviously, the outcome must be positive; after all, the additional risk of investing in the stock market needs to be rewarded.

Typically, the phases when the equity risk premium was higher coincided with the best times to invest in the stock market, vice versa when it was low. As you can see, today we are at the lowest in the last 20 years, so it is not recommended to invest in the stock market. But there is more.

The equity risk premium is even lower for all those companies with a low earnings yield and whose return depends mostly on the dividend. Usually, those companies have low beta and do not guarantee very high returns. For example, Coca-Cola has an earnings yield of 4.72%, which is lower than the yield on the 30-year T-Bond and on par with the yield on the 10-year T-Bond. Therefore, in this particular case the equity risk premium would even be negative, which is why these kinds of companies are not appreciated by the market currently.

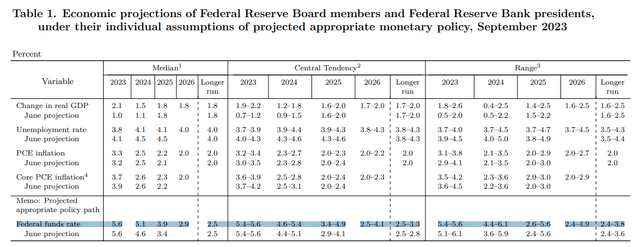

How long this situation will last we cannot know exactly. If we base our assumptions on the FOMC’s economic projections, roughly, at least until the end of 2024. Personally, I believe that rate estimates will be revised downward in the coming months given that the economic system is having quite a bit of difficulty operating with a Fed Funds Rate at 5.25%-5.50%.

Be that as it may, I would like to point out that the considerations made so far have a number of exceptions and do not apply to any investor and any company.

- The first exception is dated investors with a yield on cost that has increased over the years. For example, those who bought Coca-Cola in 2010 have a dividend yield on cost of 7%, which is higher than the T-Bond yield. Selling just because the equity risk premium is tapering off would make little sense, not least because Coca-Cola tends to increase dividends year after year; the T-Bond has a fixed coupon.

- The second exception concerns all those companies that in addition to the dividend yield also have the prerequisites for good capital gains over the long term. I am talking about undervalued companies that have been sidelined in recent quarters. In their case, as long as the capital gain will provide the investor with a good total return in terms of risk/return, it is irrelevant whether the dividend yield is equal to or less than the T-Bond yield.

- The third exception involves companies that are not at a discount but have demonstrated rapid growth in both their earnings and dividends. In this case, it matters little if the dividend yield is 2-3% and the potential capital gain is modest: after 10 years the yield on cost will probably be in the double digits. Again, it is necessary to take a long-term view, which is very difficult today. Even those who say they are long-term investors tend to sell at the first difficulties: it is simply the nature of human behavior.

In all other cases, such as a short-to-medium-term investment in a company with a high dividend yield but little margin for growth, I consider the T-bond investment always better. I am not necessarily referring to the 10-year, but also the 2-year or 5-year.

Two companies to monitor

As we know well, it is in times of trouble that the best deals are made. The tapering of the equity risk premium is bringing down the prices of dividend companies with a decades-long history of success, and now might be a good time to start building a position. While many companies are still overvalued, I believe there are some that are falling too far and have reached attractive prices not seen in a long time.

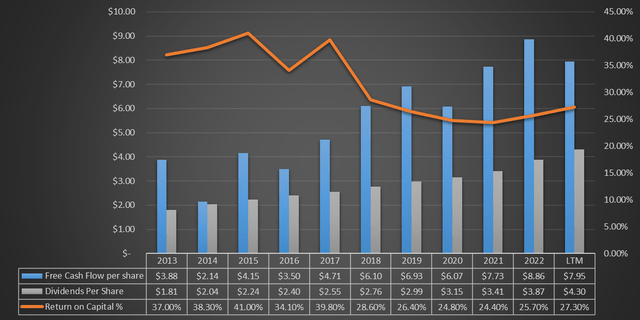

The Hershey Company is a leader in its industry, with profit margins almost like a tech company and a high return on capital. It has steadily increased free cash flow per share over the past 10 years, and has managed to issue an increasing and sustainable dividend per share over time.

The 10Y Dividend Growth Rate (CAGR) was 9.44%, well above the industry median of 5.35%. The current dividend yield is quite low, 2.25%, but its growth prospects overshadow this issue. In fact, its yield on cost is in the double digits for long-time investors.

Personally, I expect dividend growth in the next few years to be similar to that of the past 10 years. Buying Hershey at the current price would mean a yield on cost of 6.14% in 2033. Given the strength of this company, such a high dividend yield with further growth prospects is an ideal situation for dividend investors.

The only reason I have not yet bought Hershey is that buying it at the current price does not give me a high enough margin of safety; therefore, I do not expect such a capital gain that I would not invest in T-Bonds. Be that as it may, the stock is 30% off its the all-time high and is close to my price target.

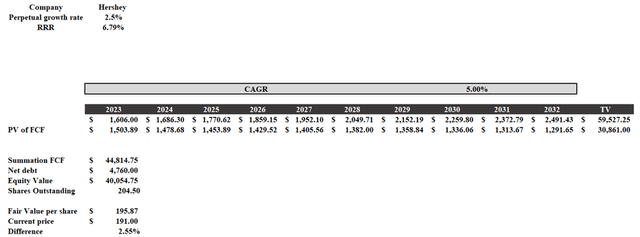

To obtain the fair value of this company, I constructed a discounted cash flow using the following assumptions:

- Required rate of return equal to the CAPM. The latter takes into account a beta of 0.36, a risk-free rate of 4.65% and an equity risk premium of 6%.

- Free cash flow in 2023 is that expected by analysts; from 2024 to 2032 I considered a CAGR of 5%, slightly lower than that experienced over the past 10 years.

Based on these assumptions, the fair value is $195.87, so Hershey is slightly undervalued. However, as already anticipated, I tend to buy a company when I have a high enough margin of safety, which is not the case here. I am willing to make an initial entry if the stock loses an additional 10-15%, so it is close to my target price of $170 or so. Let’s move on to the next company.

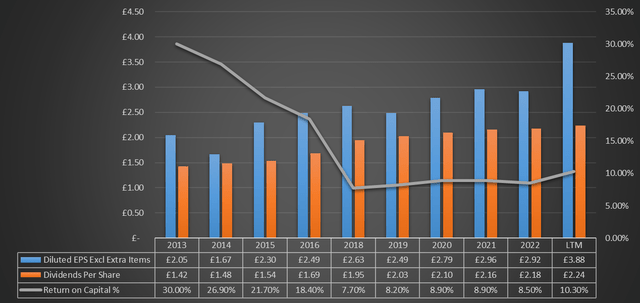

In this case, more than a company to monitor, I think it should be called a company to buy strongly. I am talking about British American Tobacco (BTI

Just like Hershey, we are dealing here with a company that is constantly improving. However, there are four important differences:

- The first is that the return on capital is significantly lower, but management is working to get it back to what it was before the huge acquisition of Reynolds Tobacco. Improvements are already visible and it has returned to double digits.

- The second is that British American Tobacco’s dividend yield is probably unmatched in the consumer staples industry: 8.80%. This is an atypical result, considering that the dividend issued is just over half of earnings, so it is largely sustainable.

- This company is based in London, so it is not a U.S. company. However, there is no double withholding tax on the dividend, so this makes it attractive to non-UK investor as well. Also, consider that in this case you are subject to fluctuations in the value of the pound.

- The last difference is that British American Tobacco, in addition to issuing a huge dividend, also seems widely undervalued.

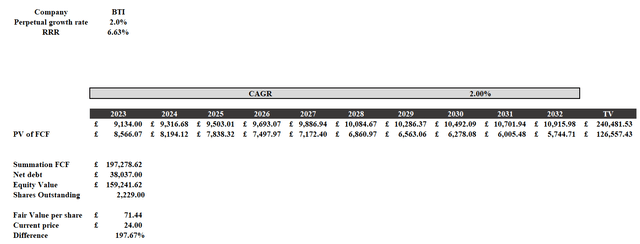

I constructed a discounted cash flow with the following assumptions:

- Required rate of return equal to CAPM. The latter was calculated with a beta of 0.37, a risk-free rate of 4.42% and an equity risk premium of 6%.

- Free cash flow in 2023 is that estimated by analysts; from 2024 to 2032 I considered a growth rate of 2%.

Based on these assumptions, this company is highly undervalued and has a fair value of £71.44 per share. Even by increasing the RRR by a lot, the fair value would still be higher than the current price: in my opinion, there is a case for double-digit annual returns.

Conclusion

Overall, although the T-bond yield is making life difficult for dividend investors, this mistrust is bringing up a number of rather attractive opportunities such as Hershey and British American Tobacco. For many other stocks, however, the slump could continue. Based on Fed rate expectations, we can expect this trend to continue into 2024.

Finally, I would like to make one last point about T-bonds, which I have often mentioned in this article. Risk-free means “default risk-free,” so investing in T-Bonds also involves risk. Specifically, those who sell before maturity are subject to rate risk, a concept that banks have become very familiar with recently. Rising T-Bond yields have caused large price declines, and this has generated substantial unrealized losses for those who bought bonds before the rate hike.

In any case, one only has to take a look at the TLT (TLT

Photo by Chris Liverani on Unsplash